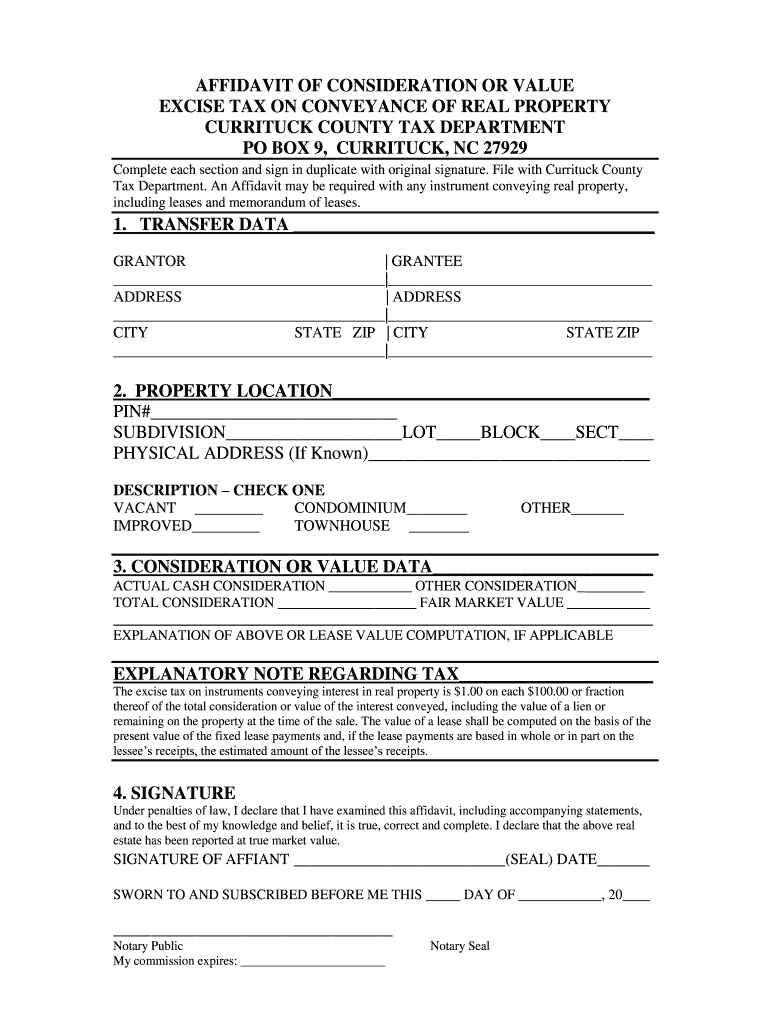

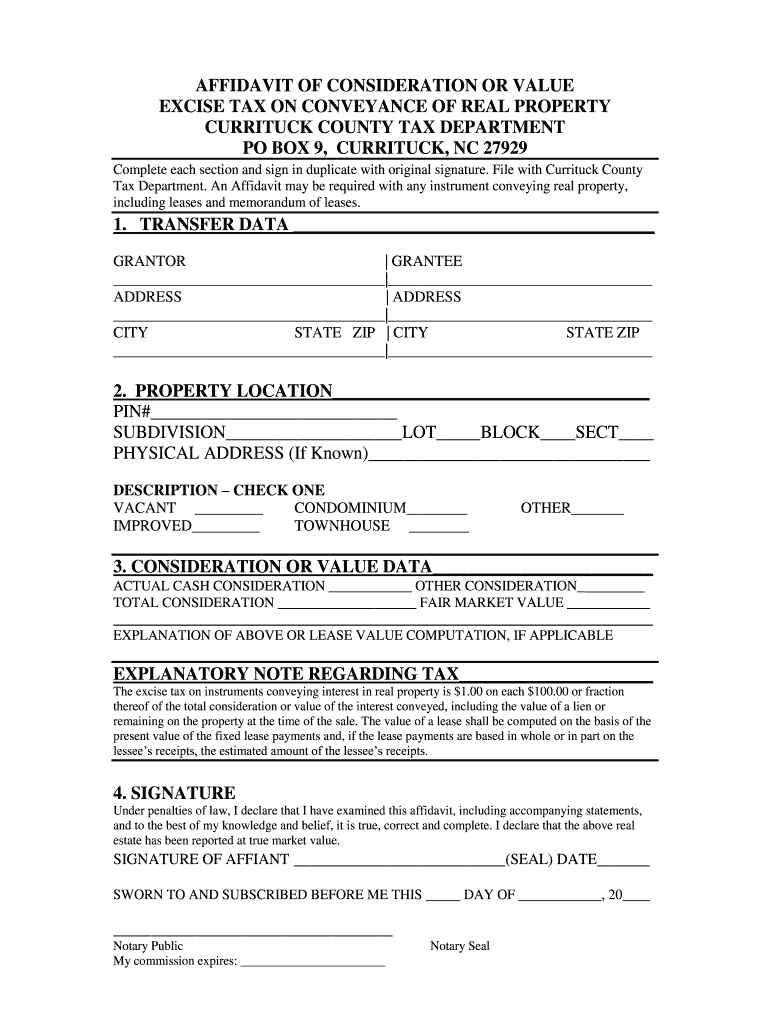

NC Affidavit of Consideration or Value Excise free printable template

Get, Create, Make and Sign affidavit consideration excise tax

How to edit affidavit consideration excise tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out affidavit consideration excise tax

How to fill out NC Affidavit of Consideration or Value Excise Tax

Who needs NC Affidavit of Consideration or Value Excise Tax?

Instructions and Help about affidavit consideration excise tax

Hello this is Dave at titlesearchcom this video is about title searching in the state of North Carolina is one state that has a requirement that it's an attorney only state any use of title records or observational title records for transfer or title insurance has to be done by an attorney now private individuals can look at title records review title records even have somebody pull documents for them but any use for a transfer or title insurance or property interest has to be done by an attorney and so if you have that type of need to get a title search or title insurance to make sure it's done by an attorney total records in North Carolina are kept at the county level there are 100 counties in North Carolina each one has its own recording requirements the state typically is a non-judicial mortgage state meaning that a deed of trust is used in place of a mortgage so that foreclosures can be handled outside the court system the trustee of that mortgage handles prosecuting any mortgage delinquencies and foreclosures in North Carolina a UCC filing is recorded at the Register of Deeds rather than at the Secretary of State, so it's shown up in that county another interesting fact about North Carolina title records is its a race notice state meaning that the records have priority of first in time first and right whoever gets there with the document first has the first priority documents that show up after that have priority that's secondary to whatever showed up before that marketable title in North Carolina typically is thirty years meaning that if you go back 30 years on a search that qualifies as marketable title for most title insurance policies mechanic's liens like most states have specific requirements has to be filed within 120 days of last doing the work or delivering materials to the property and a lawsuit has to be filed within 100, so those are just a few of the basic differences for North Carolina if you have questions about getting property records or pulling documents from North Carolina you can give us a call and see if that's what we can handle for you at titlesearchcom, and we'd be glad to help

People Also Ask about

What is the excise tax on real estate in California?

What is the current excise tax for California?

What is the real estate excise tax in Washington state?

How do I avoid transfer tax in NY?

Who pays transfer tax in NY buyer or seller?

Who pays real estate transfer tax in California?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute affidavit consideration excise tax online?

How do I edit affidavit consideration excise tax online?

Can I edit affidavit consideration excise tax on an iOS device?

What is NC Affidavit of Consideration or Value Excise Tax?

Who is required to file NC Affidavit of Consideration or Value Excise Tax?

How to fill out NC Affidavit of Consideration or Value Excise Tax?

What is the purpose of NC Affidavit of Consideration or Value Excise Tax?

What information must be reported on NC Affidavit of Consideration or Value Excise Tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.