Get the free Flexible Retirement Plan - tpt org

Show details

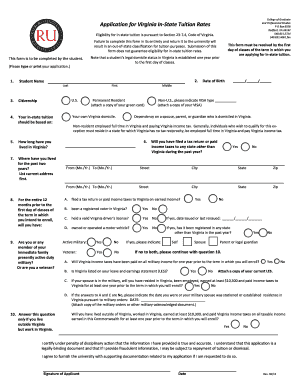

Flexible Retirement Plan Employer Application Form This form will enable your organization to participate in the Flexible Retirement Plan operated byte Pensions Trust for your employees. Please complete

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flexible retirement plan

Edit your flexible retirement plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flexible retirement plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing flexible retirement plan online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit flexible retirement plan. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flexible retirement plan

How to fill out a flexible retirement plan:

01

Start by researching and understanding the different types of retirement plans available. This will help you identify which one suits your needs and goals the best.

02

Take into consideration your current financial situation, including your income, expenses, and any debts or obligations you may have. This will help you determine how much you can afford to contribute towards your retirement plan.

03

Set clear and realistic retirement goals. Determine the age at which you plan to retire and the lifestyle you envision for your retirement years. This will give you a clear target to work towards while filling out your plan.

04

Consider seeking professional advice. A financial advisor can provide valuable insights and guidance, ensuring that you make informed decisions when filling out your flexible retirement plan.

05

Assess your risk tolerance. Determine how comfortable you are with taking risks when it comes to investing your retirement savings. This will help you choose the appropriate investment options within your plan.

06

Review and understand the terms and conditions of your retirement plan. Familiarize yourself with the rules and regulations, as well as any potential fees or penalties that may apply.

07

Determine your contribution rate. Decide how much you want to contribute towards your retirement plan on a regular basis. Keep in mind that a higher contribution rate can lead to a larger retirement nest egg.

08

Consider any match contributions offered by your employer. If your employer offers a matching contribution, make sure to take full advantage of this benefit, as it can significantly boost your retirement savings.

09

Regularly review and adjust your plan. Life circumstances can change, and it's important to review your retirement plan periodically to ensure it aligns with your current needs and goals.

10

Lastly, be consistent and disciplined in your contributions. Consistently contribute towards your retirement plan and avoid withdrawing funds unless absolutely necessary to maximize the potential growth of your savings.

Who needs a flexible retirement plan:

01

Individuals who anticipate a change in their retirement age or want the option to retire earlier or later than the traditional retirement age.

02

Those who have an irregular income or expect fluctuations in their income throughout their working years.

03

Individuals who desire more control and flexibility over their retirement savings and investment choices.

04

People who anticipate life-changing events such as career changes, health issues, or financial emergencies, and want their retirement plan to adapt accordingly.

05

Individuals who want to have the option to vary their retirement income withdrawals based on their changing needs or unexpected expenses.

06

Those who may need to fund other financial goals, such as education expenses or buying a home, while still saving for retirement.

07

People who want to have tax advantages and estate planning benefits provided by a flexible retirement plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is flexible retirement plan?

A flexible retirement plan is a retirement savings option that allows individuals to contribute money towards their retirement on a flexible basis, meaning they can adjust the amount they contribute based on their financial situation.

Who is required to file flexible retirement plan?

Individuals who want to save for retirement and have chosen a flexible retirement plan as their preferred option are required to file the plan.

How to fill out flexible retirement plan?

Flexible retirement plans can typically be filled out online through a designated portal provided by the financial institution offering the plan. Applicants will need to provide personal information and choose their contribution amount.

What is the purpose of flexible retirement plan?

The purpose of a flexible retirement plan is to provide individuals with a flexible way to save for retirement that allows them to adjust their contributions as needed.

What information must be reported on flexible retirement plan?

Flexible retirement plans require individuals to report personal information such as their name, address, Social Security number, and financial information such as income and contribution amounts.

How do I edit flexible retirement plan in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing flexible retirement plan and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I edit flexible retirement plan on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share flexible retirement plan from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I edit flexible retirement plan on an Android device?

With the pdfFiller Android app, you can edit, sign, and share flexible retirement plan on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your flexible retirement plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flexible Retirement Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.