Get the free Rider and Asset Allocation Options Request- Schwab Forms

Show details

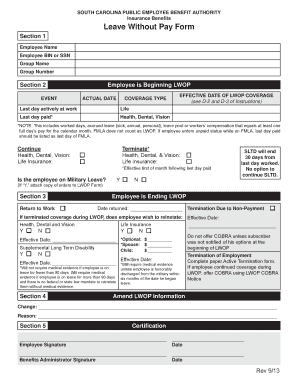

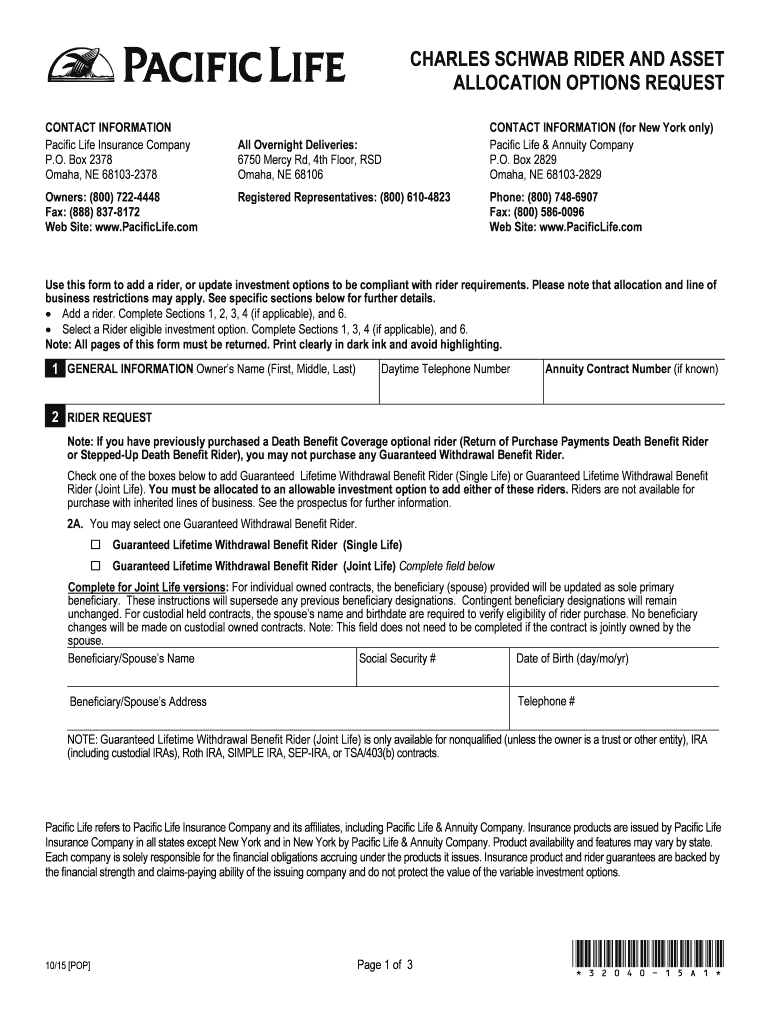

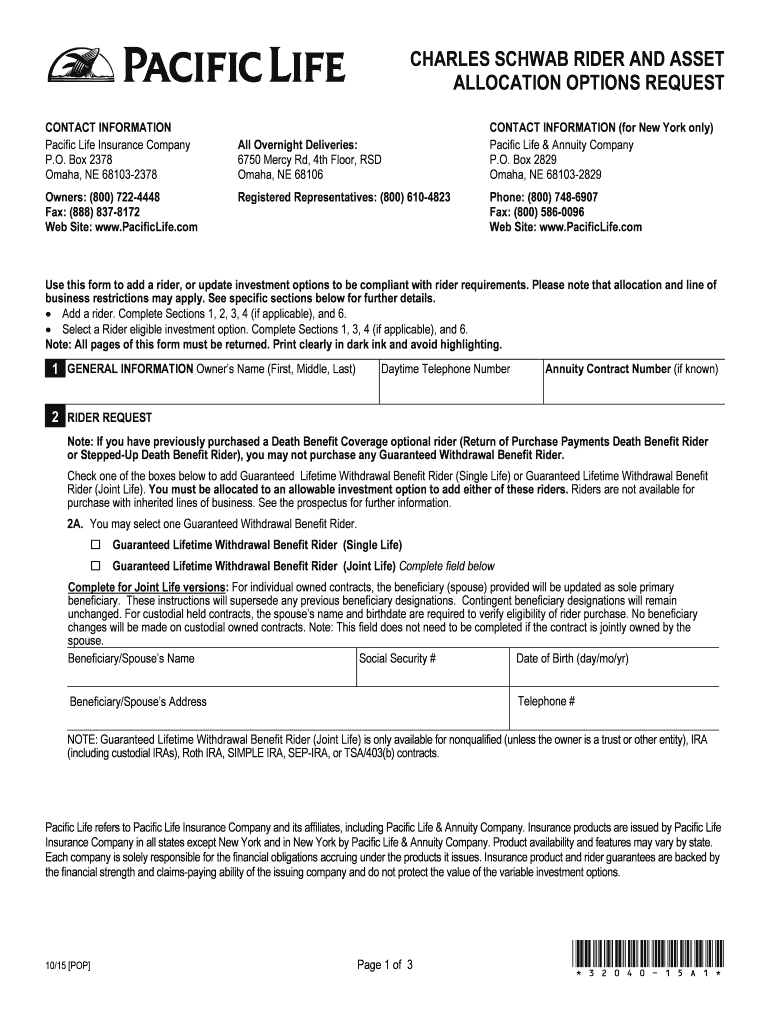

CHARLES SCHWAB RIDER AND ASSET ALLOCATION OPTIONS REQUEST CONTACT INFORMATION Pacific Life Insurance Company P.O. Box 2378 Omaha, NE 681032378 Owners: (800) 7224448 Fax: (888) 8378172 Website: www.PacificLife.com

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rider and asset allocation

Edit your rider and asset allocation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rider and asset allocation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rider and asset allocation online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rider and asset allocation. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rider and asset allocation

How to fill out rider and asset allocation:

01

Start by gathering all the necessary information. To fill out a rider and asset allocation form, you will need details about your current assets, investments, and financial goals. Collect statements, account balances, and any relevant documents before you begin.

02

Understand your risk tolerance. Asset allocation involves determining how much of your portfolio you are comfortable allocating to different asset classes, such as stocks, bonds, or cash. Assess your risk tolerance by considering your financial objectives, time horizon, and ability to tolerate market fluctuations.

03

Determine your investment goals. Are you looking for long-term growth, income generation, or a combination of both? Define your objectives and prioritize them accordingly. This will help guide your asset allocation decisions.

04

Assess your time horizon. Your investment time horizon refers to the length of time you plan to keep the funds invested before needing to access them. Longer time horizons generally allow for more aggressive investments, while shorter time horizons may require a more conservative approach.

05

Consider your financial constraints. Take into account any limitations or constraints you may have, such as liquidity needs, tax considerations, or legal restrictions. These factors can impact your asset allocation strategy.

06

Seek professional advice if needed. If you're unsure about how to fill out the rider and asset allocation form or lack experience in investment planning, it's wise to consult with a financial advisor. They can provide personalized guidance based on your unique circumstances.

Who needs rider and asset allocation:

01

Individuals planning for retirement: Planning for a secure retirement requires a carefully balanced asset allocation strategy. By diversifying your investments, you can potentially mitigate risk and maximize returns over the long term.

02

Young professionals aiming to build wealth: Those starting their careers can benefit from developing an appropriate asset allocation plan early on. With a longer time horizon, they have the ability to take on more risk and potentially earn higher returns.

03

Investors looking to protect against market volatility: Asset allocation can help reduce the impact of market volatility on your overall investment portfolio. By diversifying across different asset classes, you can spread risk and potentially safeguard against significant losses.

04

Individuals with changing financial goals: Life circumstances and financial goals evolve over time. Regularly reviewing and adjusting your asset allocation can ensure it aligns with your current objectives.

05

Risk-averse investors seeking stability: Some investors prioritize capital preservation and seek stable returns over high-risk investments. Asset allocation can help balance the desire for stability with the need for growth.

In summary, filling out a rider and asset allocation requires collecting information, understanding risk tolerance, determining investment goals, assessing time horizons, considering financial constraints, and seeking professional advice if necessary. This process is relevant for individuals planning for retirement, young professionals, those seeking to protect against market volatility, individuals with changing goals, and risk-averse investors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is rider and asset allocation?

Rider and asset allocation refers to the process of detailing the specific items or provisions that are attached to a legal document, such as an insurance policy or investment portfolio, as well as the distribution of assets within that document.

Who is required to file rider and asset allocation?

Individuals or entities who hold investments or insurance policies that include riders or asset allocations are required to file the relevant documentation.

How to fill out rider and asset allocation?

To fill out rider and asset allocation forms, individuals must carefully review their insurance policies or investment portfolios, identify any additional provisions or asset distributions, and accurately record them in the appropriate sections.

What is the purpose of rider and asset allocation?

The purpose of rider and asset allocation is to provide clarity and transparency regarding any additional provisions or asset distributions within a legal document, ensuring all relevant information is properly documented.

What information must be reported on rider and asset allocation?

Information such as specific rider details, additional provisions, asset allocation percentages, and any changes in asset distribution must be reported on rider and asset allocation forms.

How can I edit rider and asset allocation from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including rider and asset allocation, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in rider and asset allocation?

With pdfFiller, it's easy to make changes. Open your rider and asset allocation in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I complete rider and asset allocation on an Android device?

Use the pdfFiller mobile app and complete your rider and asset allocation and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your rider and asset allocation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rider And Asset Allocation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.