Get the free lost income form

Show details

Self employed application May 2015 version 9 SELF EMPLOYED CLAIM FORM Government of Western Australia Department of the Attorney General Esperance Court Dempster Street Esperance WA 6450 Email esperancecourt justice. wa.gov.au Phone 08 9071 2444 Attended Jury Service Please read the information regarding claims for lost income located on our website before submitting a claim or contacting us for further assistance. Claims may be subject to further assessment and may require additional...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lost income form

Edit your lost income form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lost income form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lost income form online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit lost income form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lost income form

How to fill out a lost income form:

01

Start by gathering all necessary documentation. This may include pay stubs, tax returns, bank statements, and any other proof of your income.

02

Read the instructions carefully. Each lost income form may vary in terms of required information and format. Make sure you understand what is being asked of you before proceeding.

03

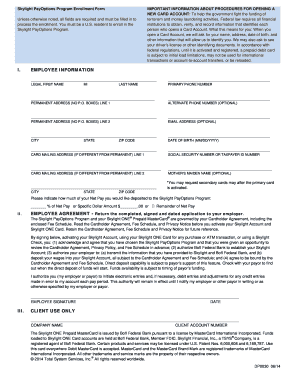

Begin by providing your personal information. This may include your full name, address, contact information, and social security number.

04

Fill in the details about the date or period for which you are claiming lost income. Be as specific as possible, including dates, hours, or days missed.

05

Describe the reason for your lost income. Whether it was due to illness, injury, layoff, or personal circumstances, provide a clear and concise explanation.

06

Calculate the total amount of income you have lost. Provide accurate figures and breakdowns, if applicable. Include any supporting documents that validate your claim.

07

If required, fill in additional sections regarding your current employment status, any benefits received, or other relevant details.

08

Double-check all the information you have provided. Make sure there are no errors or missing data. It's crucial to submit an accurate and truthful form.

09

Sign and date the lost income form. This serves as your confirmation and consent for the information you have provided.

Who needs a lost income form?

A lost income form is generally required by individuals who have experienced a loss of earnings due to various circumstances. This may include:

01

Employees who have been absent from work due to illness, injury, or disability and wish to claim income replacement benefits.

02

Self-employed individuals or freelancers who want to document their lost income for insurance claims or tax purposes.

03

individuals who have lost their jobs or faced a reduction in working hours and are applying for unemployment benefits or income assistance.

The specific requirement for a lost income form may vary based on different organizations, insurance companies, or government agencies. Therefore, it's essential to consult the relevant entity to determine if a specific form is needed and the process for completing and submitting it.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete lost income form online?

With pdfFiller, you may easily complete and sign lost income form online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit lost income form online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your lost income form and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an eSignature for the lost income form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your lost income form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is lost income form?

Lost income form is a document used to report income that was not received due to circumstances like illness, accident, or other unforeseen events.

Who is required to file lost income form?

Individuals who have experienced a loss of income due to circumstances beyond their control are required to file a lost income form.

How to fill out lost income form?

To fill out a lost income form, individuals must provide their personal information, details of the income lost, and the reason for the loss.

What is the purpose of lost income form?

The purpose of a lost income form is to document and report income that was not received due to extenuating circumstances.

What information must be reported on lost income form?

Information that must be reported on a lost income form includes personal details, the amount of income lost, and the reason for the loss.

Fill out your lost income form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lost Income Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.