Get the free Tax preparers should provide this form to clients who file - revenue louisiana

Show details

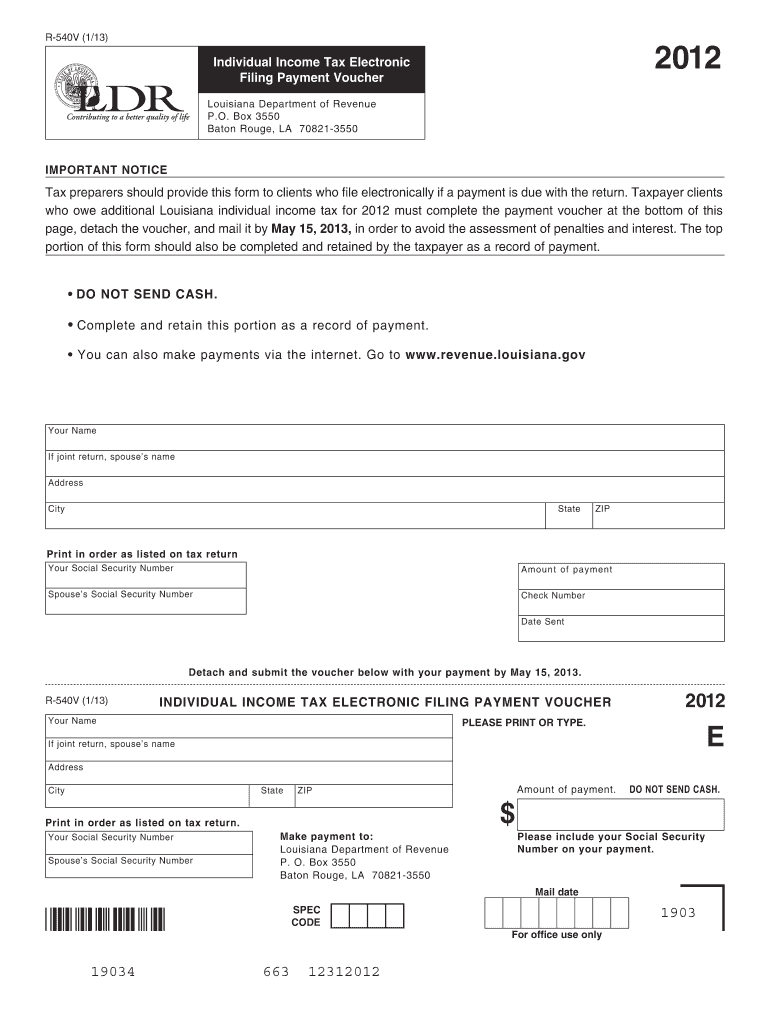

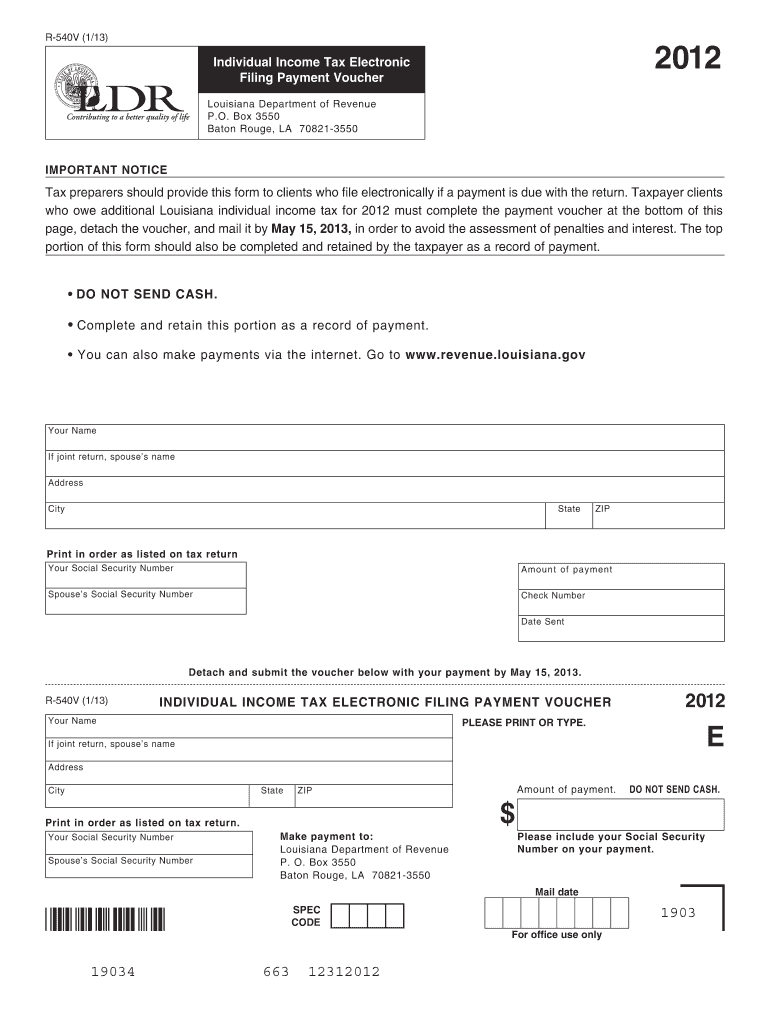

R-540V (1/13) 2012 Individual Income Tax Electronic Filing Payment Voucher Louisiana Department of Revenue P.O. Box 3550 Baton Rouge, LA 70821-3550 IMPORTANT NOTICE Tax preparers should provide this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax preparers should provide

Edit your tax preparers should provide form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax preparers should provide form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax preparers should provide online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax preparers should provide. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax preparers should provide

How to fill out tax preparers should provide:

01

Gather all necessary documents: Start by collecting important documents such as W-2 forms from all employers, 1099 forms for any freelance or contract work, receipts for deductions, and any other relevant financial information.

02

Organize your information: Sort and categorize your documents to make it easier to input the information accurately. Separate income documents from deduction receipts and keep them in separate folders or envelopes.

03

Understand the tax forms: Familiarize yourself with the tax forms that you need to fill out, such as the 1040 form or any supplementary forms required for your specific situation. Read the instructions carefully and double-check that you understand the information you need to provide.

04

Input your income: Start by entering your income information. Report wages, tips, and any other sources of income accurately. Be mindful of any additional income that may not be reported on a W-2 or 1099 form, such as rental income or interest earned from investments.

05

Deductions and credits: Identify and claim deductions and credits that you qualify for. Deductions reduce your taxable income, while credits directly decrease the amount of tax you owe. Common deductions include expenses for education, medical expenses, and home mortgage interest.

06

Verify and review your information: After entering all the necessary data, review your forms for accuracy and completeness. Ensure that all names, social security numbers, and other personal details are correct. Check for any errors or missing information before submitting your tax return.

07

File your tax return: Depending on your preference, you can file your tax return electronically or by mail. If you choose to e-file, ensure that you provide the correct payment information if you owe taxes or set up direct deposit if you are eligible for a refund.

Who needs tax preparers should provide:

01

Individuals and families with complex financial situations: Tax preparers can be beneficial for individuals or families with complicated financial situations. This could include having multiple sources of income, investment portfolios, rental properties, or self-employment income.

02

Business owners: Tax responsibilities for business owners can be more complex, especially if they have employees, need to make payroll tax deposits, or if their business structure involves multiple entities.

03

Non-residents or immigrants: Individuals who are non-residents or immigrants may have unique tax obligations and may need assistance understanding their tax filing requirements.

04

Individuals with limited time or knowledge: Even if your tax situation is relatively simple, if you lack sufficient time or knowledge to navigate the tax filing process, a tax preparer can help ensure accurate and efficient filing.

05

Those who want to maximize deductions and minimize errors: Tax preparers can provide expertise in identifying all eligible deductions and credits, ultimately reducing your tax liability and minimizing the risk of errors on your tax return.

In conclusion, tax preparers can provide valuable assistance in completing tax forms accurately and efficiently. They can be especially beneficial for individuals with complex financial situations, business owners, non-residents, individuals with limited time or knowledge, and those seeking to maximize deductions and minimize errors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax preparers should provide?

Tax preparers should provide tax preparation services which may include organizing financial information, performing calculations, completing tax forms, and advising clients on tax-related matters.

Who is required to file tax preparers should provide?

Individuals, businesses, and organizations who have income or financial transactions that require reporting to the government are required to file taxes.

How to fill out tax preparers should provide?

Tax preparers should fill out tax forms accurately and completely, making sure to include all relevant financial information and calculations.

What is the purpose of tax preparers should provide?

The purpose of tax preparers is to help individuals and businesses comply with tax laws, minimize tax liabilities, and ensure accurate reporting of financial information to the government.

What information must be reported on tax preparers should provide?

Tax preparers should report income, expenses, deductions, credits, and other relevant financial information on tax forms.

How can I get tax preparers should provide?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the tax preparers should provide in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I execute tax preparers should provide online?

Filling out and eSigning tax preparers should provide is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I complete tax preparers should provide on an Android device?

Use the pdfFiller Android app to finish your tax preparers should provide and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your tax preparers should provide online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Preparers Should Provide is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.