Get the free FISCAL YEAR JULY 1 2011-J UNE 30 b2012b - Philadelphia VIP

Show details

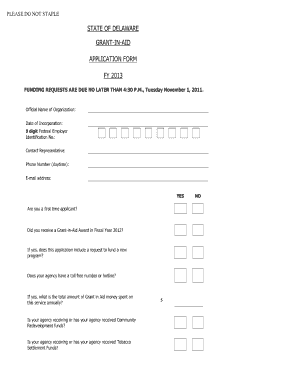

TANGLED TITLE FUND APPLICATION FORMS

FISCAL YEAR JULY 1, 2011JUNE 30, 2012

DISBURSEMENT REQUEST FORM

In order for the Tangled Title Fund Advisory Committee (the Committee) to consider a disbursement

request,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiscal year july 1

Edit your fiscal year july 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiscal year july 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fiscal year july 1 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fiscal year july 1. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiscal year july 1

How to fill out fiscal year July 1:

01

Determine the start and end dates: The fiscal year begins on July 1 and ends on June 30 of the following year. Make sure you have these dates in mind before proceeding with filling out any fiscal documents.

02

Gather financial records: Collect all relevant financial documents, such as income statements, balance sheets, and cash flow statements. These records will help you accurately calculate and report financial information for the fiscal year.

03

Review previous year's financial performance: Examine the financial performance of the previous fiscal year to identify any trends or areas that need improvement. This analysis will help you set realistic goals and projections for the upcoming fiscal year.

04

Create a budget: Develop a comprehensive budget for the entire fiscal year. Consider both revenue sources and expenses, ensuring that it aligns with your organization's financial objectives. Set clear spending limits and allocate funds appropriately to different departments or projects.

05

Track income and expenses: Use accounting software or financial spreadsheets to track all income and expenses throughout the fiscal year. Regularly update these records to maintain accurate financial data. This will help you monitor the financial health of your organization and make informed decisions.

06

Prepare financial statements: At the end of the fiscal year, compile financial statements, including an income statement, balance sheet, and cash flow statement. These reports provide a snapshot of your organization's financial performance and are essential for tax purposes and external reporting.

Who needs the fiscal year July 1:

01

Businesses and corporations: Businesses and corporations typically operate on a fiscal year that aligns with the calendar year (January 1 to December 31) or starts on July 1. Having a clear fiscal year allows them to evaluate their financial performance, plan budgets, and meet tax obligations effectively.

02

Non-profit organizations: Non-profit organizations often follow a fiscal year that begins on July 1. This enables them to align their financial reporting and grant applications with the schedules of government and funding agencies.

03

Government entities and educational institutions: Many government entities, such as federal, state, and local authorities, as well as educational institutions like schools and universities, often adopt a fiscal year starting on July 1. It facilitates financial planning, budgeting, and reporting in line with their specific needs and obligations.

In summary, filling out the fiscal year July 1 involves setting the start and end dates, gathering financial records, creating a budget, tracking income and expenses, and preparing financial statements. It is utilized by businesses, non-profit organizations, government entities, and educational institutions to effectively manage their finances and meet legal obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fiscal year july 1?

A fiscal year starting on July 1 and ending on June 30.

Who is required to file fiscal year july 1?

All businesses and organizations that operate on a fiscal year that starts on July 1.

How to fill out fiscal year july 1?

You can fill out fiscal year July 1 by providing all the necessary financial information for the year.

What is the purpose of fiscal year july 1?

The purpose of fiscal year july 1 is to track and report financial activities over a specific period.

What information must be reported on fiscal year july 1?

Income, expenses, assets, liabilities, and equity must be reported on fiscal year July 1.

How do I modify my fiscal year july 1 in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your fiscal year july 1 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I make edits in fiscal year july 1 without leaving Chrome?

fiscal year july 1 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I edit fiscal year july 1 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing fiscal year july 1, you can start right away.

Fill out your fiscal year july 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiscal Year July 1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.