Get the free Liability Insurance Coverage Bid - Tulsa International Airport

Show details

September 4, 2012, Subject: Liability Insurance Coverage Bid Request Gentlemen: The Tulsa Airports Improvement Trust invites bids for full coverage liability insurance for the Tulsa International

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign liability insurance coverage bid

Edit your liability insurance coverage bid form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your liability insurance coverage bid form via URL. You can also download, print, or export forms to your preferred cloud storage service.

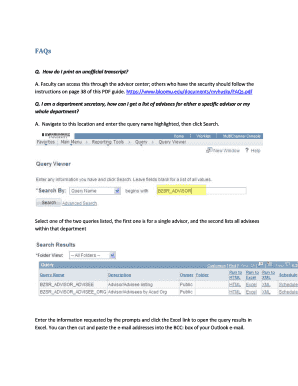

How to edit liability insurance coverage bid online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit liability insurance coverage bid. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out liability insurance coverage bid

How to fill out liability insurance coverage bid:

01

Start by obtaining the necessary bid forms from the insurance company or broker providing the coverage. These forms usually require detailed information about your business, such as its name, address, and contact information.

02

Carefully review the bid forms and ensure you understand all the sections and questions. Take note of any specific requirements or documentation that may be needed to complete the bid accurately.

03

Begin filling out the bid by providing general information about your business, including its legal structure, years in operation, and any relevant licenses or certifications. Be sure to include accurate contact information as well.

04

Next, provide a detailed description of the services or products your business offers. Specify any potential risks or hazards associated with your business operations and explain how you manage or mitigate them. This section is crucial for assessing the coverage needs and potential liabilities.

05

Include information about your current liability insurance coverage, if applicable. Indicate the type of policy, coverage limits, and the insurance company providing the coverage. If you have had any claims or incidents in the past, disclose those as well.

06

Provide a breakdown of your annual revenue or sales figures. This helps insurance providers determine the appropriate coverage limits and premiums for your business.

07

Fill out any additional sections in the bid forms, such as those requesting details about your employees, subcontractors, or any business partnerships. Be thorough and double-check for accuracy.

08

If the bid forms require any supporting documentation, gather and attach them to the bid package. This may include copies of licenses, certifications, financial statements, or any other relevant documents.

09

Review the completed bid forms to ensure all information is accurate and complete. Double-check for any mistakes or missing fields. Having someone else review the bid before submission can be beneficial in catching any errors or omissions.

10

Finally, submit the completed bid forms along with any supporting documentation to the insurance company or broker as instructed. Keep a copy of the bid package for your records.

Who needs liability insurance coverage bid?

01

Business owners: Liability insurance coverage bids are essential for all types of businesses, regardless of their size or industry. It is crucial for protecting against unexpected accidents, injuries, or property damage that may occur during business operations.

02

Contractors: Construction contractors, subcontractors, or tradespeople often require liability insurance coverage bids to showcase their risk management practices and demonstrate their ability to handle potential liabilities on construction sites or worksites.

03

Service providers: Professionals who offer services to clients, such as consultants, therapists, or designers, may also need liability insurance coverage bids. This ensures they are adequately protected against any potential errors or negligence claims that may arise from their professional activities.

04

Manufacturers: Companies involved in manufacturing or producing goods should have liability insurance coverage bids to safeguard against product liability claims. This helps in covering the costs of any injuries or damages caused by defective or unsafe products.

05

Event organizers: Event planners or organizers who handle large gatherings, weddings, or conferences should obtain liability insurance coverage bids to protect themselves against any accidents, injuries, or property damage that may occur during the event.

06

Non-profit organizations: Non-profit organizations must also consider liability insurance coverage bids to protect their volunteers, board members, and participants in case of accidents or damages that may occur while carrying out charitable activities.

07

Landlords: Property owners and landlords can benefit from liability insurance coverage bids to protect themselves against potential lawsuits or claims arising from accidents or injuries that occur on their premises.

08

Professionals: Doctors, lawyers, accountants, and other professionals should obtain liability insurance coverage bids to cover any potential professional negligence claims that may arise due to errors or omissions in their services.

09

Individuals: Even individuals who engage in certain activities, such as coaching, training, or teaching, may require liability insurance coverage bids to mitigate potential risks and protect themselves against any claims or lawsuits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is liability insurance coverage bid?

Liability insurance coverage bid is a formal proposal submitted by an insurer in response to a request for insurance coverage.

Who is required to file liability insurance coverage bid?

Businesses or individuals seeking insurance coverage are required to file liability insurance coverage bid.

How to fill out liability insurance coverage bid?

Liability insurance coverage bid can be filled out by providing all required information about the insured party, the coverage needed, and any relevant documents.

What is the purpose of liability insurance coverage bid?

The purpose of liability insurance coverage bid is to provide a detailed proposal outlining the terms and conditions of the insurance coverage being offered.

What information must be reported on liability insurance coverage bid?

Information such as the insured party's details, the coverage limits, the premium amount, and any exclusions or special conditions must be reported on liability insurance coverage bid.

How can I get liability insurance coverage bid?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the liability insurance coverage bid in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit liability insurance coverage bid online?

The editing procedure is simple with pdfFiller. Open your liability insurance coverage bid in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I fill out liability insurance coverage bid using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign liability insurance coverage bid and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your liability insurance coverage bid online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Liability Insurance Coverage Bid is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.