Get the free ST-3 Resale Certificate - newjersey

Show details

Which states do you hold a tax-exempt certificate? (check all that apply). Connecticut. New Jersey. Virginia. Illinois ... Spartan Surfaces Use Only ... Email completed form to accounting spartansurfaces.com

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign st-3 resale certificate

Edit your st-3 resale certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st-3 resale certificate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

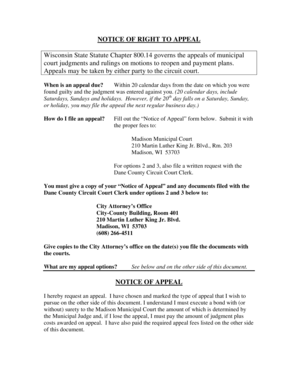

How to edit st-3 resale certificate online

In order to make advantage of the professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit st-3 resale certificate. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

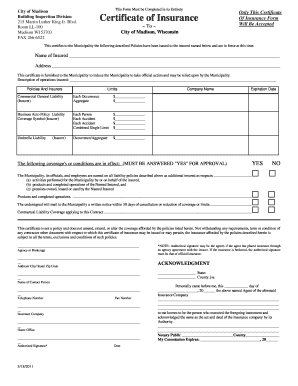

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

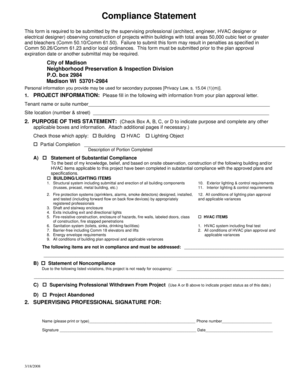

How to fill out st-3 resale certificate

How to fill out st-3 resale certificate:

01

Obtain the st-3 resale certificate form from the appropriate state tax authority or download it from their website.

02

Read the instructions carefully to understand the required information and any specific guidelines for completing the form.

03

Fill in the basic information section of the form, including your company's name, address, and tax identification number.

04

Provide information about the purchaser, including their name, address, and tax identification number if applicable.

05

Indicate the type of business you are engaged in and the nature of the products or services being purchased for resale.

06

Enter the date of the sale and the amount of the purchase or sales transaction being reported on the st-3 form.

07

Calculate and include any applicable sales tax or exemption codes as required by your state's tax laws.

08

Sign and date the form once you have completed all the necessary sections.

09

Submit the st-3 resale certificate to the appropriate tax authority by the designated deadline.

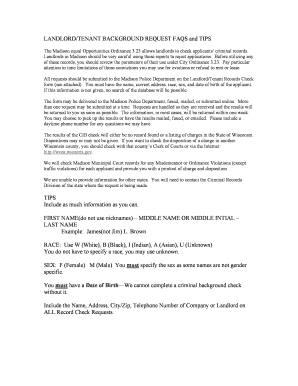

Who needs st-3 resale certificate:

01

Businesses that sell products or services for resale rather than for their own use or consumption may need to obtain and fill out an st-3 resale certificate.

02

Resellers, wholesalers, and retailers who purchase goods or services with the intention of reselling them generally require an st-3 resale certificate.

03

The st-3 resale certificate serves as proof to the tax authority that the products or services being purchased are exempt from sales tax because they will be resold to the end consumer.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from paying NC sales tax?

Qualifying Farmers or Conditional Farmers. Commercial Fishermen. Commercial Loggers. Wildlife Managers.

What type of business is a St-3 in NJ?

Form ST-3: Used for in-state suppliers. Form ST-3NR: Used for out-of-state suppliers. Form ST-4: Used for tax exemption on production machinery and packaging supplies.

How do I get a US sales tax exemption certificate?

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

How do I fill out a ST-3 form in NJ?

How to Fill Out NJ Sales Tax Exempt Form ST-3? Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction. Provide your taxpayer registration number. Describe the nature of goods or services you sell in an ordinary course of business.

What is a E 595E form?

North Carolina Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, is to be used for purchases for resale or other exempt purchases.

How do I get a resale certificate in NJ?

To register, file a Business Registration Application (Form NJ-REG) online with the Division of Revenue and Enterprise Services. Once registered, you will receive a New Jersey Business Registration Certificate and, if applicable, a New Jersey Certificate of Authority (to be able to collect Sales Tax).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get st-3 resale certificate?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific st-3 resale certificate and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my st-3 resale certificate in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your st-3 resale certificate directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit st-3 resale certificate straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing st-3 resale certificate, you can start right away.

What is st-3 resale certificate?

The st-3 resale certificate is a form used to document purchases made for resale in order to claim exemption from sales tax.

Who is required to file st-3 resale certificate?

Businesses engaged in reselling goods or services are required to file st-3 resale certificates.

How to fill out st-3 resale certificate?

The st-3 resale certificate can be filled out by providing the necessary information such as the buyer's name and address, seller's name and address, and details of the items being purchased for resale.

What is the purpose of st-3 resale certificate?

The purpose of the st-3 resale certificate is to establish the intent of the purchaser to resell the items and therefore claim exemption from paying sales tax.

What information must be reported on st-3 resale certificate?

The st-3 resale certificate typically requires the reporting of buyer and seller details, description of purchased items, and the buyer's business tax identification number.

Fill out your st-3 resale certificate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St-3 Resale Certificate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.