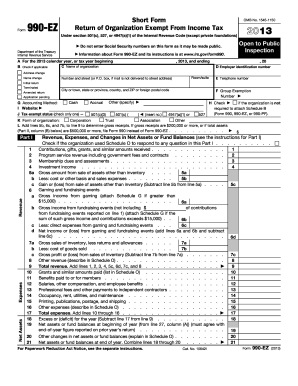

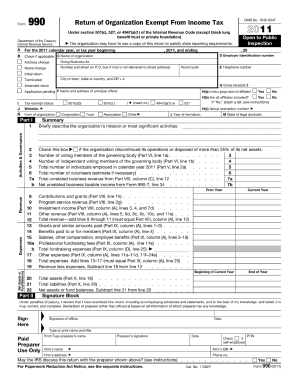

IRS 990 - Schedule B 2011 free printable template

Instructions and Help about IRS 990 - Schedule B

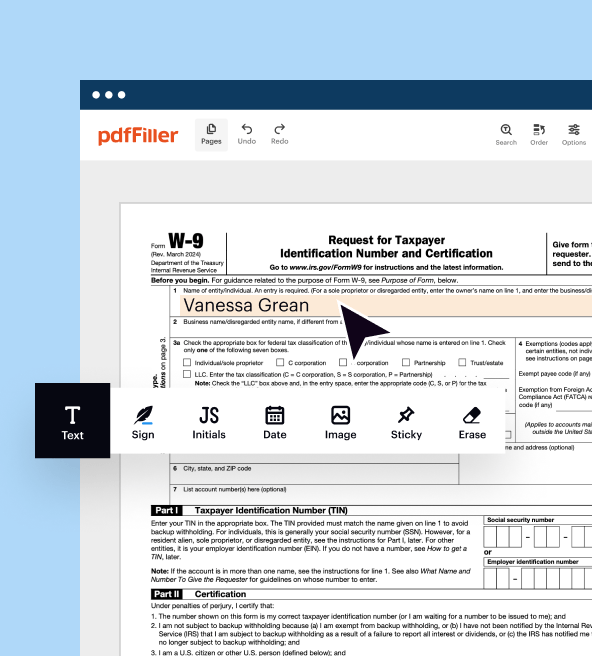

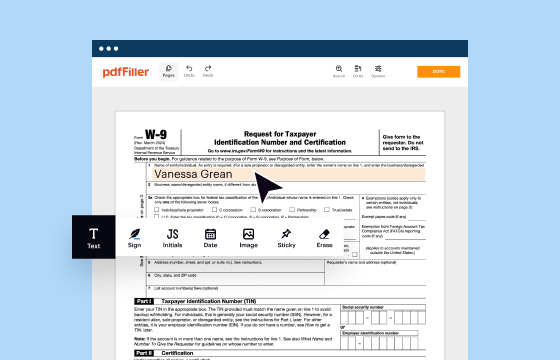

How to edit IRS 990 - Schedule B

How to fill out IRS 990 - Schedule B

About IRS 990 - Schedule B 2011 previous version

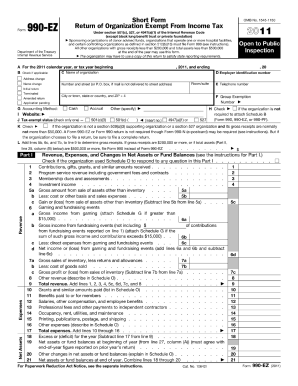

What is IRS 990 - Schedule B?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

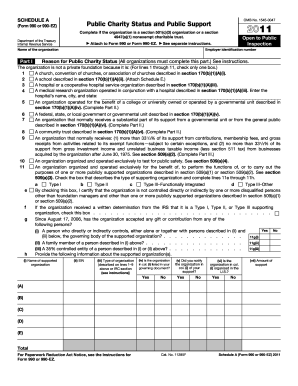

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

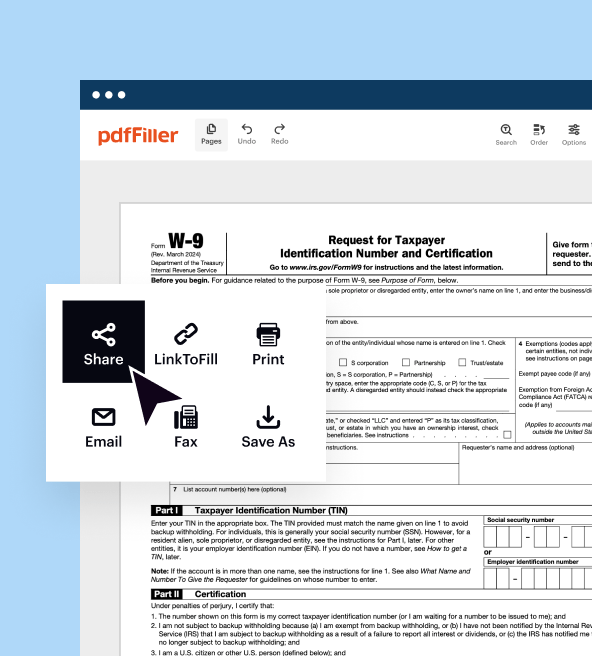

Where do I send the form?

FAQ about IRS 990 - Schedule B

What should I do if I realize I've made a mistake on my 2011 form 990 ez after submission?

If you discover an error in your 2011 form 990 ez after filing, you can submit an amended return to correct the mistake. It's important to clearly indicate on the form that it is an amended submission, and ensure that you include the correct information in place of the erroneous data. Keep in mind that the IRS recommends filing this amended return as soon as you realize the mistake to avoid potential issues.

How can I track the status of my filed 2011 form 990 ez?

To track the status of your filed 2011 form 990 ez, you can utilize the IRS's online tools or contact the relevant IRS office directly. If you e-filed, you might receive an acknowledgement of receipt via email, but for paper filings, tracking can be more challenging. Be aware of common rejection codes if you filed electronically, as these can help you understand any potential issues with your submission.

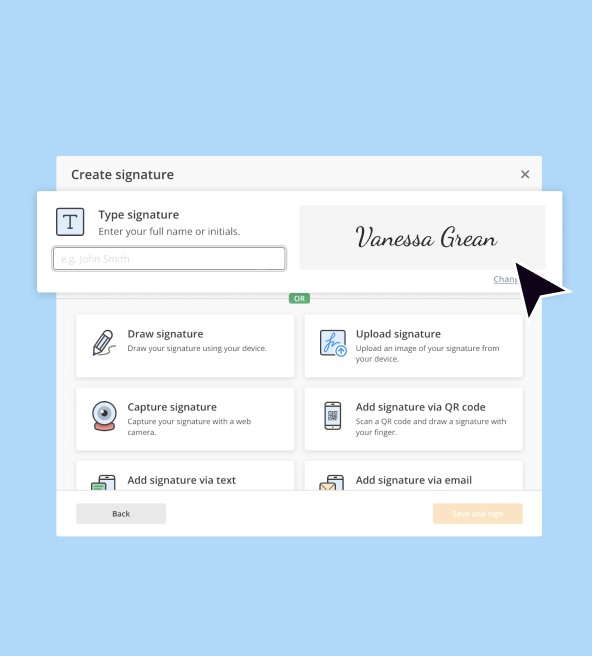

What should I know about using electronic signatures for the 2011 form 990 ez?

When filing the 2011 form 990 ez electronically, electronic signatures are generally accepted by the IRS, which can simplify the process. However, ensure you comply with the specific e-signature guidelines from the IRS to guarantee your submission is valid. Always retain copies of signed documents to maintain a record of the submission.

Are there specific common errors that I should be aware of when filing the 2011 form 990 ez?

Yes, many common errors can occur when filing the 2011 form 990 ez. These include incorrect financial data entries, failure to complete all required fields, or submitting with mismatched tax identification numbers. To avoid these issues, double-check all information before filing and consider a review by a tax professional to ensure accuracy.

What should I do if I receive an audit notice related to my 2011 form 990 ez?

If you receive an audit notice concerning your 2011 form 990 ez, it's crucial to read the notice carefully and gather all necessary documentation related to that filing. Respond promptly and be prepared to provide any requested information. Consulting with a tax advisor can also help you navigate the audit process more effectively.