Get the free Withdrawal - Hardship - bsgi401kcom

Show details

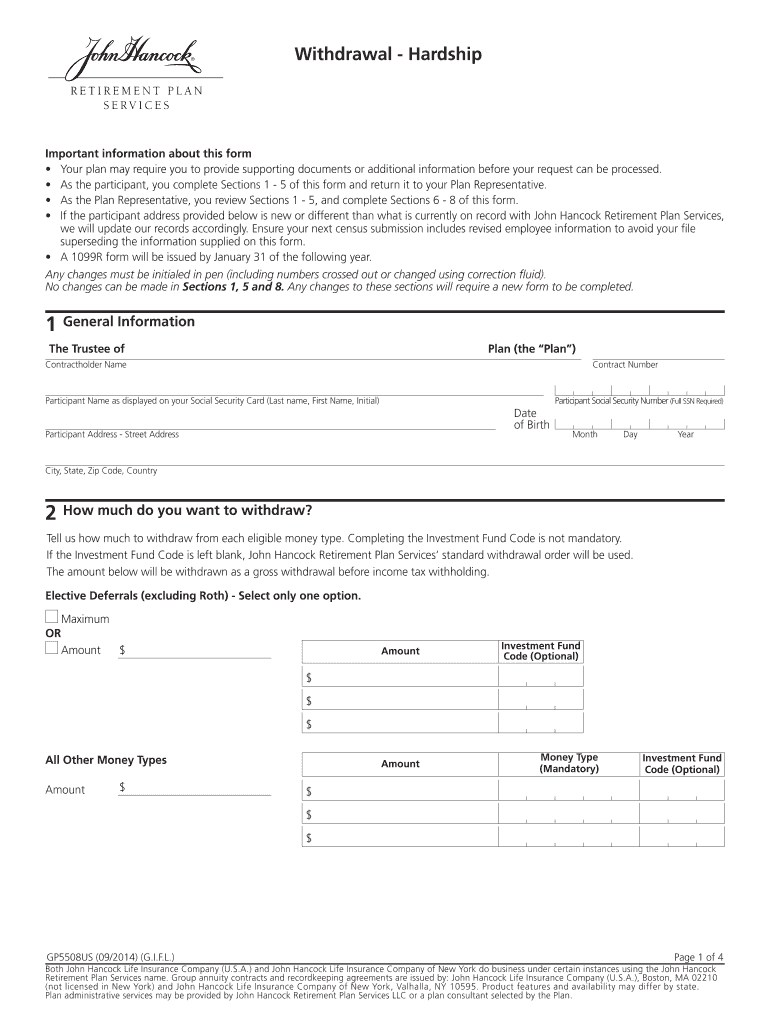

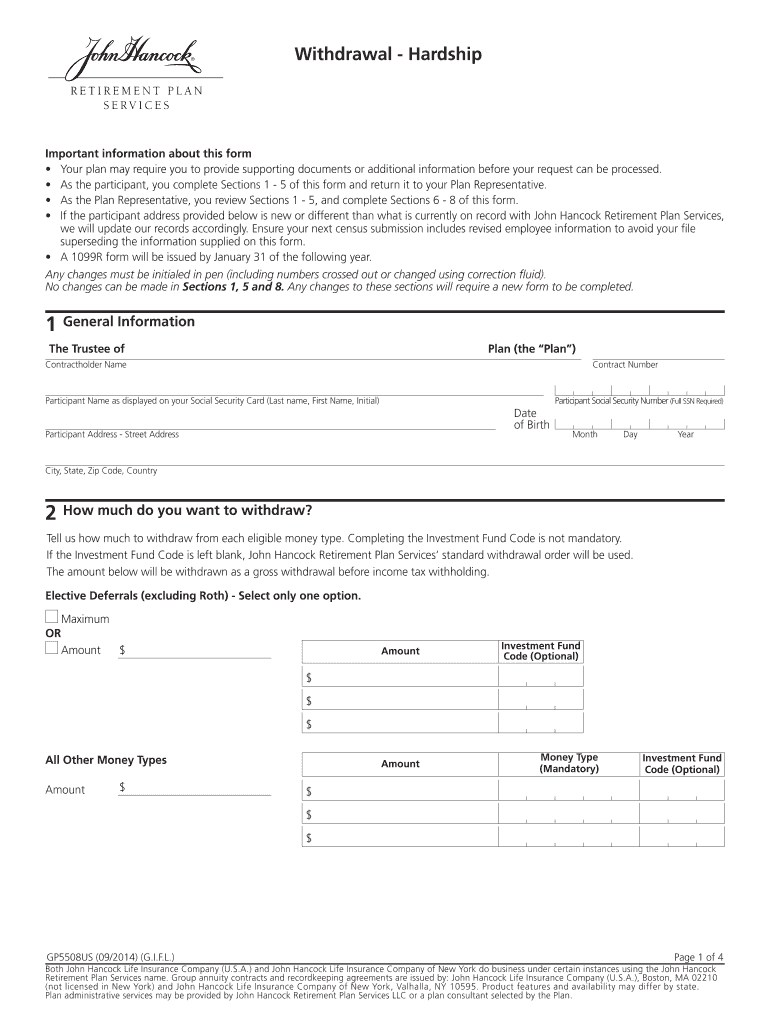

Plan administrative services may be provided by John Hancock Retirement Plan ... The amount below will be withdrawn as a gross withdrawal before income tax ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign withdrawal - hardship

Edit your withdrawal - hardship form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your withdrawal - hardship form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit withdrawal - hardship online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit withdrawal - hardship. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out withdrawal - hardship

How to Fill Out Withdrawal - Hardship:

01

Gather the necessary documents: Start by collecting all the required paperwork for a withdrawal - hardship. This may include financial statements, medical bills, pay stubs, and any other supporting documentation that demonstrates the need for the withdrawal.

02

Familiarize yourself with the withdrawal - hardship criteria: Understand the eligibility criteria for a withdrawal - hardship. Different retirement plans and financial institutions may have varying guidelines regarding what qualifies as a hardship. It is vital to review and comprehend these requirements before proceeding with the application.

03

Fill out the withdrawal application: Obtain the withdrawal application form from your retirement plan or financial institution. Carefully complete each section, ensuring that all the requested information is accurate and well-documented. Double-check for any required signatures or additional documentation that may be needed.

04

Provide a detailed explanation of the hardship: In a separate section of the application, provide a comprehensive explanation of the hardship you are facing. Be clear and concise in describing the circumstances that necessitate the withdrawal. Detail any financial difficulties, medical emergencies, or other reasons that have led to this hardship. Use facts, figures, and supporting documents to substantiate your claim.

05

Seek professional advice if needed: If you are unsure about how to fill out the withdrawal - hardship application or have concerns regarding its impact on your retirement savings, it's advisable to consult a financial advisor or a retirement plan specialist. They can provide guidance and ensure that you are making an informed decision.

Who needs withdrawal - hardship:

01

Individuals facing financial emergencies: Sometimes, unexpected financial hardships arise, such as job loss, disability, or major home repairs. In such situations, individuals may need to withdraw from their retirement savings to cover these urgent expenses.

02

Individuals dealing with medical expenses: Medical bills can be a significant financial burden, especially in cases of serious illnesses or emergencies. Withdrawal - hardship can provide a means to cover these costs without incurring excessive debt or burdening other aspects of life.

03

Individuals experiencing educational hardships: Pursuing higher education often comes with high costs. In cases where alternative funding options are limited, individuals may opt for withdrawal - hardship from their retirement accounts to finance their education or that of their dependents.

Overall, withdrawal - hardship serves individuals who are facing unforeseen financial challenges that require immediate attention. However, it is essential to carefully assess the consequences and explore alternative options before making such a decision.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is withdrawal - hardship?

Withdrawal - hardship is a request submitted by an individual to withdraw funds from a retirement account before reaching the age of 59 and a half due to financial hardship.

Who is required to file withdrawal - hardship?

Individuals who are facing financial hardship and meet the specific criteria set by the retirement account administrator are required to file withdrawal - hardship.

How to fill out withdrawal - hardship?

To fill out a withdrawal - hardship form, the individual must provide detailed information about their financial hardship, including the reason for the withdrawal and supporting documentation.

What is the purpose of withdrawal - hardship?

The purpose of withdrawal - hardship is to provide individuals with access to funds in their retirement account in situations of financial need.

What information must be reported on withdrawal - hardship?

The individual must report their financial hardship situation, the amount of funds being requested for withdrawal, and provide any required documentation to support their claim.

How can I get withdrawal - hardship?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific withdrawal - hardship and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit withdrawal - hardship in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing withdrawal - hardship and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I complete withdrawal - hardship on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your withdrawal - hardship. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your withdrawal - hardship online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Withdrawal - Hardship is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.