Get the free Income Tab

Show details

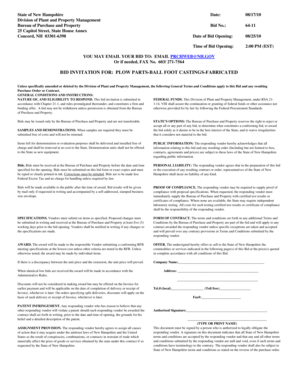

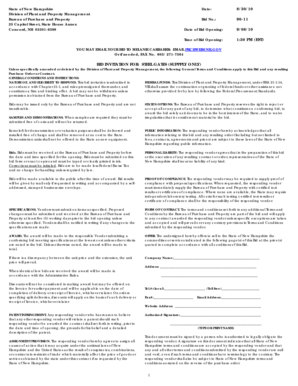

Completing the Financial Form Income Tab Line Category Explanation 1 Contributions A Meeting Grants B Meeting Awards C Non-Meeting Grants D Non-Meeting Awards E Innovative Project Funding F G Donations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income tab

Edit your income tab form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income tab form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing income tab online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit income tab. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income tab

How to fill out income tab?

01

Start by gathering all your sources of income. This can include wages/salary from your job, rental income, dividends, freelance income, etc.

02

Once you have identified all your income sources, list them out in the income tab. This can be in a spreadsheet or on a designated form provided by your financial institution.

03

Be sure to accurately input the amount of income you receive from each source. It is essential to be precise to have an accurate representation of your overall income.

04

If you have multiple sources of income, consider categorizing them. This can make it easier to track and analyze your income later on. For example, you can have categories like "Salary", "Investments", "Side Hustle", etc.

05

Review your income tab periodically to ensure it is up to date. If there are any changes in your income, make the necessary updates to maintain accurate records.

Who needs income tab?

01

Individuals managing their finances: Tracking your income is crucial for understanding your financial situation, managing your expenses, and making informed financial decisions. Whether you are budgeting, planning for the future, or just trying to stay organized, having an income tab can be beneficial.

02

Small business owners: For entrepreneurs or small business owners, the income tab becomes even more important. It helps them monitor their business income, keep track of their revenue streams, and assess their profitability.

03

Financial professionals: Accountants, bookkeepers, and financial advisors need income tabs to help their clients manage and analyze their financial information accurately.

04

Lenders or credit institutions: Income tabs are often required when applying for loans or credit. Financial institutions use this information to assess your creditworthiness and determine your ability to repay the debt.

Having an income tab is beneficial for individuals and businesses alike as it allows for better financial planning, budgeting, and overall stability in managing finances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my income tab directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign income tab and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an eSignature for the income tab in Gmail?

Create your eSignature using pdfFiller and then eSign your income tab immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out income tab using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign income tab and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is income tab?

Income tab is a section where individuals report their earnings and sources of income.

Who is required to file income tab?

Individuals who have income from various sources such as salary, investments, or self-employment are required to file income tab.

How to fill out income tab?

To fill out income tab, individuals need to provide detailed information about their income sources, amounts, and any deductions or credits they may qualify for.

What is the purpose of income tab?

The purpose of income tab is to assist in calculating an individual's total income and determining their tax liabilities.

What information must be reported on income tab?

Information such as salary, wages, bonuses, dividends, interest, and any other sources of income must be reported on income tab.

Fill out your income tab online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Tab is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.