Get the free Inheritance and Estate Transfer Tax Return - Louisiana Department ... - rev louisiana

Show details

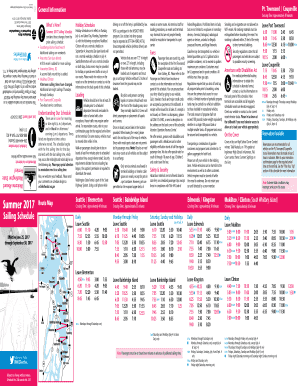

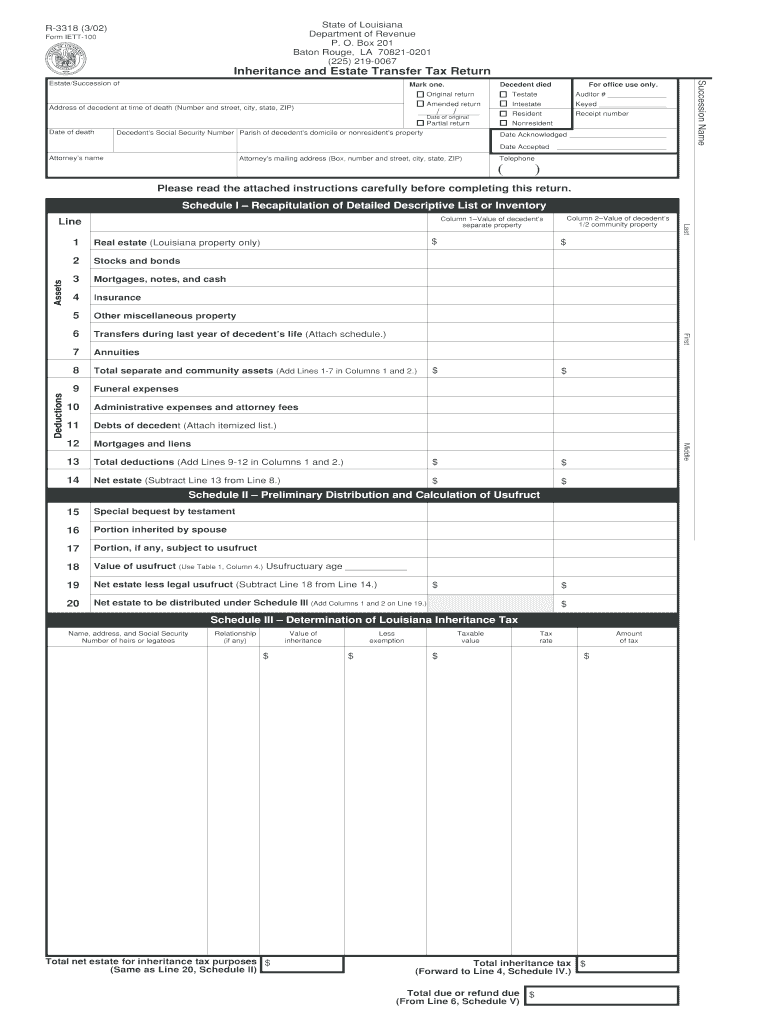

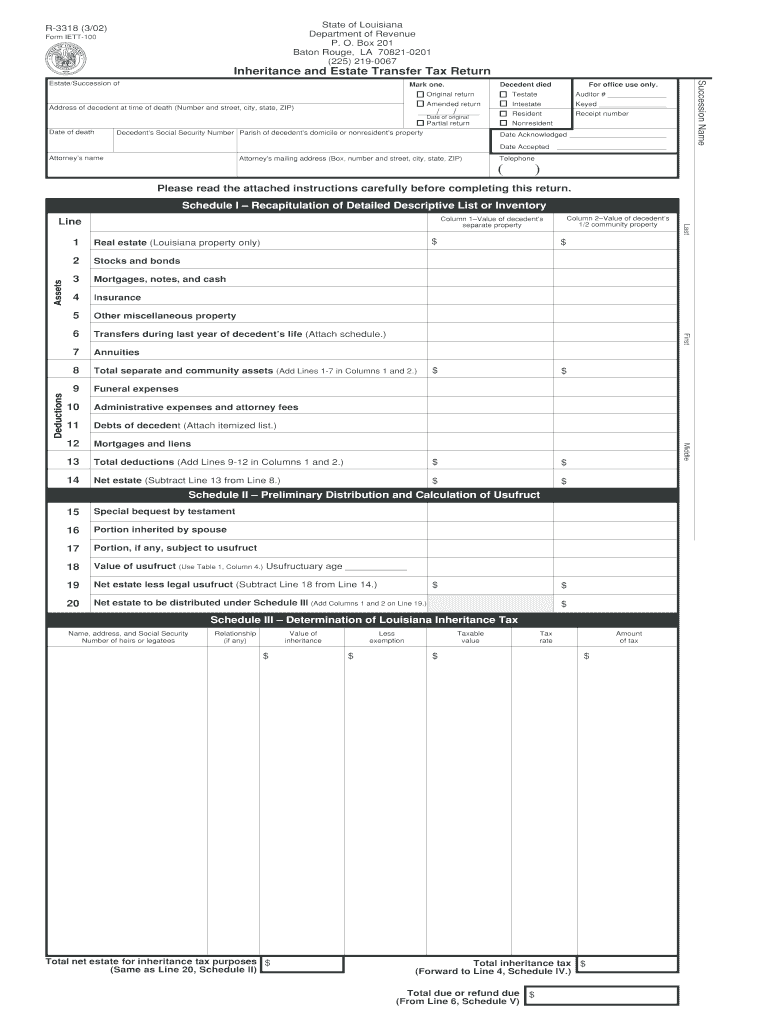

State of Louisiana Department of Revenue P. O. Box 201 Baton Rouge, LA 708210201 (225) 2190067 R3318 (3/02) Form IETT100 Inheritance and Estate Transfer Tax Return Mark one. Decedent died Original

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign inheritance and estate transfer

Edit your inheritance and estate transfer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your inheritance and estate transfer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit inheritance and estate transfer online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit inheritance and estate transfer. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out inheritance and estate transfer

How to fill out inheritance and estate transfer:

01

Gather necessary documents: Start by collecting all the relevant documents such as the deceased person's will, death certificate, and any other relevant legal documents.

02

Identify and appoint an executor: Determine who will be responsible for handling the estate transfer and make sure they understand their duties and responsibilities.

03

Inventory the estate: Create a comprehensive list of all the assets and liabilities of the deceased person. This may include bank accounts, properties, investments, debts, and any other relevant financial information.

04

Determine the beneficiaries: Identify the individuals or organizations who will inherit the estate according to the deceased person's will or applicable laws of inheritance if there is no will. Ensure that the beneficiaries are clearly named and that their contact information is available.

05

Evaluate and distribute assets: Assess the value of each asset and determine how they will be distributed among the beneficiaries. This may involve selling properties, transferring ownership of assets, or dividing financial assets accordingly. Ensure to follow the legal requirements and any specific instructions outlined in the will.

06

File necessary paperwork: Complete any required forms, applications, or tax returns related to the estate transfer. This may include filing an estate tax return or notifying relevant government authorities of the transfer.

07

Settle debts and taxes: Pay off any outstanding debts or taxes owed by the deceased person's estate. This may involve working with creditors, banks, or tax authorities to ensure all financial obligations are settled.

08

Obtain necessary approvals and permissions: In some cases, you may need to obtain court approval or seek legal guidance to ensure the estate transfer process is carried out correctly and in compliance with applicable laws.

09

Keep detailed records: Maintain meticulous records of all transactions, communications, and actions taken during the estate transfer process. This will help to ensure transparency and provide necessary documentation in case of any legal challenges or disputes.

10

Close the estate: Once all assets have been distributed, debts settled, and necessary paperwork filed, you can officially close the estate transfer process.

Who needs inheritance and estate transfer?

01

Individuals with significant assets: People who have accumulated substantial wealth or have valuable assets such as properties, businesses, or investments may require inheritance and estate transfer to ensure their assets are distributed according to their wishes.

02

Families with dependents: Individuals with children or other dependents may utilize inheritance and estate transfer to provide for their loved ones' financial well-being in case of their unexpected death.

03

Business owners: Entrepreneurs who own businesses may need to plan for the succession of their company and ensure a smooth transfer of ownership, preventing disruption to their business operations.

04

People with specific wishes: Individuals who have specific intentions for their assets, such as donating to charitable organizations or leaving funds for specific purposes, can utilize inheritance and estate transfer to ensure their wishes are honored.

05

Individuals looking to minimize taxes and expenses: Estate planning can help individuals reduce taxes and expenses associated with the transfer of assets, allowing more of their wealth to be preserved for their intended beneficiaries.

06

Those seeking to avoid disputes or legal challenges: By having a clear and comprehensive estate transfer plan, individuals can minimize the risk of family conflicts, disputes, or challenges to the distribution of their assets after their death.

07

Elderly or terminally ill individuals: Those who are in advanced age or facing a terminal illness might prioritize organizing their estate transfer to ensure their wishes are executed and their loved ones are taken care of with minimal burden.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete inheritance and estate transfer on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your inheritance and estate transfer. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I edit inheritance and estate transfer on an Android device?

The pdfFiller app for Android allows you to edit PDF files like inheritance and estate transfer. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I fill out inheritance and estate transfer on an Android device?

Complete inheritance and estate transfer and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is inheritance and estate transfer?

Inheritance and estate transfer refers to the passing on of assets, property, and wealth from a deceased person to their heirs or beneficiaries.

Who is required to file inheritance and estate transfer?

The executor or administrator of the deceased person's estate is typically required to file inheritance and estate transfer.

How to fill out inheritance and estate transfer?

To fill out inheritance and estate transfer, the executor or administrator must gather information about the deceased person's assets, debts, and beneficiaries, and follow the specific requirements set by the relevant tax authority.

What is the purpose of inheritance and estate transfer?

The purpose of inheritance and estate transfer is to ensure that the deceased person's assets are properly distributed to their heirs or beneficiaries according to their wishes or relevant laws.

What information must be reported on inheritance and estate transfer?

Information such as the value of the deceased person's assets, any outstanding debts, details of beneficiaries, and any relevant tax liabilities must be reported on inheritance and estate transfer forms.

Fill out your inheritance and estate transfer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Inheritance And Estate Transfer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.