Get the free LHDNM - MEF Tax Seminar 2012 Penang

Show details

HDM MEF SEMINAR ON TAXATION FOR EMPLOYERS 2012 TOWARDS KNOWLEDGEABLE EMPLOYERS Registration Form Send your Registration Form to : MALAYSIAN EMPLOYERS FEDERATION 3A06 3A07, Block A, Pusan Dagestan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lhdnm - mef tax

Edit your lhdnm - mef tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lhdnm - mef tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lhdnm - mef tax online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit lhdnm - mef tax. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lhdnm - mef tax

How to fill out lhdnm - mef tax:

01

Obtain the necessary forms: To fill out the lhdnm - mef tax, you will need to acquire the required forms from the Lembaga Hasil Dalam Negeri Malaysia (LHDNM) or the Inland Revenue Board of Malaysia. These forms can typically be found on their official website or obtained from their local branch offices.

02

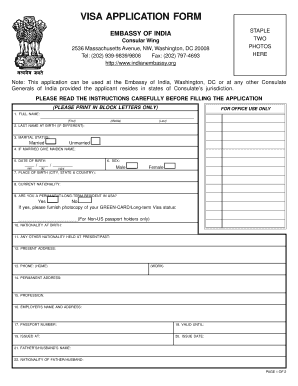

Provide personal information: Start by providing your personal information, such as your full name, identification number, address, and contact details. This ensures that the tax authorities can identify and communicate with you regarding your tax obligations.

03

Declare your income: Proceed with declaring your income from various sources. This may include income from employment, business profits, rental properties, investments, or any other income-generating activities. Make sure to accurately report your income to avoid any penalties or legal issues.

04

Deduct eligible expenses: Deduct any eligible expenses that you are entitled to claim against your income. This may include business expenses, allowable deductions, or tax reliefs. Be sure to gather all relevant receipts and documents to support your claims.

05

Calculate your tax liability: Use the provided tax tables or online calculators to determine your tax liability based on your declared income and eligible deductions. Make sure to apply the correct tax rates and thresholds as per the guidelines provided by LHDNM.

06

Pay any outstanding tax: If you find that you owe taxes after calculating your tax liability, make the necessary payment to the LHDNM. They may provide you with various options for settling your tax dues, such as online payment, bank transfer, or in-person at their offices.

Who needs lhdnm - mef tax:

01

Individuals earning taxable income: Anyone who earns taxable income, whether from employment, business profits, investments, or other sources, may need to fill out the lhdnm - mef tax form. It is essential to report your income accurately and meet your tax obligations to comply with the tax laws of Malaysia.

02

Self-employed individuals: Self-employed individuals, such as freelancers, sole proprietors, or partners in a partnership, are also required to fill out the lhdnm - mef tax form. They need to declare their business income, deductible expenses, and pay taxes based on their respective tax brackets.

03

Rental property owners: If you own rental properties and receive rental income, you must include this income in your lhdnm - mef tax form. Reporting rental income accurately is vital to ensure compliance with tax regulations.

04

Individuals with investment income: If you earn income from investments, such as dividends, interest, or capital gains, you may need to declare this income in your lhdnm - mef tax form. Reporting investment income correctly ensures that you fulfill your tax obligations pertaining to these earnings.

05

Individuals claiming tax reliefs: Tax reliefs are specific deductions allowed by the tax authorities to reduce your overall tax liability. If you are eligible for any tax reliefs, you should fill out the lhdnm - mef tax form to claim these reliefs effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send lhdnm - mef tax for eSignature?

lhdnm - mef tax is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I execute lhdnm - mef tax online?

pdfFiller has made it simple to fill out and eSign lhdnm - mef tax. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my lhdnm - mef tax in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your lhdnm - mef tax and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is lhdnm - mef tax?

The LHDNM - MEF tax is a tax imposed by the Inland Revenue Board of Malaysia (Lembaga Hasil Dalam Negeri Malaysia) on individuals or entities with income derived from Malaysia.

Who is required to file lhdnm - mef tax?

Any individual or entity with income sourced from Malaysia is required to file LHDNM - MEF tax.

How to fill out lhdnm - mef tax?

To fill out LHDNM - MEF tax, you need to provide detailed information about your income, deductions, and any tax reliefs that you are eligible for.

What is the purpose of lhdnm - mef tax?

The purpose of LHDNM - MEF tax is to ensure that individuals or entities pay their fair share of taxes on income derived from Malaysia.

What information must be reported on lhdnm - mef tax?

On LHDNM - MEF tax, you must report your income, deductions, tax reliefs, and any other relevant financial information.

Fill out your lhdnm - mef tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lhdnm - Mef Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.