Get the free Publication 504 - irs

Show details

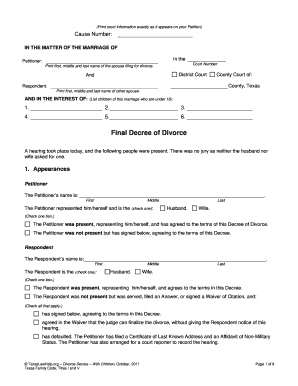

This publication explains tax rules that apply if you are divorced or separated from your spouse. It covers general filing information and helps you choose your filing status and determine exemptions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign publication 504 - irs

Edit your publication 504 - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publication 504 - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit publication 504 - irs online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit publication 504 - irs. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out publication 504 - irs

How to fill out Publication 504

01

Obtain a copy of Publication 504 from the IRS website or a local tax office.

02

Read the instructions on the first page to understand the purpose and requirements.

03

Gather all necessary documentation, including your marital status and any relevant income information.

04

Begin filling out the form by following the directions for each section.

05

Make sure to provide accurate and complete information to avoid delays or issues.

06

Review the completed form for any errors or missing information.

07

Submit the form as specified in the instructions, either electronically or by mail.

Who needs Publication 504?

01

Publication 504 is needed by taxpayers who are married or divorced and need guidance on the tax implications of their marital status.

02

It is particularly useful for individuals seeking information on filing statuses, deductions, and credits related to marriage and divorce.

Fill

form

: Try Risk Free

People Also Ask about

Can two unmarried people claim the head of household?

Two people can both claim Head of Household filing status while living in the same home. However, both need to meet the criteria necessary to be eligible for Head of Household status: You both are unmarried. You both are able to claim your own qualifying dependent.

What disqualifies you from claiming head of household?

Here are the most common reasons you may be denied the HOH filing status: Your qualifying relative's gross income is above the limit. Your qualifying child's age is 19 years old but under 24 years old and not a full time student. Your qualifying child lived with you less than 183 days.

What is the IRS publication 501?

Publication 501 discusses some tax rules that affect every person who may have to file a federal income tax return. It answers some basic questions: who must file, who should file, what filing status to use, and the amount of the standard deduction.

What happens if two people file head of household at the same address?

A commonly asked question is, “Can there be two Heads of Households at an address?” The answer is “yes,” but the devil is in the details. There can't be two Head of Households per household. This is because of the requirement that the Head of Household paid more than 50% of the total household expenses.

What happens if I file Single when married but separated?

You can file ``single'' if you're still married but separated, but you have to be under a separate maintenance decree from a court.

Can I file head of household and claim my girlfriend?

You cannot file as Head of Household or claim your girlfriend as a dependent, even though you supported her and she lived with you for the entire year, because she does not meet the IRS criteria for a Qualifying Relative or Qualifying Child under tax regulations.

Can an unmarried couple both claim head of household?

You must meet these criteria independently of your partner. You must pay at least half of the household expenses for you and your own children to file as head of household. If both adults in the household meet this requirement, then both will qualify to use the status.

What is publication 555?

Publication 555 discusses community property laws that affect how you figure your income on your federal income tax return if you are married, live in a community property state or country, and file separate returns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Publication 504?

Publication 504 is an IRS document that provides information on tax rules and filing requirements for divorced or legally separated individuals, specifically focusing on alimony, child support, and the associated tax implications.

Who is required to file Publication 504?

Individuals who are divorced, legally separated, or contemplating divorce are required to refer to Publication 504 to understand their tax responsibilities and any benefits related to alimony and child support.

How to fill out Publication 504?

To fill out Publication 504, individuals should follow the guidelines provided within the publication. This includes gathering necessary documents related to divorce, alimony payments, and child support, and ensuring that all relevant sections are completed accurately according to personal financial situations.

What is the purpose of Publication 504?

The purpose of Publication 504 is to educate taxpayers on the tax implications of divorce and separation, providing clarity on how to report alimony and child support and helping individuals comply with IRS regulations.

What information must be reported on Publication 504?

Publication 504 requires reporting information related to alimony received or paid, child support received, and any related deductions or tax claims that need to be made as a result of divorce or separation agreements.

Fill out your publication 504 - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Publication 504 - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.