Get the free 2011 1040ez instructions form - irs

Show details

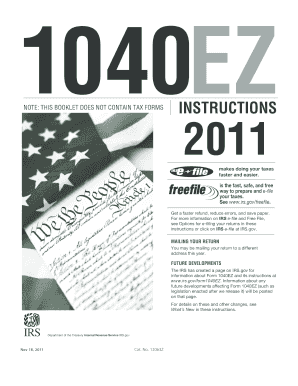

1040EZ NOTE: THIS BOOKLET DOES NOT CONTAIN TAX FORMS INSTRUCTIONS 2011 makes doing your taxes faster and easier. Is the fast, safe, and free way to prepare and e-file your taxes. See www.irs.gov/freefile.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2011 1040ez instructions form

Edit your 2011 1040ez instructions form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 1040ez instructions form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2011 1040ez instructions form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2011 1040ez instructions form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2011 1040ez instructions form

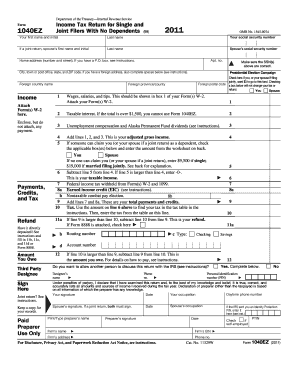

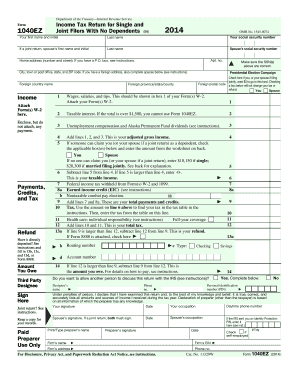

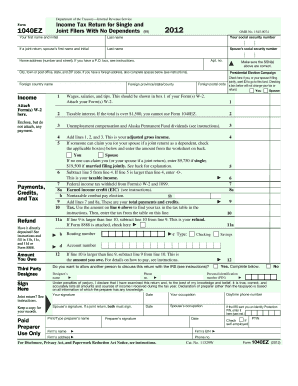

How to fill out IRS Instruction 1040-EZ

01

Gather all necessary documents, including W-2 forms and any other income statements.

02

Write your name, address, and Social Security number at the top of the form.

03

Indicate your filing status (single or married filing jointly).

04

Fill out the income section, reporting all wages, salaries, and tips.

05

Calculate your adjusted gross income (AGI) and enter it on the appropriate line.

06

Complete the deductions section, ensuring you only claim the standard deduction.

07

Calculate your taxable income by subtracting the standard deduction from your AGI.

08

Determine your tax amount using the IRS tax tables provided.

09

Fill out any credits or payments sections, including withholding amounts.

10

Sign and date the form before submitting it to the IRS.

Who needs IRS Instruction 1040-EZ?

01

Individuals with a straightforward tax situation, generally with taxable income under a certain threshold.

02

Those who file as single or married filing jointly and do not itemize deductions.

03

Taxpayers who have no dependents and do not claim certain credits.

04

Individuals who earn income only from employment (W-2) with no other income sources.

Fill

form

: Try Risk Free

People Also Ask about

Can I print a 1040EZ form?

To access online forms, select "Individuals" at the top of the IRS website and then the "Forms and Publications" link located on the left hand side of the page. You will then see a list of printable forms, including the 1040, 1040-EZ, 4868 form for an extension of time and Schedule A for itemized deductions.

How do I fill out a 1040EZ tax return?

0:30 2:17 Learn How to Fill the Form 1040EZ Income Tax Return for - YouTube YouTube Start of suggested clip End of suggested clip In the income. Section of your form 1040ez lists all income from paychecks salary or any amountsMoreIn the income. Section of your form 1040ez lists all income from paychecks salary or any amounts listed on your w-2. Form. List any taxable interest you may have accrued if the amount is over $1,500.

How do you file a simple tax return using 1040EZ form?

How to Fill Out a US 1040EZ Tax Return 1 Determining if You Can Use the Form 1040EZ and Gathering Materials. 2 Completing the Top Section. 3 Completing the Income Section. 4 Completing the Payments, Credits and Tax Section. 5 Calculating Your Refund or the Amount You Owe. 6 Finishing and Filing Your Return.

Does the IRS have a form 1040EZ anymore?

Form 1040EZ is no longer used, but Form 1040 and Form 1040-SR are important for taxpayers to be familiar with. Here's a guide to what is on these forms and what has changed from previous tax years.

When was 1040EZ discontinued?

Form 1040EZ was a shortened version of Form 1040 for taxpayers with basic tax situations. The form was discontinued as of the 2018 tax year and replaced with the redesigned Form 1040.

How do I get an old 1040 form?

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

Fill out your 2011 1040ez instructions form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011 1040ez Instructions Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.