Get the free Actuarial Valuation Report - armymwr

Show details

Actuarial Valuation Report for the United States Army Nonappropriated Fund Employee Retirement Plan as of October 1, 2010, Produced by Charon March 2011 Table of Contents Letter of Transmittal ............................................................................................................................................................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign actuarial valuation report

Edit your actuarial valuation report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your actuarial valuation report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing actuarial valuation report online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit actuarial valuation report. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out actuarial valuation report

How to Fill Out Actuarial Valuation Report:

01

Collect relevant data: Begin by gathering all the necessary information for the actuarial valuation report. This may include financial statements, employee data, historical data, and any other relevant documentation.

02

Identify the valuation date: Determine the valuation date, which is the point in time for which the actuarial valuation is being conducted. This date will be used as a reference point for calculations and analysis.

03

Assess plan provisions: Understand the plan provisions and carefully review the plan documents to determine the specific details of the benefit structure, such as retirement ages, interest rates, mortality rates, and any other relevant factors that impact the valuation.

04

Calculate liabilities: Use actuarial methods and formulas to calculate the present value of the plan's liabilities. This involves projecting future benefit payments and discounting them back to the valuation date.

05

Determine the funding status: Compare the calculated liabilities to the plan's assets to determine the funding status. If the assets are sufficient to cover the liabilities, the plan may be considered fully funded. If the assets fall short, the plan may be underfunded.

06

Prepare financial statements and disclosures: Summarize the results of the actuarial valuation in a clear and concise manner. Prepare financial statements, including the balance sheet, income statement, and cash flow statement, as well as any required disclosures and footnotes.

07

Review and finalize: Thoroughly review the actuarial valuation report, ensuring accuracy of calculations and consistency with relevant regulatory requirements. Make any necessary revisions or adjustments before finalizing the report.

Who needs actuarial valuation report:

01

Pension plan sponsors: Companies that offer defined benefit pension plans need actuarial valuation reports to assess the financial health and funding status of their plans. These reports help plan sponsors make informed decisions regarding contributions and funding strategies.

02

Regulatory bodies: Government agencies responsible for regulating pension plans often require actuarial valuation reports to ensure compliance with relevant laws and regulations. These reports help monitor plan funding, solvency, and adherence to minimum funding requirements.

03

Plan participants and beneficiaries: Actuarial valuation reports provide valuable information to plan participants and beneficiaries, helping them understand the financial status and sustainability of their pension plans. This information is crucial for making retirement planning decisions and assessing expected future benefits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete actuarial valuation report online?

pdfFiller has made it easy to fill out and sign actuarial valuation report. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I edit actuarial valuation report on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing actuarial valuation report.

Can I edit actuarial valuation report on an iOS device?

You certainly can. You can quickly edit, distribute, and sign actuarial valuation report on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

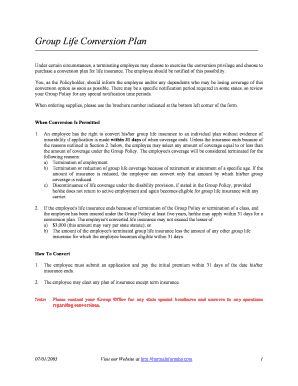

What is actuarial valuation report?

An actuarial valuation report is a report prepared by an actuary that provides an analysis of the financial position of a pension plan or scheme.

Who is required to file actuarial valuation report?

Employers sponsoring a pension plan or scheme are typically required to file an actuarial valuation report.

How to fill out actuarial valuation report?

An actuarial valuation report is typically filled out by a qualified actuary who analyzes the financial data of the pension plan and prepares the report based on actuarial principles.

What is the purpose of actuarial valuation report?

The purpose of an actuarial valuation report is to provide an assessment of the financial health and obligations of a pension plan or scheme.

What information must be reported on actuarial valuation report?

An actuarial valuation report typically includes information on the plan's assets, liabilities, funding status, contribution requirements, and actuarial assumptions.

Fill out your actuarial valuation report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Actuarial Valuation Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.