Vanguard 403NDR 2015-2025 free printable template

Get, Create, Make and Sign Vanguard 403NDR

How to edit Vanguard 403NDR online

Uncompromising security for your PDF editing and eSignature needs

Vanguard 403NDR Form Versions

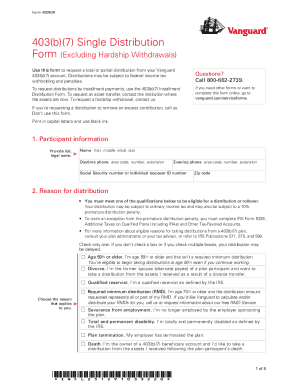

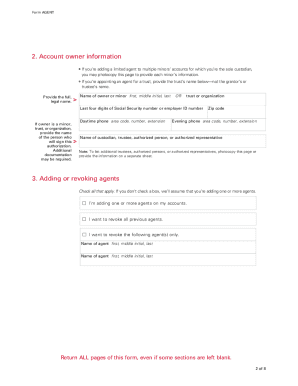

How to fill out Vanguard 403NDR

How to fill out Vanguard 403NDR

Who needs Vanguard 403NDR?

Video instructions and help with filling out and completing vanguard hardship withdrawal documentation

Instructions and Help about Vanguard 403NDR

Just like Indiana Jones that holy grail of your savings that 401k that you have saved up has some pitfalls and traps attached to it that you need to know about hey there welcome back to my channel people often want to know when they can tap into the money that they have saved up that 401 K nest egg that they've saved over the years when can we tap into it well this is the video going over that so if taking money out of your 401k is something you're interested in right now stick around, and we'll jump into that content, but before we get into that have you subscribed to this channel this is the Happiness IRA where we talk about how money weaves itself into your life you are stepping into the driver's seat of your finances, and you need to know some information this is the channel for you so hit that subscribe button the first thing you need to know is that every 401k plan is unique, so I'm going to be talking in general principles today, but you'll want to reference what's called a summary plan description an SPD for short and that document it should be found on your online access to your 401k that document is going to tell whether you're actually able to do the things that I'm mentioning it second thing we should talk about here is that I am referencing a pre-tax 401k, so we're not talking about Roth 401 k's here especially when it comes to the tax implications all right now that we've got all of our assumptions out of the way let's dive on in typically for someone to be able to take money from a 401 K they have to have hit several qualifying events so what are those qualifying events death disability separation from service that means you are no longer working with that company the company has terminated the plan or made some substantial changes to it so termination of the plan your plan might also allow you to take a distribution if you have a hardship that you've bumped up against you're unable to pay your mortgage, and you're facing eviction or foreclosure you have storm-damaged and the final one is in-service distributions which are typically triggered by an age that you attain now I'm not going to go too far into in-service distributions because I've made a video, and you can watch it here and that goes into more of the considerations when you're thinking about taking that in-service distribution so let's say that you have a qualifying event there was a death of a spouse and your with their 401k or your spouse was disabled, and you're helping them with their 401k, or you've separated from service you're no longer working for that company how do you actually access the money from the plan typically it's a form that you have to sign and the plan administrator has to sign if your spouse is still living they might have to sign off on that form as well just acknowledging that you are taking money from your 401k occasionally there's an online signature that's always much easier but not all plans happen when you go to take that distribution...

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in Vanguard 403NDR without leaving Chrome?

How do I fill out the Vanguard 403NDR form on my smartphone?

How do I complete Vanguard 403NDR on an Android device?

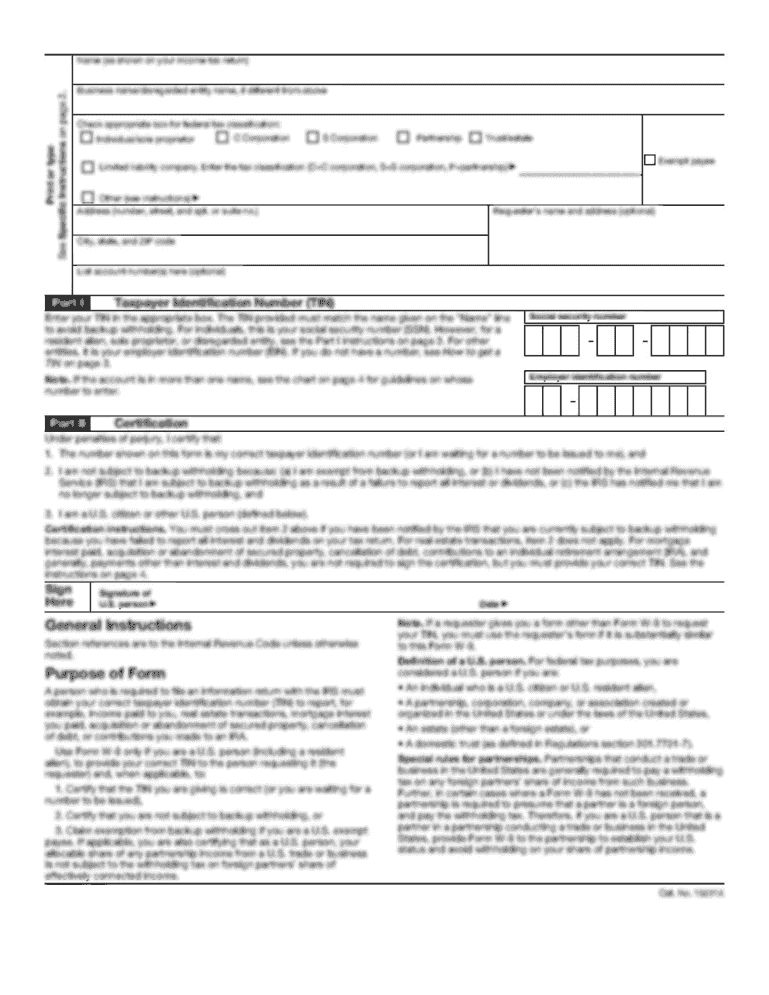

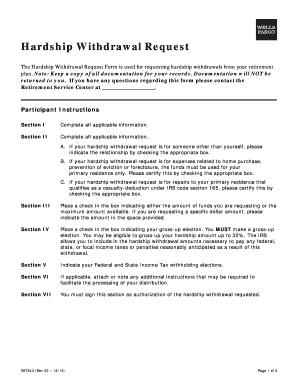

What is Vanguard 403NDR?

Who is required to file Vanguard 403NDR?

How to fill out Vanguard 403NDR?

What is the purpose of Vanguard 403NDR?

What information must be reported on Vanguard 403NDR?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.