Get the free pdffiller

Show details

Reset Form UIA 4101 (813) RICK SNYDER GOVERNOR Authorized By MCL 421.1 et seq STATE OF MICHIGAN DEPARTMENT OF LICENSING AND REGULATORY AFFAIRS STEVE ATWOOD UNEMPLOYMENT INSURANCE AGENCY P.O. Box 33598,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdffiller form

Edit your pdffiller form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pdffiller form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pdffiller form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdffiller form

How to fill out UIA 4101:

01

Provide personal information: Start by filling in your name, address, social security number, and contact information. Make sure to provide accurate and up-to-date information.

02

Provide employment details: Enter your current employer's name, address, and contact information. Include your job title, the dates you've been employed, and your average weekly wage.

03

Report your earnings: Fill in the required fields to report your gross wages earned during the specific periods mentioned in the UIA 4101 form. You may need to provide additional details such as tips, bonuses, or commissions earned.

04

Report any other income: If you have any additional sources of income, such as self-employment earnings or income from rental properties, make sure to report them accurately in the designated sections.

05

Explain any breaks in employment: If you had any periods of unemployment or gaps in employment during the reporting period, provide a brief explanation along with the dates. This could include layoff periods, medical leave, or any other valid reason for being out of work.

06

Provide details of any pension or retirement benefits: If you receive any pension or retirement benefits, include the relevant information in the appropriate sections of the form.

07

Sign and date the form: Once you have completed filling out all the required information, review the form for any errors or missing details. Sign and date the form to certify its accuracy.

Who needs UIA 4101:

01

Michigan residents applying for unemployment benefits: The UIA 4101 form is typically required for Michigan residents who are applying for unemployment benefits through the Unemployment Insurance Agency (UIA) of Michigan.

02

Individuals who have lost their job: Anyone who has lost their job and is seeking unemployment benefits from the state of Michigan needs to fill out the UIA 4101 form as part of their application process.

03

Temporary or part-time workers: Even if you have only worked temporarily or part-time, you may still be eligible for unemployment benefits. In such cases, you will still need to complete the UIA 4101 form to apply for these benefits.

04

Individuals with reduced work hours: If your work hours have been reduced significantly and you are earning less than your normal wages, you may be eligible for unemployment benefits. Filling out the UIA 4101 form is essential for such individuals seeking assistance.

Note: It's important to keep in mind that specific eligibility requirements may vary, and it is recommended to refer to the official guidelines and instructions provided by the UIA for accurate and up-to-date information.

Fill

form

: Try Risk Free

People Also Ask about

Is Michigan waiving unemployment overpayment?

The agency began the waiver process for overpayments it caused by using unauthorized criteria in June 2021, asking nearly 650,000 PUA claimants to requalify and/or recertify for benefits, using the specific federal criteria only.

What is the Michigan Obligation Assessment Rate for 2023?

You submit a protest through your MIWAM account: Click on the PUA claim ID to view the details. Click on "Determination Status", and then on "file a protest" or "file appeal" for the issue you wish to protest.

How do I restart my unemployment claim in Michigan?

Reopen your claim during the first week of unemployment or reduced work hours or wages. To file a reopen/additional claim, log in to MiWAM and click on "Additional Information Required - Click Here to File a UI claim."

How do I file a new UIA claim in Michigan?

Michigan. Michigan's 2023 SUTA rates range from 0.6% to 10.3%, with the wage base holding at $9,500.

How do I appeal an unemployment overpayment in Michigan?

If you believe you are eligible for benefits and the UIA made a mistake, you can ask for a waiver due to agency error. There is not an application for this on MiWAM, but you can ask for the waiver by going to your main account page and finding the link "Send Unemployment a Message".

Can you be terminated without a termination letter?

Yes, employers must give a termination letter called a Notice to Employee of Change in Relationship upon terminating an employee.

What is the UI rate in Michigan 2023?

Michigan's 2023 SUTA rates range from 0.6% to 10.3%, with the wage base holding at $9,500.

What is Michigan UIA register for work waiver?

Waivers can be requested through the Michigan Web Account Manager (MiWAM). Login to your MIWAM account. Under Accounts tab select UI Tax. Select Account Services tab. Scroll down, under Benefit Services submenu, select Seeking Work Waiver.

Is a termination letter required in Michigan?

Michigan. Form IA 1711 must be provided to an employee upon separation unless an employer is filing claims on behalf of the employee.

What are the termination requirements in Michigan?

Michigan is considered an at-will employment state, meaning, with a few exceptions, state employers can fire employees for essentially any reason and at any time. Conversely, Michigan's employees are also able to quit a position at any time, and for just about any reason, though there are a few exceptions.

How do I file a new UIA claim in Michigan?

0:05 5:01 How to File a Claim - YouTube YouTube Start of suggested clip End of suggested clip And your dates of employment. From all your employers for the last 18. Months in addition you willMoreAnd your dates of employment. From all your employers for the last 18. Months in addition you will need your most recent employers federal employer identification number or fein.

How many job searches are required for unemployment in Michigan?

You are required to actively search for work every week you receive unemployment benefits. This includes making at least two job contacts each week and keeping a record of your searches.

Is work search waived in Michigan?

(1) A laid off individual need not seek work if, under section 28(1)(a) of the act, this requirement is waived by the agency upon written notification by the individual's employer that the layoff is temporary and that work is expected to be available within 45 calendar days following the last day the individual worked.

How many work searches do you have to do for unemployment in Michigan?

Michigan Work Search Requirements. You are required to actively search for work every week you receive unemployment benefits. This includes making at least two job contacts each week and keeping a record of your searches.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pdffiller form in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your pdffiller form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit pdffiller form straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing pdffiller form.

How do I edit pdffiller form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like pdffiller form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

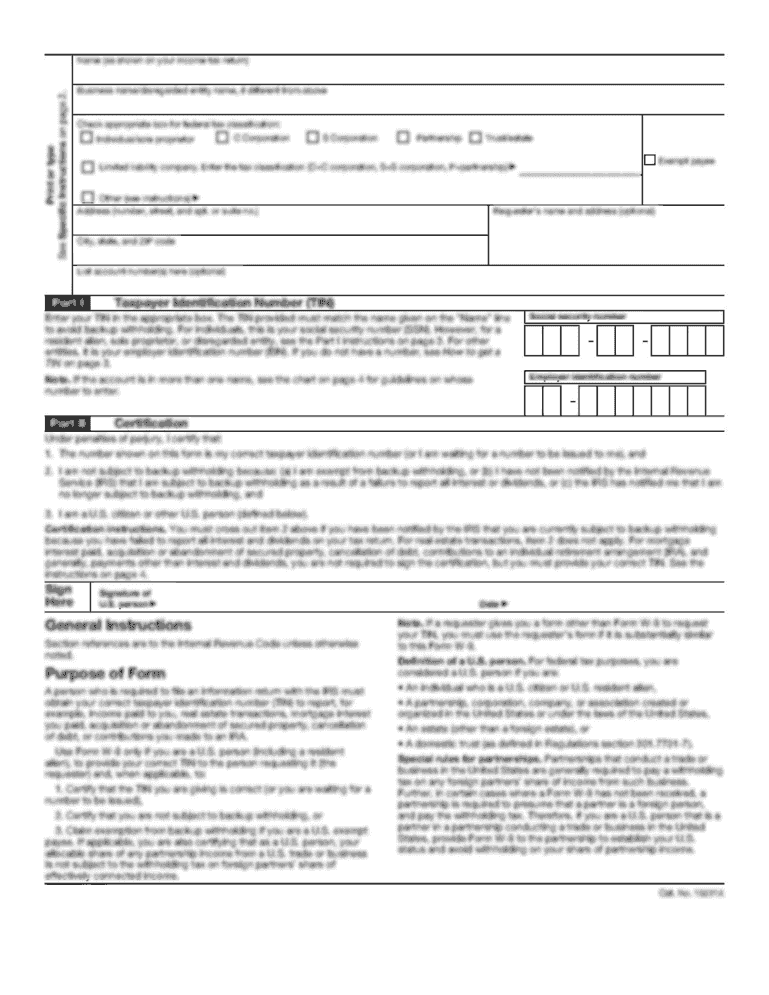

What is uia 4101?

UIA 4101 is a form used for reporting unemployment insurance contributions in the state of Michigan.

Who is required to file uia 4101?

Employers who have employees working in Michigan and are subject to unemployment insurance law are required to file UIA 4101.

How to fill out uia 4101?

To fill out UIA 4101, employers must provide details such as their business information, employee wages, and contribution amounts as required on the form.

What is the purpose of uia 4101?

The purpose of UIA 4101 is to collect unemployment insurance contributions from employers to fund unemployment benefits for eligible individuals.

What information must be reported on uia 4101?

Employers must report their business name, address, federal employer identification number (FEIN), total wages paid, and the amount of unemployment insurance contributions owed on UIA 4101.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.