Get the free Foreign Company AML Form Foreign Company AML Form

Show details

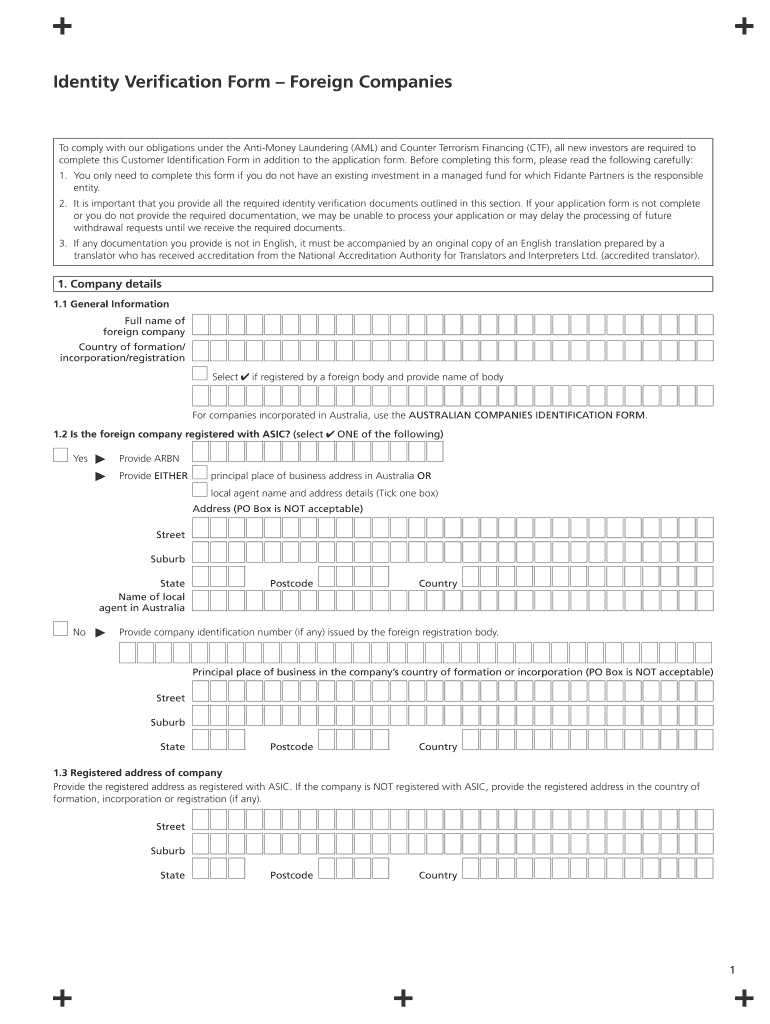

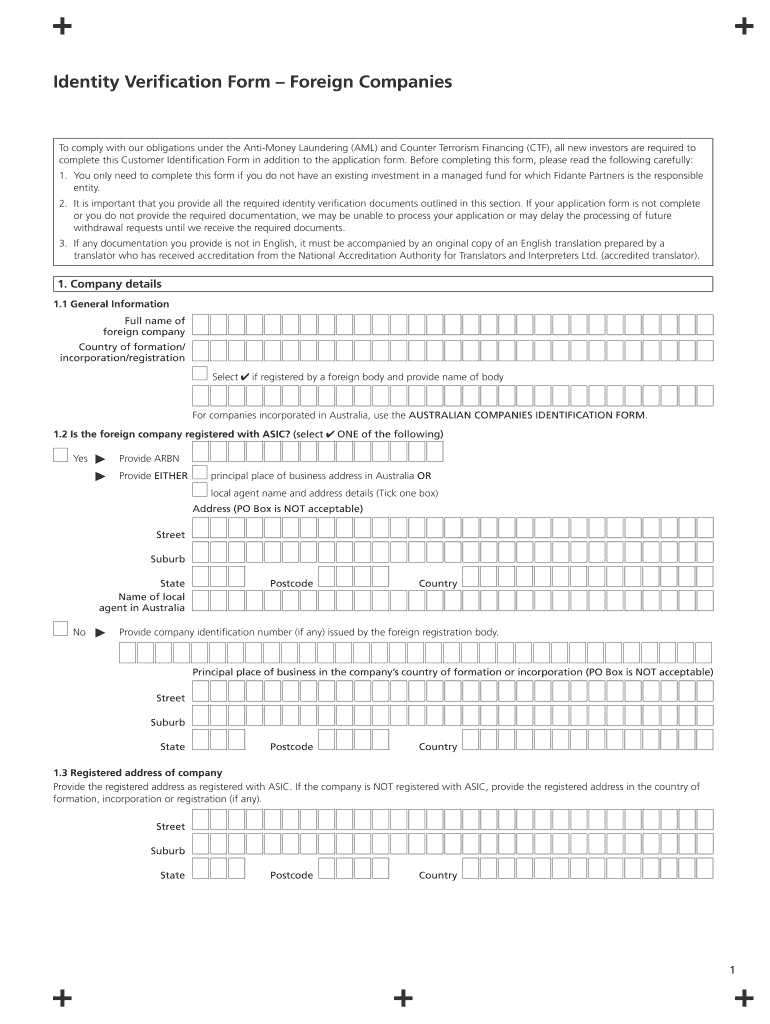

Identity Verification Form Foreign Companies To comply with our obligations under the Antimony Laundering (AML) and Counterterrorism Financing (CTF), all new investors are required to complete this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foreign company aml form

Edit your foreign company aml form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foreign company aml form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing foreign company aml form online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit foreign company aml form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out foreign company aml form

How to fill out foreign company AML form:

01

Obtain the form: The first step in filling out a foreign company AML form is to acquire the form itself. This can usually be done by visiting the website or contacting the relevant regulatory authority or institution that requires the form.

02

Provide company information: Begin by entering the necessary details about the foreign company. This typically includes the company's legal name, registered address, contact information, and any additional information as requested in the form.

03

Identify beneficial owners: One important aspect of the AML form is to identify and disclose the beneficial owners of the foreign company. Beneficial owners are individuals who ultimately have control or ownership over the company. The form may require providing personal information about these individuals, such as their names, addresses, and percentage of ownership.

04

Describe business activities: The AML form may ask for a description of the foreign company's business activities. Provide a clear and accurate summary of the primary business conducted by the company and any other relevant details.

05

Provide supporting documents: It is common for the AML form to require supporting documents to verify the information provided. This may include documents such as copies of identification documents for beneficial owners, company registration certificates, and financial statements. Ensure that all the required documents are gathered and attached to the form as instructed.

06

Review and submit: Before submitting the form, carefully review all the information provided and ensure its accuracy. Any errors or missing information should be corrected before submission. Once reviewed, submit the completed form and any supporting documentation through the designated method, such as online submission or mailing.

07

Keep a copy: It is advisable to keep a copy of the filled-out foreign company AML form for your records. This can serve as proof of compliance if it is ever required or requested in the future.

Who needs foreign company AML form?

01

Financial institutions: Banks, credit unions, and other financial institutions typically require foreign companies, especially those involved in international transactions, to fill out AML forms. These institutions have a legal obligation to ensure that they are not unknowingly facilitating money laundering or terrorist financing.

02

Government regulatory bodies: Various government agencies and regulatory bodies may also require foreign companies to complete AML forms. These agencies are responsible for enforcing AML laws and regulations and require information to assess the risk of financial crime associated with foreign entities.

03

Business partners and clients: In some cases, foreign companies may be asked to provide AML forms by their business partners or clients as part of their due diligence processes. This is particularly true when engaging in high-value transactions or partnerships where financial crime risks need to be mitigated.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is foreign company aml form?

The Foreign Company AML Form is a form used to report any anti-money laundering activities conducted by a foreign company operating in a particular jurisdiction.

Who is required to file foreign company aml form?

Foreign companies operating in a specific jurisdiction are required to file the foreign company AML form.

How to fill out foreign company aml form?

The foreign company AML form can typically be filled out online or by submitting a physical copy to the relevant authorities as per the instructions provided.

What is the purpose of foreign company aml form?

The purpose of the foreign company AML form is to ensure transparency and accountability in the operations of foreign companies, especially in relation to anti-money laundering measures.

What information must be reported on foreign company aml form?

The foreign company AML form typically requires information such as the company's name, address, beneficial owners, anti-money laundering procedures, and any suspicious activities.

How can I modify foreign company aml form without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your foreign company aml form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Where do I find foreign company aml form?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the foreign company aml form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I execute foreign company aml form online?

pdfFiller has made it simple to fill out and eSign foreign company aml form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Fill out your foreign company aml form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foreign Company Aml Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.