Get the free Group Credit Protect Insurance Plan - Proposal Form - HDFC Life

Show details

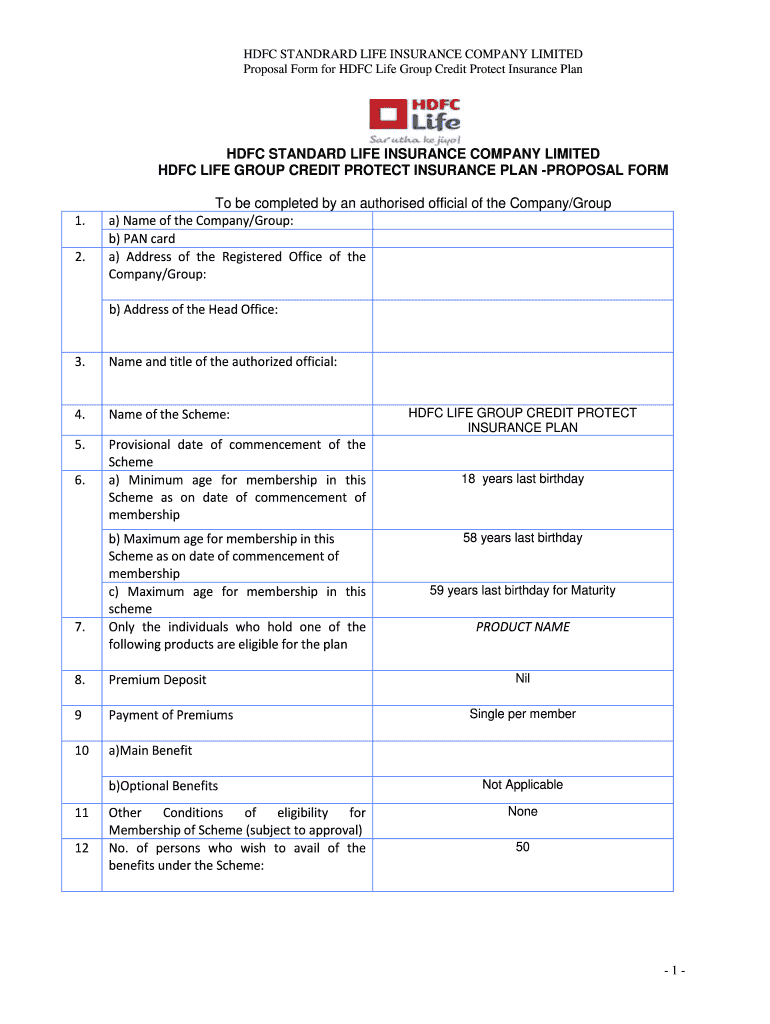

HDFC STANDARD LIFE INSURANCE COMPANY LIMITED Proposal Form for HDFC Life Group Credit Protect Insurance Plan HDFC STANDARD LIFE INSURANCE COMPANY LIMITED HDFC LIFE GROUP CREDIT PROTECT INSURANCE PLAN

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group credit protect insurance

Edit your group credit protect insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group credit protect insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing group credit protect insurance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit group credit protect insurance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out group credit protect insurance

How to fill out group credit protect insurance:

01

Gather necessary information: Before filling out the insurance application, collect all relevant details such as the name and contact information of the insured group, the number of members in the group, and any specific requirements or preferences.

02

Choose a reputable insurance provider: Research and select an insurance company that offers group credit protect insurance and has a good reputation. Look for companies that have experience in providing this type of insurance and excellent customer service.

03

Review the policy: Carefully study the terms and conditions of the group credit protect insurance policy before filling out any forms. Understand the coverage, benefits, and exclusions of the policy to ensure it aligns with the needs of the insured group.

04

Complete the application form: Fill out the application form provided by the insurance company. Be sure to provide accurate and honest information regarding the insured group and its members. Double-check all details to avoid any errors or discrepancies.

05

Provide necessary documentation: Attach any required documents, such as proof of group membership, identification documents, and financial statements if requested by the insurance company. Ensure that all documents are complete and valid.

06

Pay the premium: Calculate the premium amount based on the coverage chosen and the number of insured members in the group. Make the necessary payment as specified by the insurance company. Ensure you keep a record of the payment for future reference.

07

Submit the completed application: Once all sections of the application form are filled out correctly and relevant documents are attached, submit the application as instructed by the insurance company. Double-check that all required fields are completed before submission.

08

Wait for confirmation: After submitting the application, wait for confirmation from the insurance company. They may contact you for additional information, clarification, or to provide you with the policy documents.

09

Review the policy documents: Once received, carefully go through the policy documents provided by the insurance company. Understand the coverage, limitations, and any specific requirements outlined in the document.

10

Keep the policy documents safe: Store the policy documents in a secure location and inform the insured group members about the coverage and any conditions they need to be aware of. Regularly review the policy to ensure it continues to meet the needs of the insured group.

Who needs group credit protect insurance:

01

Businesses or organizations: Group credit protect insurance is suitable for businesses or organizations that offer credit to their customers or members. It helps protect their financial interests by providing coverage for unpaid debts or defaults.

02

Lenders or financial institutions: Lenders or financial institutions that provide loans or credit to individuals or groups can benefit from group credit protect insurance. It safeguards their investments by covering potential default risks.

03

Membership-based groups: Associations, unions, or clubs that offer credit facilities to their members can mitigate the risk of non-payment through group credit protect insurance. It provides protection against potential losses arising from defaults.

04

Service providers: Companies or service providers who allow customers to make purchases on credit, such as utility companies or healthcare providers, can use group credit protect insurance to safeguard their financial interests.

05

Government entities: Government entities that offer credit programs or financial assistance to individuals or groups may find group credit protect insurance beneficial. It helps manage the risks associated with non-payments and defaults.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is group credit protect insurance?

Group credit protect insurance is a type of insurance that provides coverage for a group of individuals to protect their credit in case of unexpected events such as death, disability or unemployment.

Who is required to file group credit protect insurance?

Employers or financial institutions are usually required to file group credit protect insurance on behalf of their employees or customers.

How to fill out group credit protect insurance?

Group credit protect insurance can be filled out by providing the necessary information about the group of individuals to be covered, such as their names, contact information, and coverage details.

What is the purpose of group credit protect insurance?

The purpose of group credit protect insurance is to provide financial security and peace of mind for a group of individuals by protecting their credit in case of unforeseen circumstances.

What information must be reported on group credit protect insurance?

Information such as the names of the individuals to be covered, their contact details, the coverage amount, and the policy terms must be reported on group credit protect insurance.

How can I modify group credit protect insurance without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including group credit protect insurance. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an eSignature for the group credit protect insurance in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your group credit protect insurance and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I edit group credit protect insurance on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing group credit protect insurance.

Fill out your group credit protect insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Credit Protect Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.