Get the free Offering Memorandum OFFERING MEMORANDUM - tn

Show details

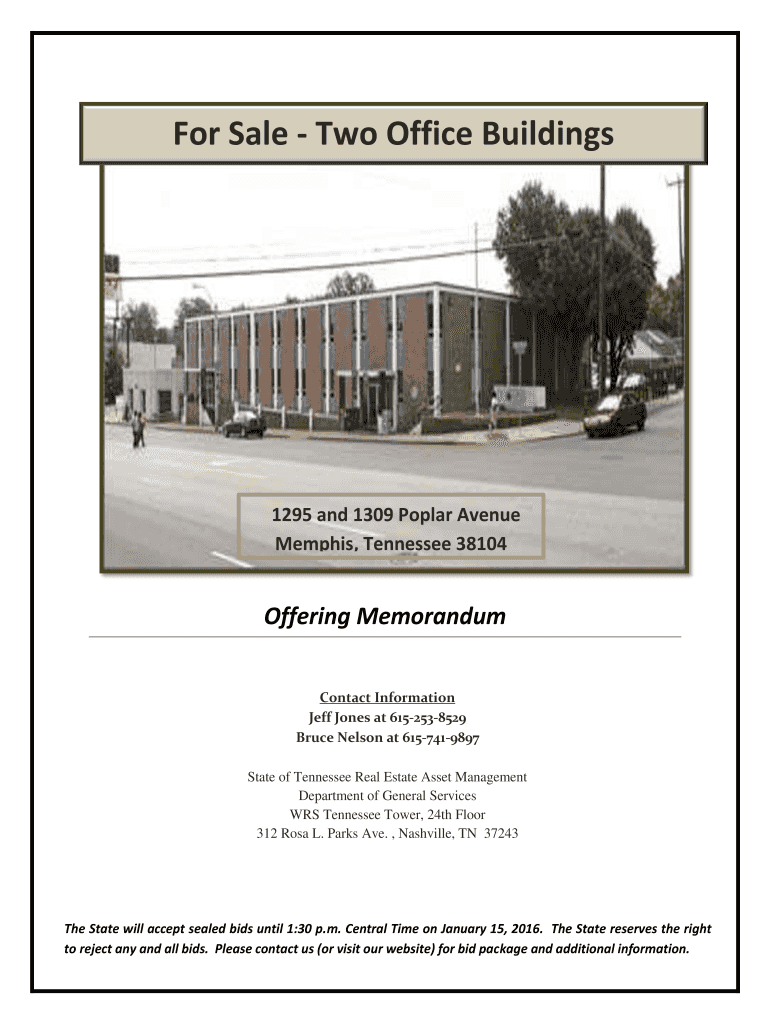

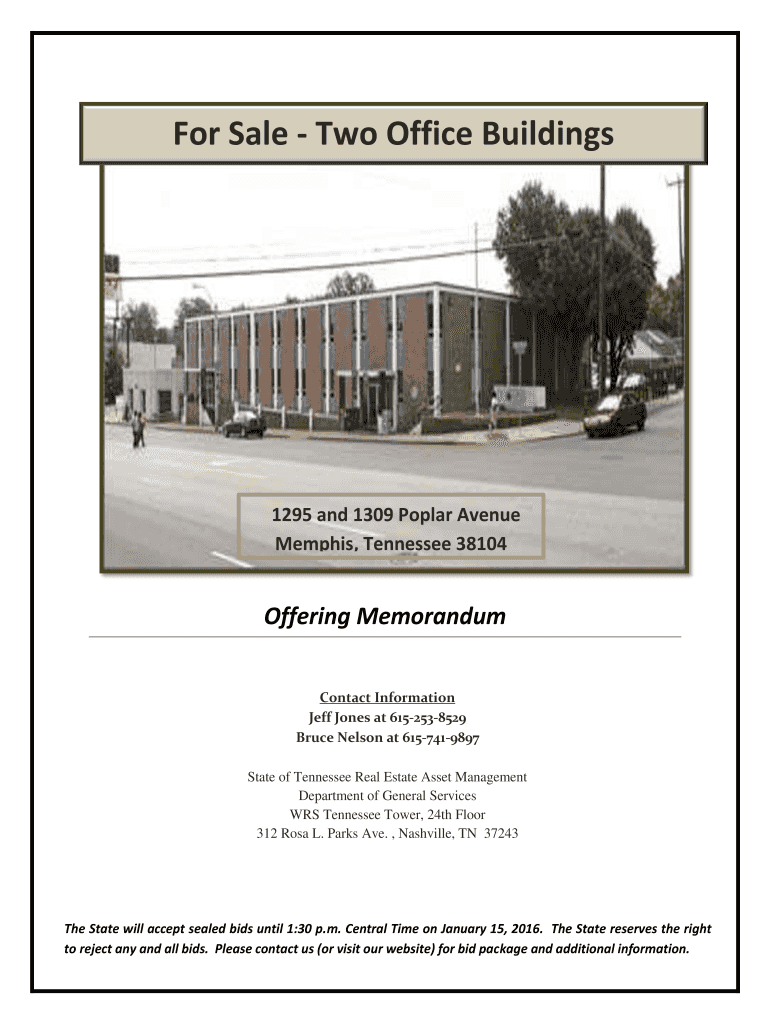

For Sale Two Office Buildings 1295 and 1309 Poplar Avenue Memphis, Tennessee 38104 Offering Memorandum Contact Information Jeff Jones at 615-253-8529 Bruce Nelson at 615-741-9897 State of Tennessee

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign offering memorandum offering memorandum

Edit your offering memorandum offering memorandum form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your offering memorandum offering memorandum form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing offering memorandum offering memorandum online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit offering memorandum offering memorandum. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out offering memorandum offering memorandum

01

Research and gather all relevant information: Before filling out the offering memorandum, it is important to conduct thorough research and gather all the necessary information about the offering. This may include details about the company or project, financial statements, business plan, market analysis, risk factors, and any legal documentation required.

02

Structure and organize the information: Once you have collected all the necessary information, it is important to structure and organize it in a clear and concise manner. This may involve creating sections or headings to highlight different aspects of the offering, such as executive summary, company overview, financials, risk factors, management team, and offering terms.

03

Prepare a detailed business description: Provide a comprehensive description of the company or project that is being offered. This should include information about the company's history, industry background, target market, unique selling proposition, competitive advantages, and any future growth prospects.

04

Include financial statements and projections: It is essential to include accurate and up-to-date financial statements, including balance sheets, income statements, and cash flow statements. Additionally, you may also need to provide financial projections or forecasts that demonstrate the potential future performance of the company or project.

05

Address risk factors: Identify and address any potential risks or uncertainties associated with the offering. This could include risks related to the industry, market conditions, regulatory factors, competitive landscape, or any other significant risks that may impact the success of the offering. It is important to disclose these risks and provide a mitigation plan to ensure transparency and investor confidence.

06

Highlight the management team: Present information about the key members of the management team, their backgrounds, qualifications, and relevant experience. This will help to instill confidence in potential investors and demonstrate that the team has the necessary skills and expertise to execute the offering successfully.

07

Determine offering terms and structure: Decide on the terms and conditions of the offering, including the type of securities being offered, the price per share, the total amount being raised, any minimum investment requirements, and the intended use of funds. This information should be clearly outlined in the offering memorandum to provide potential investors with a clear understanding of the investment opportunity.

08

Seek legal and regulatory guidance: It is crucial to consult with legal and regulatory experts to ensure compliance with all applicable laws and regulations. They can help review the offering memorandum, ensure accuracy and transparency, and address any legal or regulatory concerns.

09

Review and revise: Once the initial draft of the offering memorandum is completed, it is important to review and revise it multiple times. This will help to eliminate any errors, improve clarity and readability, and ensure that all relevant information is included.

10

Distribute the offering memorandum: The offering memorandum should be distributed to potential investors who have expressed interest in the offering. This can be done through various channels such as email, physical copies, or online platforms. It is crucial to maintain confidentiality and comply with any legal requirements regarding the distribution of the offering memorandum.

Who needs offering memorandum offering memorandum?

01

Companies seeking to raise capital: Offering memorandums are typically used by companies or projects that are looking to raise capital through private placements or public offerings. It provides potential investors with detailed information about the investment opportunity and helps to attract interested parties.

02

Investors: Potential investors who are considering investing in a company or project want to review an offering memorandum to evaluate the viability and potential returns of the investment. It helps them make informed decisions based on the information presented.

03

Financial institutions and advisors: Banks, financial institutions, and investment advisors may also require the offering memorandum to assess the investment opportunity and provide recommendations to their clients. They need to understand the risks and potential returns associated with the offering before advising their clients.

04

Legal and regulatory authorities: Offering memorandums may be required by legal and regulatory authorities to ensure compliance with securities laws and regulations. These authorities review the offering memorandum to ensure that all necessary information is disclosed and that investors are adequately protected.

05

Due diligence professionals: Professionals conducting due diligence on behalf of potential investors or financial institutions may need to review the offering memorandum to gather information and evaluate the investment opportunity. They analyze the offering memorandum to identify any discrepancies, risks, or concerns that need to be addressed before making a decision.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the offering memorandum offering memorandum electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your offering memorandum offering memorandum and you'll be done in minutes.

How do I edit offering memorandum offering memorandum straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing offering memorandum offering memorandum right away.

How can I fill out offering memorandum offering memorandum on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your offering memorandum offering memorandum. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is offering memorandum offering memorandum?

An offering memorandum is a legal document that states the objectives, risks, and terms of an investment involved with a private placement.

Who is required to file offering memorandum offering memorandum?

Companies or organizations looking to raise capital through a private placement are required to file an offering memorandum.

How to fill out offering memorandum offering memorandum?

You can fill out an offering memorandum with the help of legal and financial professionals who are experienced in drafting such documents.

What is the purpose of offering memorandum offering memorandum?

The purpose of an offering memorandum is to provide potential investors with information about the investment opportunity and to protect both the company offering the investment and the investors.

What information must be reported on offering memorandum offering memorandum?

An offering memorandum must contain detailed information about the company or organization offering the investment, the terms of the investment, the risks involved, and any other relevant information that potential investors need to make an informed decision.

Fill out your offering memorandum offering memorandum online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Offering Memorandum Offering Memorandum is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.