Get the free In-kind Gift Report Form pdf - Policy Library - devpolicylibrary gatech

Show details

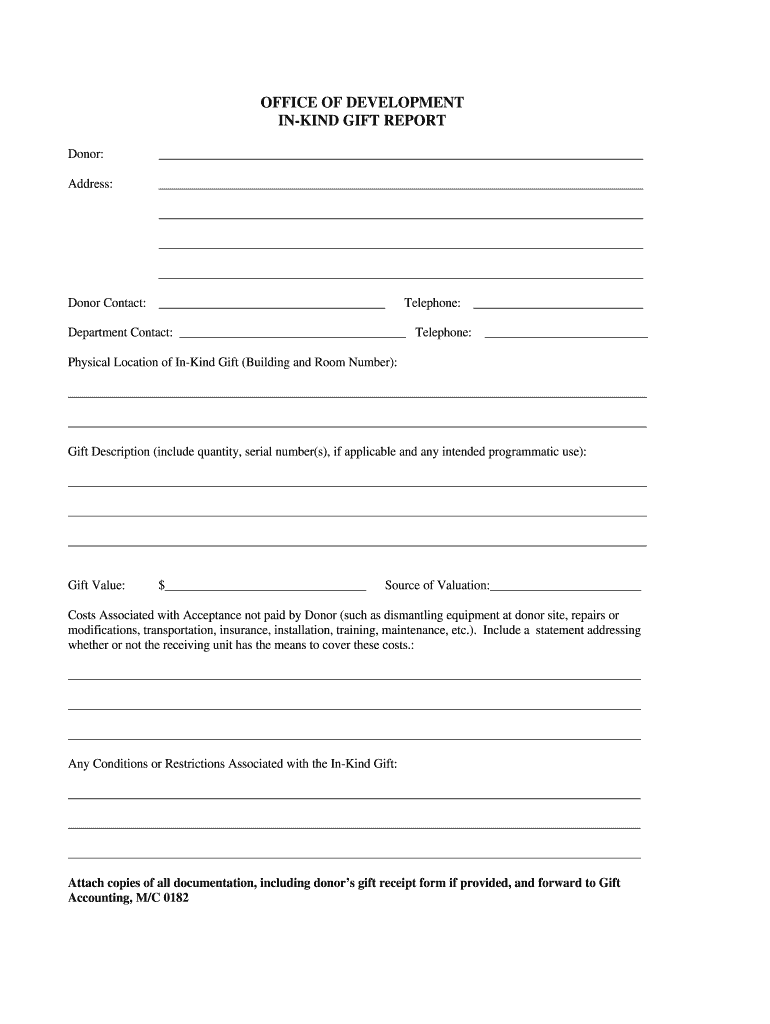

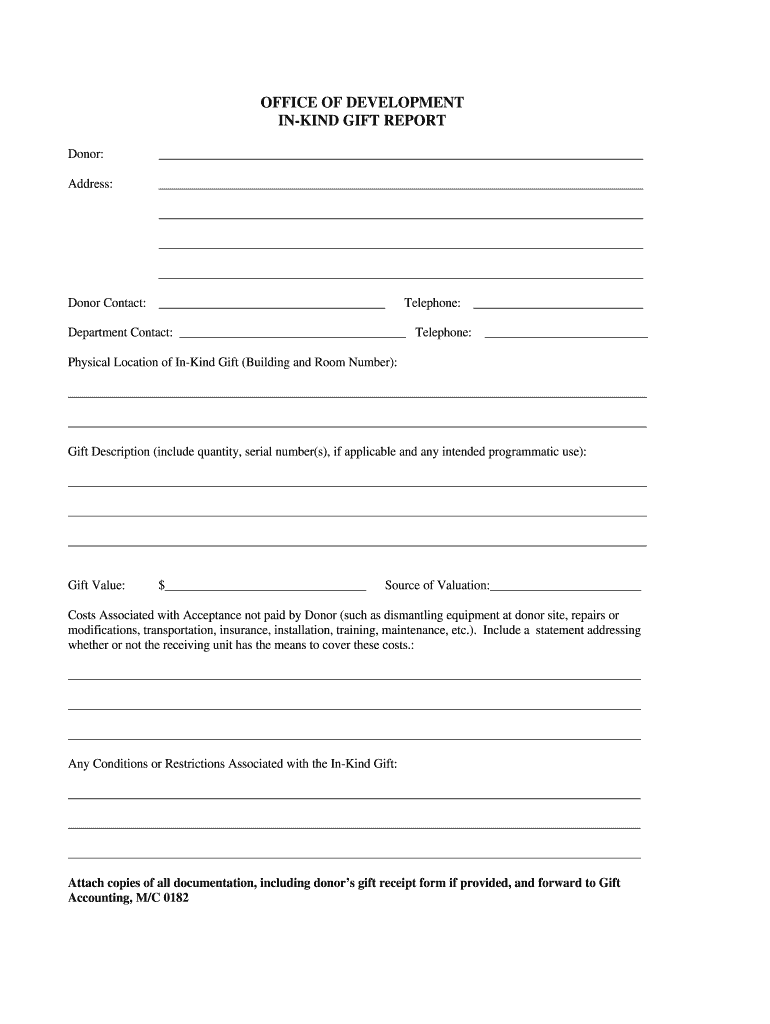

OFFICE OF DEVELOPMENT INKING GIFT REPORT Donor: Address: Donor Contact: Telephone: Department Contact: Telephone: Physical Location of Inking Gift (Building and Room Number): Gift Description (include

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign in-kind gift report form

Edit your in-kind gift report form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your in-kind gift report form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit in-kind gift report form online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit in-kind gift report form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out in-kind gift report form

How to fill out an in-kind gift report form:

01

Begin by gathering all necessary information about the in-kind gift. This includes the donor's name and contact information, description of the gift, its estimated value, and any relevant supporting documentation.

02

Start filling out the form by providing your organization's details, such as its name, address, and tax identification number.

03

Specify the date when the in-kind gift was received and the date when the report is being filled out.

04

Clearly describe the in-kind gift, including its nature, quantity, and any specific details that may be relevant.

05

Assign a monetary value to the in-kind gift. If you are unsure about the value, consider consulting with an appraiser or using reliable resources like market prices or comparable items.

06

Include any supporting documentation, such as receipts, invoices, or appraisals, that validate the value of the in-kind gift.

07

Indicate whether the gift was used for the organization's own purposes or if it was given to a specific project or program.

08

If the gift was used for a specific project or program, provide a brief explanation of how it was utilized and the impact it had.

09

Sign and date the form, and ensure that it is properly filed or submitted to the relevant department or individual within your organization.

Who needs an in-kind gift report form?

01

Nonprofit organizations often require an in-kind gift report form to accurately track and acknowledge donations made in the form of non-cash items or services.

02

Philanthropic foundations or grant-making organizations may request an in-kind gift report to assess the overall contributions and impact of the organizations they support.

03

Donors themselves may sometimes use in-kind gift report forms for tax purposes, as they can use these reports to claim deductions for their non-cash gifts on their tax returns.

In summary, anyone who needs to accurately track, acknowledge, or report in-kind gifts should utilize an in-kind gift report form. This includes nonprofit organizations, philanthropic foundations, and donors themselves for tax purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my in-kind gift report form in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your in-kind gift report form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I make edits in in-kind gift report form without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing in-kind gift report form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I complete in-kind gift report form on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your in-kind gift report form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is in-kind gift report form?

The in-kind gift report form is a document used to report non-monetary donations or gifts received by an individual or organization.

Who is required to file in-kind gift report form?

Entities or individuals who receive in-kind gifts that exceed a certain threshold set by the governing authority are required to file in-kind gift report form.

How to fill out in-kind gift report form?

To fill out in-kind gift report form, one must provide details of the in-kind gifts received, including description, value, donor information, and date received.

What is the purpose of in-kind gift report form?

The purpose of in-kind gift report form is to ensure transparency and accountability in disclosing non-monetary donations received by entities.

What information must be reported on in-kind gift report form?

Information such as description of gift, estimated value, donor information, date received, and any restrictions or conditions attached to the gift must be reported on in-kind gift report form.

Fill out your in-kind gift report form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

In-Kind Gift Report Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.