Canada AT4818 2012 free printable template

Show details

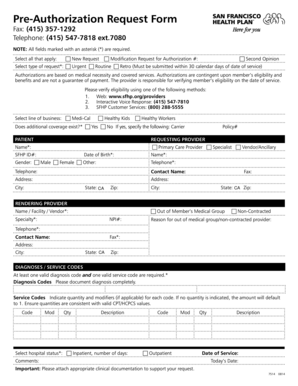

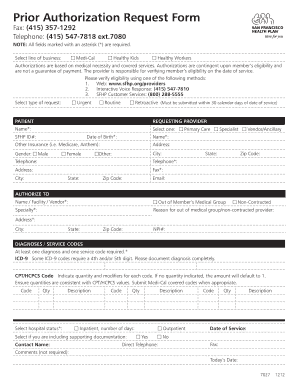

ALBERTA INDIAN TAX EXEMPTION RETAILER REFUND APPLICATION Tax and Revenue Administration To be completed by a retailer requiring a refund for tax exempt sales made to eligible Alberta Indians or Indian Bands. This form must be submitted no more frequently than weekly to Alberta Treasury Board and Finance Tax and Revenue Administration 9811 109 ST EDMONTON AB T5K 2L5. Refunds of less than 20 will not be processed unless specifically requested* Copies of this application purchase invoices and...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign apply for white card form

Edit your white card application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada AT4818 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada AT4818 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada AT4818. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada AT4818 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada AT4818

Point by point instructions on how to fill out an Alberta White Card:

01

Start by gathering all the necessary information. You will need to provide your personal details such as your full name, address, contact information, and date of birth.

02

Ensure you have the required identification documents. The Alberta White Card typically requires a valid government-issued ID, such as a driver's license or passport. Make sure you have these documents readily available.

03

Obtain the application form. You can typically find the Alberta White Card application form online on the official government website or request a physical copy from the appropriate government office.

04

Complete the application form accurately and legibly. Follow the instructions on the form and provide all the requested information. Double-check for any errors or missing details before submitting it.

05

Pay the required fees, if applicable. Some provinces may charge a fee for processing the application. Ensure you include the correct payment method or attach a proof of payment if required.

06

Review your completed application. Take a moment to go through the entire form and ensure that all the information provided is correct and up to date. This will help prevent any delays or issues with your application.

07

Submit your application. Depending on the process outlined by your province's government office, you may be able to submit your application online, by mail, or in person. Follow the instructions provided to ensure your application is properly received.

Who needs an Alberta White Card?

01

Individuals working in industries that require safety certification, such as construction, oil and gas, or transportation, may need an Alberta White Card. This card serves as proof of completion of safety training programs specific to these industries.

02

Employers may require their employees to possess an Alberta White Card as a condition of employment. It ensures that the workforce is adequately trained in safety protocols, reducing the risk of accidents and promoting workplace safety.

03

Individuals seeking employment in industries that require safety certification may need an Alberta White Card. Many job postings in these industries list possession of a valid Alberta White Card as a requirement for consideration.

Fill

form

: Try Risk Free

People Also Ask about

What is the Indian status tax exemption in Alberta?

Status Indians may claim an exemption from paying the five per cent Goods and Services Tax (GST) when the goods are delivered to the reserve by vendors or their agents (e.g., a common carrier or the postal service). Alberta does not have a provincial sales tax.

Do natives pay taxes in Alberta?

Indigenous peoples are subject to the same tax rules as any other resident in Canada unless their income is eligible for the tax exemption under section 87 of the Indian Act.

Can I use my status card in Alberta?

Starting October 4th, the province will begin accepting federal status cards as the only form of identification for applicable tax exemptions on-reserve in Alberta.

What is the native tax exemption in Alberta?

The Alberta Indian Tax Exemption (AITE) program consists of: An exemption from taxes and levies for eligible consumers and bands at the time of purchase on: fuel products purchased on reserve in Alberta or delivered to reserve.

How to apply for white card in Alberta?

How to apply Eligibility. Learn about AHCIP eligibility requirements. Complete the application form. Complete and save the Application form for AHCIP Coverage. Gather your supporting documents. When you apply for AHCIP coverage, you must provide supporting documents that prove: Submit the application. In person.

What is white card in Alberta?

The Alberta government has given notice to First Nations that they will soon no longer have the Alberta Indian Tax Exemption (AITE) card—commonly referred to as the “white card” —to get fuel, tobacco and accommodation tax exemptions on reserve. “This white card has been long overdue to be discontinued.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Canada AT4818 directly from Gmail?

Canada AT4818 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit Canada AT4818 in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing Canada AT4818 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out Canada AT4818 using my mobile device?

Use the pdfFiller mobile app to fill out and sign Canada AT4818. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is Canada AT4818?

Canada AT4818 is a tax form used for reporting certain information regarding foreign affiliates and their income for Canadian tax purposes.

Who is required to file Canada AT4818?

Canadian corporations that have foreign affiliates or interests in such affiliates are required to file Canada AT4818.

How to fill out Canada AT4818?

To fill out Canada AT4818, a taxpayer must complete the form by providing details of foreign affiliates, their income, and other specified information, which is then reported to the Canada Revenue Agency.

What is the purpose of Canada AT4818?

The purpose of Canada AT4818 is to ensure that Canadian taxpayers disclose information about their foreign affiliates, helping to assess compliance with international tax obligations.

What information must be reported on Canada AT4818?

Information that must be reported on Canada AT4818 includes the names of foreign affiliates, their earnings, dividends, and specific financial data as required by the Canada Revenue Agency.

Fill out your Canada AT4818 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada at4818 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.