Get the free CommerCial lending development program - Washington Bankers

Show details

Overview Modeled after the Was extremely successful Executive Development Program, the Commercial Lending Development Program (CLIP) is specifically designed for commercial bankers looking to maximize

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial lending development program

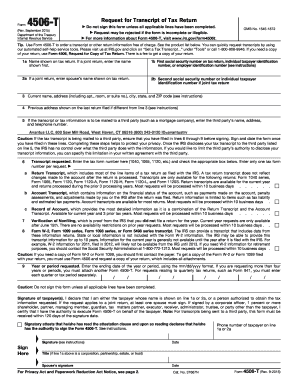

Edit your commercial lending development program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial lending development program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit commercial lending development program online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit commercial lending development program. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial lending development program

How to fill out a commercial lending development program:

01

Start by gathering all necessary documents and information. This may include financial statements, tax returns, personal credit history, business plans, and any other relevant documents required by the lending institution.

02

Research and select the appropriate lending institution or program that suits your needs. Look into various options such as banks, credit unions, or online lenders, and compare their terms, interest rates, and loan requirements.

03

Review the eligibility criteria and ensure that you meet all the necessary requirements for the commercial lending program. This may include factors such as credit score, business history, collateral, and financial stability.

04

Prepare an accurate and comprehensive loan application. Fill out all the required sections, including personal and business information, loan purpose, requested amount, and repayment terms.

05

Provide supporting documentation to strengthen your loan application. This may include financial statements (income statements, balance sheets, cash flow statements), business plans, tax returns, legal documents, and any other relevant information that demonstrates your ability to repay the loan.

06

Double-check all the information provided and ensure that it is accurate and up-to-date. Any errors or discrepancies may hinder the approval process or delay the decision.

07

Submit your completed loan application and supporting documents to the lending institution. Follow their designated submission process and ensure that you have met all the requirements for a complete application.

08

Stay in communication with the lending institution throughout the application process. Respond promptly to any requests for additional information or clarifications to help expedite the review and approval process.

09

Once a decision is made, carefully review the terms and conditions of the loan offer. Understand the interest rate, repayment period, fees, and any other relevant terms before accepting the loan.

10

If approved, utilize the funds responsibly and for the intended purpose. Make timely payments as per the agreed-upon terms to maintain a positive relationship with the lending institution and to build a strong credit history.

Who needs a commercial lending development program?

01

Entrepreneurs and small business owners who are looking for financing options to start or expand their businesses.

02

Real estate developers or investors who seek funding for commercial property acquisitions, construction projects, or property improvement.

03

Established businesses that require additional capital to finance equipment purchases, inventory expansion, or general operating expenses.

04

Individuals or companies looking to participate in mergers, acquisitions, or joint ventures.

05

Startups or innovative ventures that require early-stage funding for research, development, and market entry.

06

Non-profit organizations that need financial support to carry out their missions or implement community development projects.

07

Agricultural businesses seeking funding for farm purchases, equipment upgrades, or expansion of operations.

08

Exporters or importers in need of financing for international trade transactions.

09

Professional service providers, such as doctors, dentists, or lawyers, who require financing to enhance their practice or fund expansion initiatives.

10

Individuals or businesses who have identified investment opportunities and need capital to execute their strategies.

Note: The content provided above is for informational purposes only and should not be considered financial or legal advice. It is important to consult with professionals and carefully review the terms and conditions of any lending program before making any decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send commercial lending development program for eSignature?

When you're ready to share your commercial lending development program, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit commercial lending development program straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing commercial lending development program.

How do I fill out commercial lending development program using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign commercial lending development program and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is commercial lending development program?

Commercial lending development program is a structured program designed to develop the skills and knowledge of individuals working in the commercial lending industry.

Who is required to file commercial lending development program?

Financial institutions and organizations involved in commercial lending are required to file commercial lending development programs.

How to fill out commercial lending development program?

Commercial lending development programs can be filled out by providing information on the institution, program objectives, curriculum, and assessment methods.

What is the purpose of commercial lending development program?

The purpose of commercial lending development program is to improve the skills and competencies of individuals working in commercial lending, ultimately leading to better decision-making and risk management.

What information must be reported on commercial lending development program?

Information such as program objectives, course curriculum, evaluation methods, and the individuals participating in the program must be reported on commercial lending development program.

Fill out your commercial lending development program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial Lending Development Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.