Get the free New FHA Condo

Show details

New FHA Condo

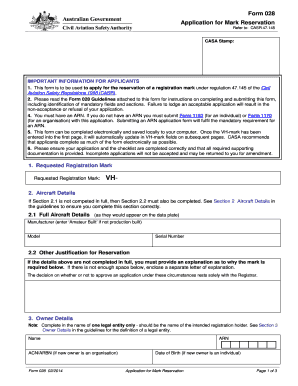

Eligibility FeatureRatePlug now offers FHA approval and eligibility information

for all condos and town homes in the RED database.

Earplug works with a third party company that specializes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new fha condo

Edit your new fha condo form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new fha condo form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new fha condo online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit new fha condo. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new fha condo

How to fill out a new FHA condo:

01

Gather all necessary documents: Before filling out the FHA condo application, make sure to collect all the required documents, such as personal identification, proof of income, tax returns, bank statements, and any other relevant financial information.

02

Review the FHA guidelines: Familiarize yourself with the specific guidelines and requirements set by the Federal Housing Administration (FHA) for obtaining a condo loan. This includes understanding the minimum credit score, debt-to-income ratio, and other eligibility criteria.

03

Complete the application: Fill out the FHA condo application form accurately and provide all requested information. Make sure to double-check each entry to avoid errors or discrepancies. The application will typically ask for details about your personal information, employment history, financial status, and the condominium unit you wish to purchase.

04

Submit supporting documents: Attach all the necessary supporting documents to your application. This may include items such as pay stubs, W-2 forms, and bank statements to verify your income and assets. Additionally, include any documentation related to the condominium itself, such as the homeowners association (HOA) information and insurance details.

05

Pay the application fees: There may be certain fees associated with the FHA condo application process, such as an appraisal fee or an upfront mortgage insurance premium. Make sure to submit the necessary payments along with your application.

06

Double-check everything: Before submitting your application, review all the information provided and ensure its accuracy. Mistakes or missing information can delay the approval process or even lead to rejection.

Who needs a new FHA condo?

01

First-time homebuyers: The FHA condo loan program is often sought after by individuals who are purchasing their first home. The program provides more lenient borrowing requirements and lower down payment options, making it an attractive option for those with limited funds or less robust credit profiles.

02

Individuals with limited income: The FHA condo program is designed to assist individuals with moderate to low incomes in obtaining affordable housing. If you fall within this income bracket and are unable to secure a conventional mortgage, an FHA loan may be a suitable option.

03

Condo buyers: As the name suggests, the FHA condo program is specifically tailored for those looking to purchase a condominium unit. Whether you are a young professional, a retiree, or someone who prefers a low-maintenance lifestyle, an FHA condo loan can help you finance your dream condo.

04

Buyers in need of a low down payment option: One of the advantages of the FHA condo program is its low down payment requirement. If you are unable to afford a substantial down payment, an FHA loan allows you to put down as little as 3.5% of the purchase price, making homeownership more accessible to a wider range of individuals.

05

Borrowers with imperfect credit: While credit requirements still exist for FHA condo loans, they tend to be more forgiving compared to conventional loans. If you have a less-than-perfect credit history, an FHA loan may offer more flexibility and a higher likelihood of approval.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is new fha condo?

New FHA condo refers to a type of condominium project that meets the eligibility requirements for Federal Housing Administration (FHA) financing.

Who is required to file new fha condo?

The developers or builders of condominium projects seeking FHA approval are required to file new FHA condo.

How to fill out new fha condo?

To fill out a new FHA condo application, developers need to provide information on the project's legal compliance, finances, and management.

What is the purpose of new fha condo?

The purpose of new FHA condo is to ensure that condominium projects meet FHA standards for financing, making them eligible for FHA loans.

What information must be reported on new fha condo?

The new FHA condo application requires information on the project's legal documentation, financial status, and management structure.

How do I complete new fha condo online?

Filling out and eSigning new fha condo is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make edits in new fha condo without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing new fha condo and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit new fha condo on an iOS device?

Create, modify, and share new fha condo using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your new fha condo online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Fha Condo is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.