Get the free LLC, S-Corp, Small Business Worksheet - Watson CPA Group

Show details

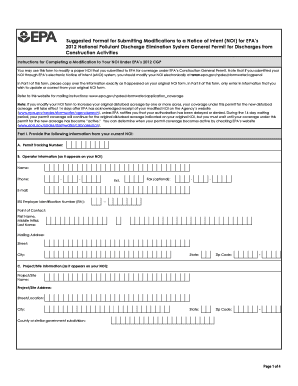

LLC, Score, Small Business Worksheet As with all our forms, you may submit this information electronically using our secure online submit forms. Using this PDF as a work paper and submitting the information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign llc s-corp small business

Edit your llc s-corp small business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your llc s-corp small business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing llc s-corp small business online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit llc s-corp small business. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out llc s-corp small business

How to fill out llc s-corp small business:

01

Choose a name for your business: Research and select a unique name that aligns with your vision and purpose.

02

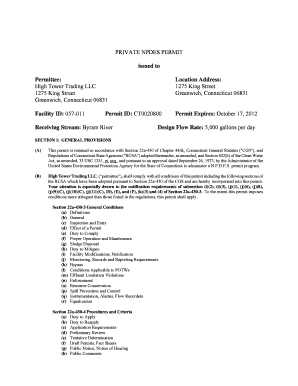

Complete the necessary paperwork: Visit the Secretary of State's website or office in your state to obtain the required forms for registering your LLC and electing S-Corp status. Fill out these forms accurately and completely.

03

Provide business information: Include details such as the business address, the registered agent's name and address, and the primary purpose of the LLC. Ensure that all information provided is correct and up to date.

04

Appoint a registered agent: A registered agent is responsible for receiving legal documents on behalf of the LLC. Choose an individual or entity that meets your state's requirements and can fulfill this role effectively.

05

File the paperwork: Submit the completed forms along with the necessary filing fee to the Secretary of State's office. Depending on your state, this can be done online, by mail, or in person.

06

Create an operating agreement: Although not always legally required, it is advisable to create an operating agreement that outlines the management structure, member responsibilities, and distribution of profits and losses. This document helps maintain internal organization and can be helpful in case of disputes.

07

Obtain necessary permits and licenses: Depending on the nature of your business, you may need to obtain additional permits or licenses at the local, state, or federal level. Research the specific requirements for your industry and comply accordingly.

Who needs llc s-corp small business?

01

Entrepreneurs and small business owners: LLC S-Corps are popular among entrepreneurs and small business owners due to their flexibility, limited liability protection, and potential tax advantages.

02

Professionals: Doctors, lawyers, consultants, and other professionals who operate their own practices or businesses can benefit from setting up an LLC S-Corp to protect their personal assets and take advantage of tax planning strategies.

03

Startups and small businesses with growth aspirations: LLC S-Corps can be a suitable choice for businesses with plans to grow, seek investment, or issue shares. Electing S-Corp status allows for pass-through taxation, simplifying the reporting process and potentially reducing overall tax liability.

04

Businesses seeking personal liability protection: Forming an LLC S-Corp separates your personal assets from business liabilities. This can safeguard your personal property, savings, and investments in case of legal problems or financial obligations related to the business.

05

Businesses aiming for credibility and professionalism: Having an LLC S-Corp structure can enhance the professional image and credibility of your business. It not only demonstrates commitment but also provides transparency to clients, partners, and investors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is llc s-corp small business?

An LLC S-Corp is a type of small business entity that combines the limited liability protection of an LLC with the favorable tax treatment of an S-Corporation.

Who is required to file llc s-corp small business?

Any small business that chooses to operate as an LLC and elects to be taxed as an S-Corporation is required to file as an LLC S-Corp.

How to fill out llc s-corp small business?

To fill out the LLC S-Corp tax form, you will need to include information about the business's income, expenses, and any distributions made to shareholders.

What is the purpose of llc s-corp small business?

The purpose of forming an LLC S-Corp small business is to combine the benefits of limited liability protection with the tax advantages of being treated as an S-Corporation.

What information must be reported on llc s-corp small business?

Information that must be reported on an LLC S-Corp tax form includes the business's income, expenses, shareholder distributions, and any other relevant financial information.

Can I create an electronic signature for the llc s-corp small business in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your llc s-corp small business in seconds.

Can I edit llc s-corp small business on an iOS device?

Use the pdfFiller mobile app to create, edit, and share llc s-corp small business from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I fill out llc s-corp small business on an Android device?

Use the pdfFiller app for Android to finish your llc s-corp small business. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your llc s-corp small business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Llc S-Corp Small Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.