Get the free We are Partners in - tcdsb

Show details

Validating our Mission/Vision T H E DIRECTORS BULLETIN November 22, 2004, Subjects: We are Partners in Catholic Education, a Fellowship of Inspiration and Unending Dedication. SAINTS OF THE TORONTO

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign we are partners in

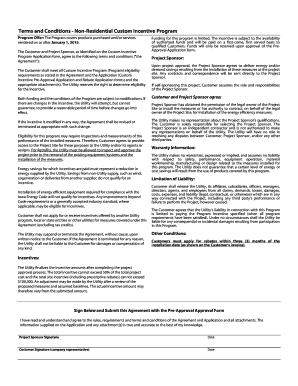

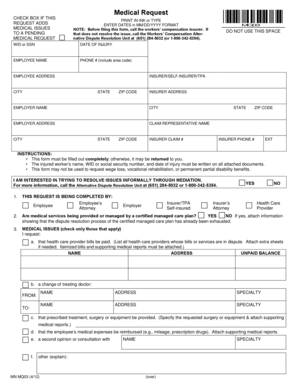

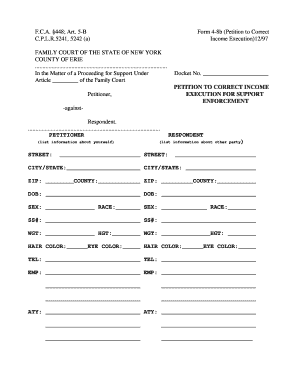

Edit your we are partners in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your we are partners in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

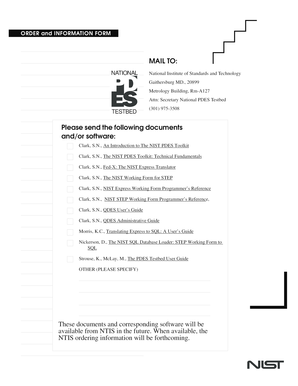

How to edit we are partners in online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit we are partners in. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out we are partners in

How to fill out "We are partners in":

01

Start by entering the name or names of the individuals or entities that will be acting as partners. This should be clearly indicated at the top of the document.

02

Next, specify the purpose or objectives of the partnership. This could include details about the type of business or collaboration the partners will engage in.

03

Provide information about the duration of the partnership. Specify whether it is temporary or ongoing, and if there is a specific end date or event that will mark its conclusion.

04

Include details about the financial contributions each partner will make to the partnership. This could involve an initial capital investment or ongoing financial support.

05

Outline the roles and responsibilities of each partner. This should cover tasks, decision-making authority, and any specific areas of expertise or focus.

06

Define how profits and losses will be shared among the partners. Specify the allocation method and percentage distribution.

07

Include any terms or conditions related to the termination or dissolution of the partnership. This could involve procedures for dispute resolution, withdrawal of partners, or other relevant factors.

08

Finally, provide space for the partners to sign and date the document, indicating their agreement to the terms outlined.

Who needs "We are partners in":

01

Business owners who want to establish a partnership with other individuals or entities.

02

Individuals or organizations looking to collaborate on a specific project or venture.

03

Companies seeking to expand their reach or pool resources by partnering with other businesses.

By filling out the "We are partners in" document correctly, individuals and entities can establish a clear and legally binding partnership agreement, ensuring that all parties are on the same page regarding their roles, responsibilities, and shared objectives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute we are partners in online?

pdfFiller makes it easy to finish and sign we are partners in online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I edit we are partners in on an Android device?

You can edit, sign, and distribute we are partners in on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I fill out we are partners in on an Android device?

On Android, use the pdfFiller mobile app to finish your we are partners in. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

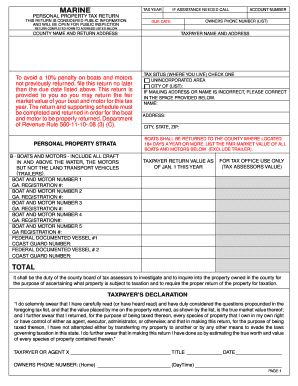

What is we are partners in?

We are partners in a business venture.

Who is required to file we are partners in?

All partners involved in the business are required to file.

How to fill out we are partners in?

You can fill out the partnership details on the appropriate forms provided by the governing tax authority.

What is the purpose of we are partners in?

The purpose of filing as partners is to report income, losses, and other relevant information related to the partnership.

What information must be reported on we are partners in?

Partners need to report their share of income, losses, deductions, credits, and other relevant information.

Fill out your we are partners in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

We Are Partners In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.