Get the free Customs Regulations applicable when Moving To Italy

Show details

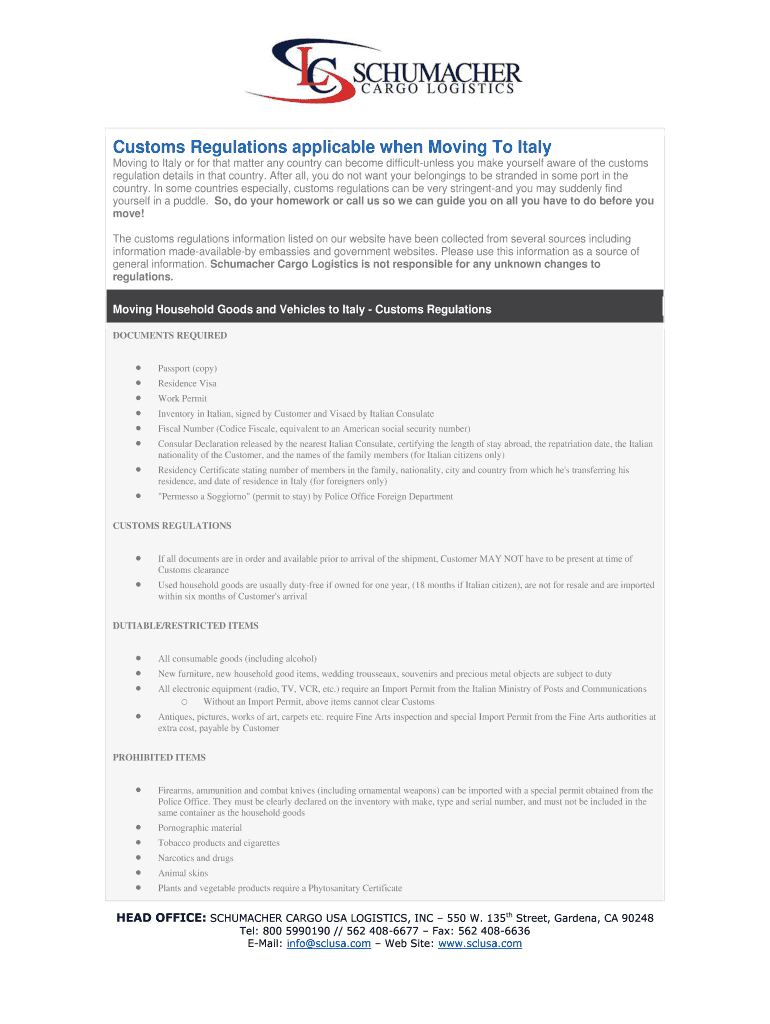

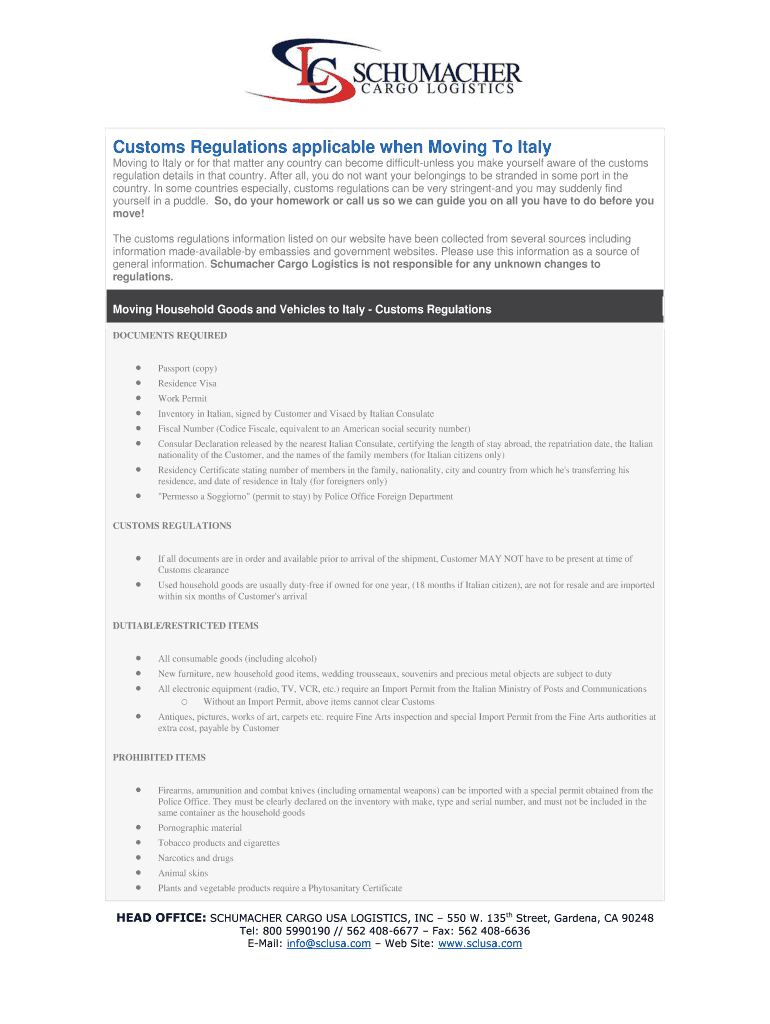

Customs Regulations applicable when Moving To Italy

Moving to Italy or for that matter any country can become difficult unless you make yourself aware of the customs

regulation details in that country.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customs regulations applicable when

Edit your customs regulations applicable when form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customs regulations applicable when form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing customs regulations applicable when online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit customs regulations applicable when. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out customs regulations applicable when

How to fill out customs regulations applicable when:

01

Start by gathering all the necessary documents and information required for the customs regulations. This may include the description of goods, their value, quantity, country of origin, and any necessary permits or licenses.

02

Fill out the required customs forms accurately and completely. Pay close attention to details, as any errors or missing information can lead to delays or penalties. It's advisable to seek guidance from customs experts or consultants if you are unsure about specific requirements.

03

Ensure that you properly classify your goods according to the customs regulations. This involves determining the appropriate customs tariff code or Harmonized System (HS) code for your products. Accurate classification is crucial for proper assessment of duties and taxes.

04

Declare the value of your goods accurately. This includes the transaction value, which is the price paid or payable for the goods, along with any additional costs such as insurance and transportation. Be prepared to provide supporting documents if required.

05

Comply with any special requirements or restrictions specified by the customs regulations. These might include specific labeling or packaging requirements, adherence to health and safety standards, or restrictions on certain goods such as hazardous materials or prohibited items.

06

Complete any additional paperwork or permits that may be necessary for customs clearance, such as import/export licenses or certificates of origin. This may vary depending on the nature of your goods and the countries involved in the trade.

07

Submit the customs documentation and pay any applicable duties, taxes, or fees as required by the customs regulations. Ensure that you keep copies of all the documents submitted for your records.

08

In some cases, you may be subject to customs audits or inspections. Cooperate with customs officials and provide any requested information or access to goods for verification purposes.

Who needs customs regulations applicable when:

01

Importers and exporters: Any individual or business involved in international trade, whether importing or exporting goods, needs to comply with customs regulations applicable to their specific countries and jurisdictions.

02

Customs brokers: These are professionals or organizations specialized in facilitating customs clearance procedures on behalf of importers and exporters. They help clients navigate the complex customs regulations, ensure compliance, and expedite the customs clearance process.

03

Freight forwarders and logistics providers: These companies play a crucial role in managing the transportation and logistics of goods across borders. As part of their services, they need to be aware of and adhere to the customs regulations applicable when handling international shipments.

04

Business owners and managers: Even if you are not directly involved in the import/export process, understanding customs regulations applicable when can be essential for making informed business decisions. It helps you assess trade opportunities, analyze costs, and comply with legal obligations when engaging in global commerce.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is customs regulations applicable when?

Customs regulations are applicable when goods are being imported or exported across international borders.

Who is required to file customs regulations applicable when?

Any individual or business involved in importing or exporting goods is required to file customs regulations.

How to fill out customs regulations applicable when?

Customs regulations can be filled out electronically through the customs portal or with the help of a customs broker.

What is the purpose of customs regulations applicable when?

The purpose of customs regulations is to ensure that goods entering or leaving a country comply with local laws and regulations.

What information must be reported on customs regulations applicable when?

Information such as the description of the goods, value, country of origin, and exporter/importer details must be reported on customs regulations.

How can I send customs regulations applicable when for eSignature?

To distribute your customs regulations applicable when, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I sign the customs regulations applicable when electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your customs regulations applicable when in seconds.

How do I complete customs regulations applicable when on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your customs regulations applicable when. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your customs regulations applicable when online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customs Regulations Applicable When is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.