Get the free application form for rupay atm-kisan card

Show details

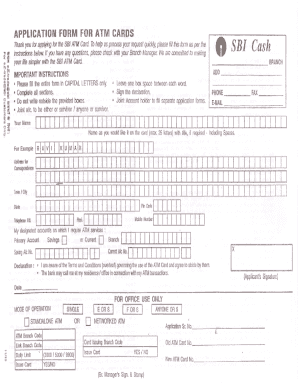

This document serves as an application form for the Rupay ATM-KISAN Card, intended for customers of Uttarakhand Gramin Bank. It collects personal and account-related information necessary for the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign uttarakhand gramin bank atm pin generate form

Edit your gramin bank atm form pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application form for rupay atm-kisan card form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit uttarakhand gramin bank atm online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit uttarakhand gramin bank atm. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application form for rupay atm-kisan card

How to fill out application form for rupay atm-kisan card

01

Obtain the application form from a designated bank branch or download it from the bank's official website.

02

Fill in personal details such as name, address, date of birth, and contact information.

03

Provide details of your agricultural activities, including land ownership and type of crops cultivated.

04

Include identification documents such as Aadhaar card, PAN card, or any other required documents.

05

Attach passport-sized photographs as specified in the application form.

06

Review the completed application form for accuracy and completeness.

07

Submit the application form at the bank branch along with all required documents.

08

Obtain acknowledgment of your application submission for future reference.

Who needs application form for rupay atm-kisan card?

01

Farmers and agricultural workers looking to access banking facilities.

02

Individuals requiring financial assistance for agricultural activities.

03

Anyone who wishes to withdraw cash using an ATM for farming-related expenses.

Fill

form

: Try Risk Free

People Also Ask about

Can I apply for an Indian Bank ATM card online?

Additionally, if you are looking for an Indian Bank debit card apply online procedure, you can either consider Internet Banking (Click here to access Indian Bank Internet Banking) or you can opt to apply for a debit card online via Internet Banking mobile banking app IndOASIS.

How to renew an ATM card in Indian Overseas Bank?

In case where the customer has not given the consent for renewal till expiry of the card, customer can still approach the branch for renewal of the card. All such requests received within 12 months after expiry of the card shall be treated as Renewal Card and no charges shall be recovered from the customer.

Can I apply for an ATM card online?

Debit cards can also be applied online. This simple process will help you procure one in a few easy steps: Visit your bank's website. Go to the retail banking/personal banking/debit/credit card section.

What is the maximum amount of cash that can be withdrawn from a Kisan RuPay debit card?

Rupay Card – The currency for cash free India FeaturesRupay Debit Card Maximum cash withdrawal Rs. 30,000/- per day in ATM POS Limit Rs. 50,000/- per day No. of Transactions free at HDCCB Bank ATMs Unlimited free No. of Transactions free at other Bank ATMs 3 transactions free per month

How to apply for an ATM card in Indian Overseas Bank online?

How to fill out the Application for Debit Card from Indian Overseas Bank? Begin by filling in your personal details. Select the type of debit card you are applying for. Provide your account information accurately. Confirm all mandatory fields are completed. Submit the application once finished.

How long is the Indian Overseas Bank ATM card valid for?

The Card is only for your use and expires after 5 years from date of issue of the Card. Upon expiry you will not be able to use the Card. Please contact Customer Care / Indian Overseas Bank branch for a renewal Card.

How to get Kisan credit card in India?

Documents Required Application Form. Two Passport Size Photographs. ID proof such as Driving License / Aadhar Card / Voter Identity Card / Passport. Address Proof such as Driving License, Aadhar Card. Proof of landholding duly certified by the revenue authorities. Cropping pattern (Crops grown) with acreage.

How to activate rupay kisan debit card?

To activate your card, use your card in ATM or POS terminal once you have set your PIN. Through the RBL MoBank 2.0 App, you can manage and safeguard your debit cards. Note: Your Debit Card is active only for Domestic ATM and POS transactions.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is application form for rupay atm-kisan card?

The application form for Rupay ATM-Kisan Card is a document that farmers fill out to request the issuance of a Rupay ATM-Kisan Card, which facilitates easy access to banking services and cash withdrawals.

Who is required to file application form for rupay atm-kisan card?

Farmers who have a bank account linked to the Kisan Credit Card (KCC) scheme are required to file the application form for the Rupay ATM-Kisan Card.

How to fill out application form for rupay atm-kisan card?

To fill out the application form for the Rupay ATM-Kisan Card, applicants need to provide personal information, bank account details, and any relevant identification documents as specified in the form.

What is the purpose of application form for rupay atm-kisan card?

The purpose of the application form for the Rupay ATM-Kisan Card is to initiate the process of obtaining the card, which enables farmers to manage their finances easily and access banking services.

What information must be reported on application form for rupay atm-kisan card?

The application form must report the applicant's name, address, contact details, Kisan Credit Card number, and necessary identification and bank details.

Fill out your application form for rupay atm-kisan card online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uttarakhand Gramin Bank Atm is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.