Get the free Life Insurance Enrollment and Change Form

Show details

Sep 15, 2015 ... medical, dental, vision, disability, life and optional benefit .... Rights, United States Department of Health and Human ... Your Benefits Resources at http://resources. hewitt.com/wea

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance enrollment and

Edit your life insurance enrollment and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance enrollment and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit life insurance enrollment and online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit life insurance enrollment and. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance enrollment and

How to fill out life insurance enrollment and:

01

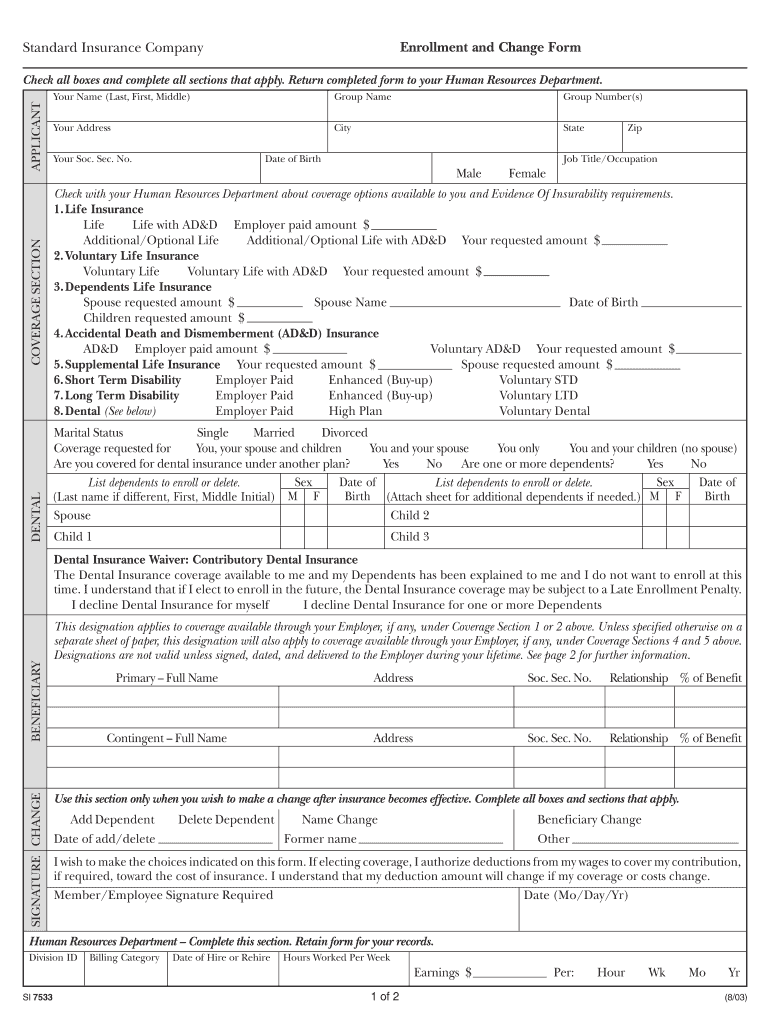

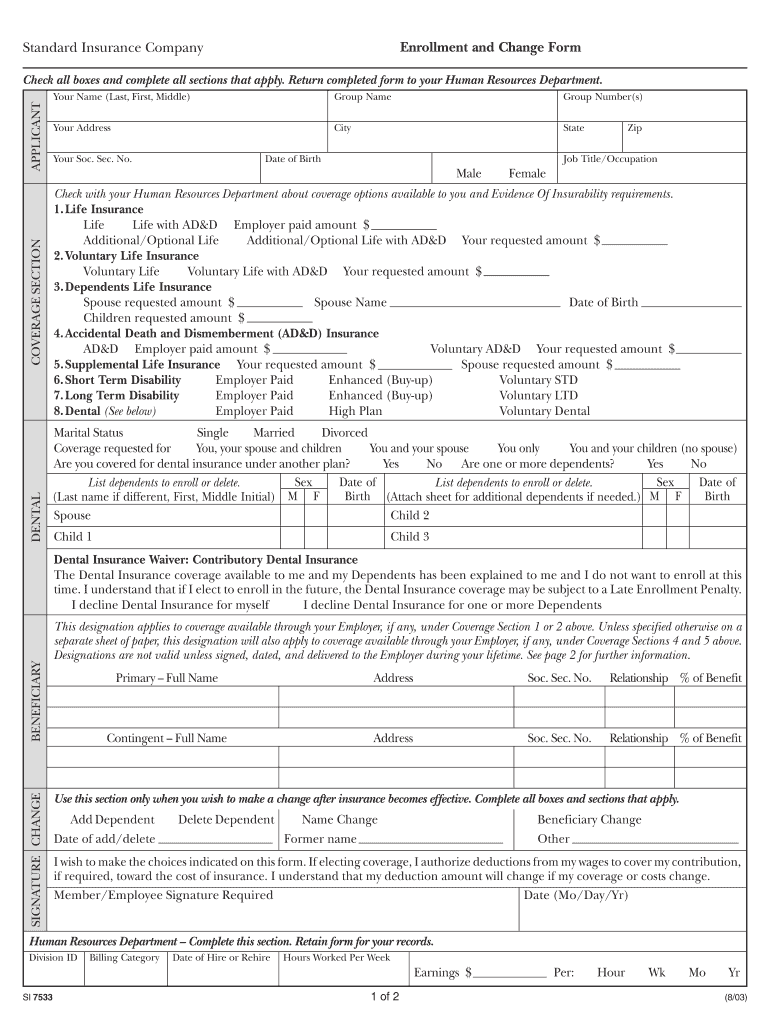

Gather necessary information: Before starting the enrollment process, make sure you have all the required information at hand. This may include personal details, employment information, beneficiary information, and any relevant health information.

02

Review the enrollment form: Carefully read through the life insurance enrollment form to understand the questions being asked and the information required. Pay attention to any specific instructions or guidelines provided.

03

Provide personal details: Begin by filling out your personal information such as your full name, date of birth, social security number, and contact information. Ensure that the information provided is accurate and up-to-date.

04

Employment information: If the life insurance is offered through your employer, you will likely need to provide your employment details. This may include your job title, company name, and years of employment. Be sure to accurately input this information.

05

Choose the coverage amount: Determine the amount of life insurance coverage you require based on your financial needs, dependents, and future obligations. Consider factors like mortgage payments, education expenses, and living costs for your family in case of your untimely demise.

06

Select beneficiaries: Indicate the beneficiaries who will receive the life insurance payout in the event of your death. Ensure you provide their full names, relationship to you, and their contact information. You can also specify the percentage of the death benefit each beneficiary should receive.

07

Submit the form: Once you have completed all the necessary sections of the enrollment form, review it for accuracy and completeness. Ensure you have signed and dated the form appropriately. Make a copy of the completed form for your records and submit the original as directed by your insurance provider.

Who needs life insurance enrollment and:

01

Individuals with dependents: If you have loved ones who rely on your income, life insurance enrollment is crucial. It provides financial protection and ensures that your dependents are taken care of financially if something were to happen to you.

02

Breadwinners: If you are the primary earner in your family, life insurance enrollment is essential. It can provide a safety net to replace lost income and cover ongoing expenses, allowing your family to maintain their standard of living.

03

Homeowners with a mortgage: Life insurance enrollment is vital for homeowners with a mortgage. In the event of your death, life insurance can help pay off the outstanding mortgage balance, preventing your loved ones from facing financial challenges or losing their home.

04

Business owners: If you own a business, life insurance enrollment can be advantageous. It can protect your business from financial hardships and ensure its continuity by providing funds for key business expenses or the buyout of your share.

05

Individuals with debts or loans: If you have outstanding debts or loans, life insurance enrollment can be beneficial. It can assist in covering these financial obligations, preventing your loved ones from inheriting the burden of debt after your passing.

Remember, life insurance enrollment provides peace of mind and financial security for you and your loved ones. It is essential to carefully assess your needs and consult with a financial advisor or insurance professional to determine the appropriate coverage amount and policy type for your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is life insurance enrollment and?

Life insurance enrollment is the process of signing up for a life insurance policy to provide financial protection for loved ones in case of death.

Who is required to file life insurance enrollment and?

Individuals who want to secure life insurance coverage for themselves or their dependents are required to file life insurance enrollment.

How to fill out life insurance enrollment and?

To fill out life insurance enrollment, one must provide personal information, beneficiary details, policy preferences, and medical history.

What is the purpose of life insurance enrollment and?

The purpose of life insurance enrollment is to ensure financial security for beneficiaries in the event of the policyholder's death.

What information must be reported on life insurance enrollment and?

Information such as personal details, beneficiary information, policy preferences, and medical history must be reported on life insurance enrollment.

How can I send life insurance enrollment and for eSignature?

life insurance enrollment and is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I execute life insurance enrollment and online?

pdfFiller makes it easy to finish and sign life insurance enrollment and online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit life insurance enrollment and on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute life insurance enrollment and from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your life insurance enrollment and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance Enrollment And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.