Get the free VENTURE CAPITAL AND ENTREPRENEURSHIP

Show details

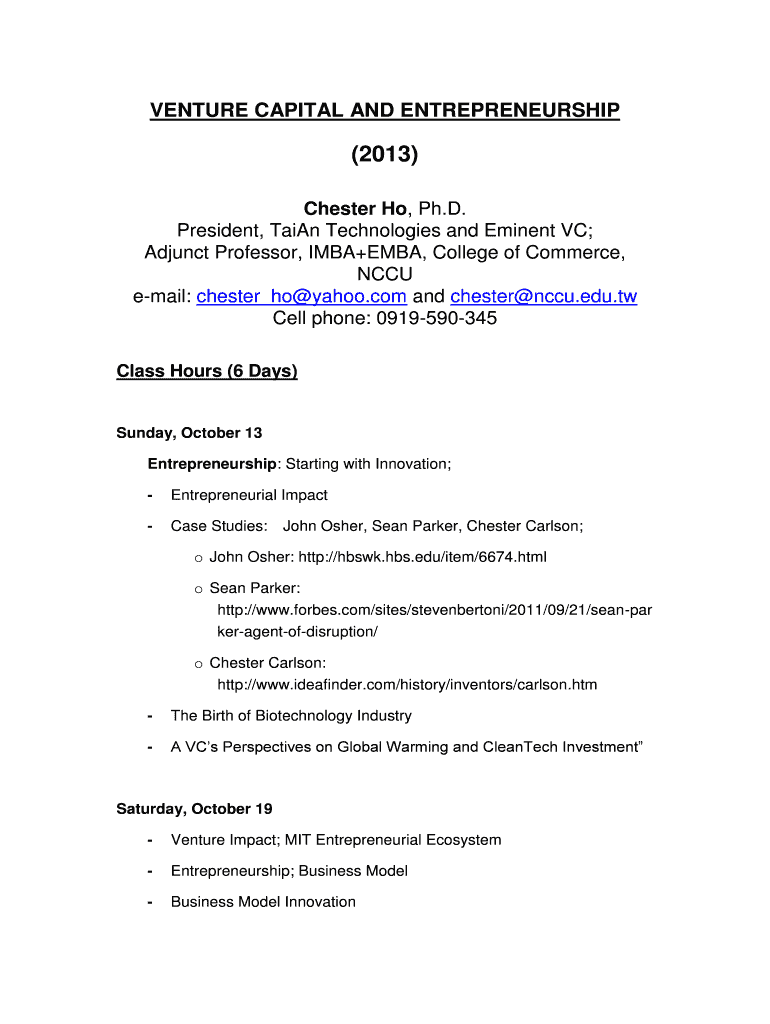

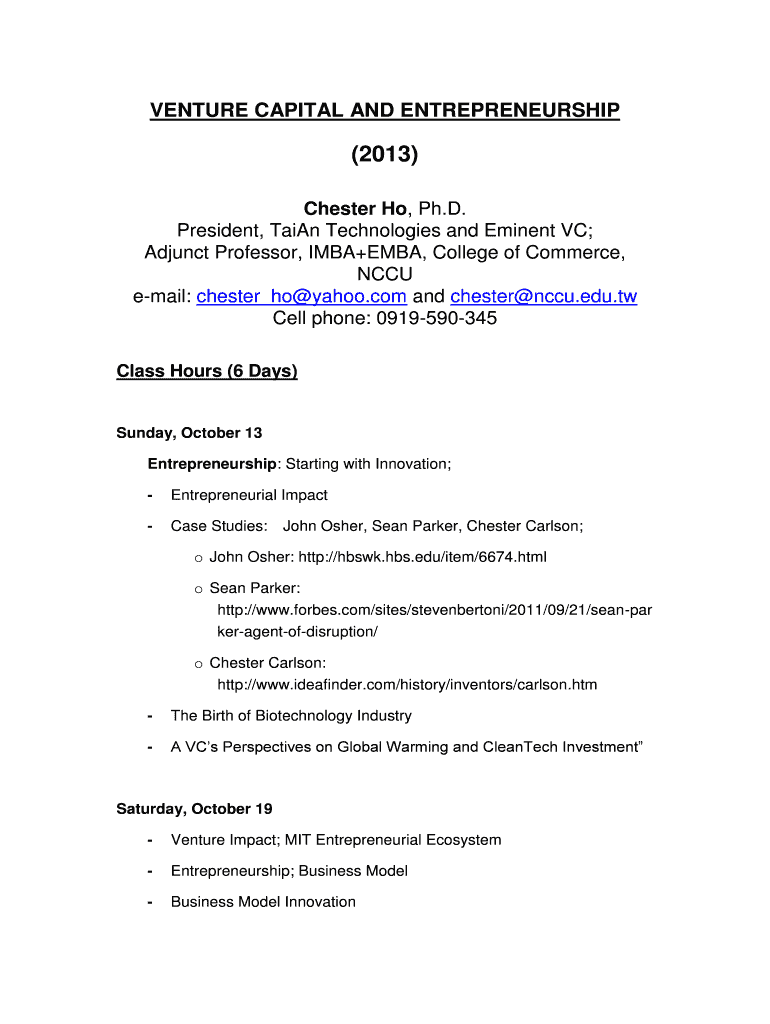

VENTURE CAPITAL AND ENTREPRENEURSHIP(2013)

Chester Ho, Ph.D.

President, Taiwan Technologies and Eminent VC;

Adjunct Professor, IMA+EMMA, College of Commerce,

CCU

email: chester_ho@yahoo.com and chester@nccu.edu.tw

Cell

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign venture capital and entrepreneurship

Edit your venture capital and entrepreneurship form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your venture capital and entrepreneurship form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit venture capital and entrepreneurship online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit venture capital and entrepreneurship. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out venture capital and entrepreneurship

How to fill out venture capital and entrepreneurship:

01

Research potential investors: Begin by conducting thorough research on potential venture capital firms or investors who specialize in your industry or have a track record of supporting startups. Look for investors who align with your company's mission and values.

02

Create a compelling business plan: Develop a comprehensive business plan that clearly outlines your product or service, target market, financial projections, competitive analysis, and growth strategies. This plan will serve as a roadmap for your venture and help attract potential investors.

03

Build a strong team: Surround yourself with a talented and experienced team that can help execute your business plan effectively. Investors often look for teams with diverse skills and expertise, as this increases the likelihood of success.

04

Show traction and market validation: Demonstrate evidence of early traction or customer interest in your product or service. This can include user numbers, revenue growth, partnerships, customer testimonials, or market research data. Investors want to see that your venture has the potential for growth and profitability.

05

Prepare financial statements: Develop accurate and detailed financial statements, including an income statement, balance sheet, and cash flow statement. Investors will assess your financials to evaluate the sustainability and scalability of your venture.

06

Develop a compelling pitch deck: Create a visually appealing and informative pitch deck that highlights the key aspects of your business plan, including market opportunity, competitive advantage, revenue model, and investment requirements. Your pitch deck should be concise, engaging, and persuasive.

Who needs venture capital and entrepreneurship?

01

Startups: Venture capital is often crucial for startups looking to scale their operations, develop new products, or expand into new markets. It provides the necessary funding and expertise to accelerate growth and attract other sources of financing.

02

Early-stage companies: Entrepreneurship and venture capital can be instrumental for early-stage companies that require capital to research, develop, and launch their products or services. It helps bridge the funding gap between self-funding and traditional sources of financing.

03

High-growth potential businesses: Venture capital is typically targeted towards businesses with high-growth potential in industries such as technology, biotechnology, clean energy, and e-commerce. These ventures often require substantial capital injections to support rapid expansion and innovation.

04

Founders lacking personal funds: Many entrepreneurs lack the personal funds needed to start or grow their ventures. Venture capital provides an alternative source of funding, allowing founders to access the necessary resources to turn their ideas into viable businesses.

05

Businesses seeking expertise and mentorship: Venture capital firms often bring more than just capital to the table. They can provide valuable expertise, industry connections, and mentorship to help businesses navigate challenges and make strategic decisions.

06

Innovators and disruptors: Venture capital is often attracted to innovative and disruptive ideas that have the potential to transform industries. Entrepreneurs who are creating groundbreaking products or services that solve major problems can benefit greatly from venture capital investments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is venture capital and entrepreneurship?

Venture capital is a type of funding for new or growing businesses provided by investors in exchange for ownership equity. Entrepreneurship is the process of starting and running a business.

Who is required to file venture capital and entrepreneurship?

Entrepreneurs and business owners seeking venture capital funding may be required to file documentation related to their business plans, financial projections, and potential return on investment.

How to fill out venture capital and entrepreneurship?

Filling out venture capital documents typically involves providing detailed information about the business, including its market potential, financial performance, and growth strategy.

What is the purpose of venture capital and entrepreneurship?

The purpose of venture capital is to provide funding to businesses with high growth potential, while entrepreneurship aims to create and develop innovative business solutions.

What information must be reported on venture capital and entrepreneurship?

Information reported on venture capital documents may include business plans, financial statements, market research, and investment terms.

How do I modify my venture capital and entrepreneurship in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign venture capital and entrepreneurship and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make changes in venture capital and entrepreneurship?

With pdfFiller, it's easy to make changes. Open your venture capital and entrepreneurship in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I edit venture capital and entrepreneurship on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign venture capital and entrepreneurship on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your venture capital and entrepreneurship online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Venture Capital And Entrepreneurship is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.