AZ United Way Donor Advised Fund Guidelines 2015-2026 free printable template

Show details

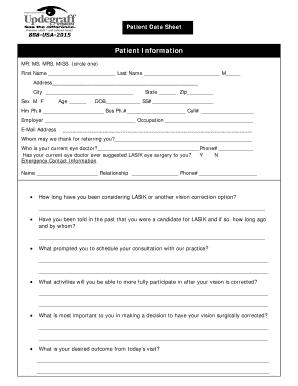

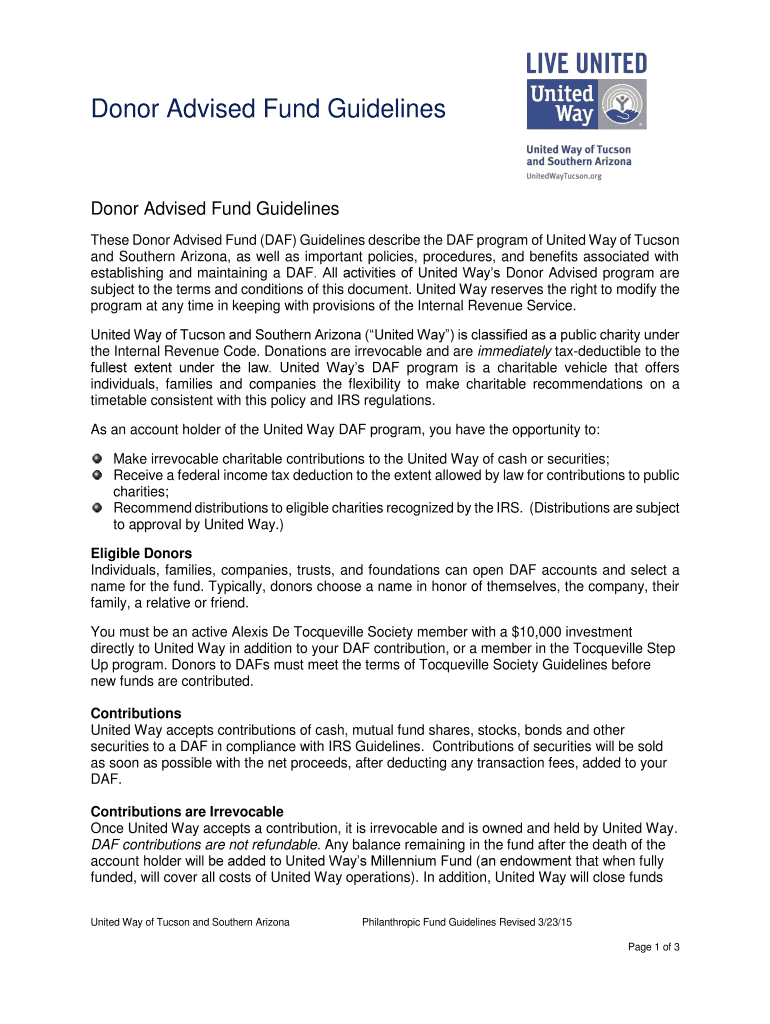

Donor Advised Fund Guidelines Donor Advised Fund Guidelines This Donor Advised Fund (DAF) Guidelines describe the DAF program of United Way of Tucson and Southern Arizona, as well as important policies,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign united advised guidelines tucson create form

Edit your united advised guidelines tucson printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your get guidelines unitedwaytucson template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit advised fund form tucson template online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit advised unitedwaytucson print form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out advised tucson unitedwaytucson template form

How to fill out AZ United Way Donor Advised Fund Guidelines

01

Begin by downloading the AZ United Way Donor Advised Fund Guidelines document from their official website.

02

Read through the introduction to understand the purpose and benefits of the fund.

03

Identify your eligibility: ensure you meet the criteria for setting up a Donor Advised Fund.

04

Gather necessary documentation: collect financial statements and any other required papers.

05

Fill in the application form provided in the guidelines with accurate personal and financial details.

06

Specify your charitable goals and interests in the fund's purpose section.

07

Review the investment options available and select those that align with your priorities.

08

Ensure all sections of the application are completed and double-check for accuracy.

09

Submit the completed application to the AZ United Way, along with any required supporting documents.

10

Await confirmation and follow any additional steps as directed by the AZ United Way.

Who needs AZ United Way Donor Advised Fund Guidelines?

01

Individuals looking to manage their charitable giving effectively.

02

Families wanting to create a legacy of philanthropy.

03

Corporations seeking to support their community through charitable contributions.

04

Financial advisors who assist clients with philanthropic strategies.

05

Nonprofit organizations interested in understanding donor engagement and funding.

Fill

get fund unitedwaytucson make

: Try Risk Free

People Also Ask about get donor unitedwaytucson pdf

How do I withdraw money from my donor-advised fund?

A contribution to a donor-advised fund is an irrevocable commitment to charity; the funds cannot be returned to the donor or any other individual or used for any purpose other than grantmaking to charities.

What is the penalty for withdrawing from a donor-advised fund?

What are the penalties? If a taxable expenditure is made, the charity that administers the fund must pay a penalty equal to 20% of the expenditure.

Can you transfer funds from a donor-advised fund to a private foundation?

Is it possible to convert a donor-advised fund into a private foundation? No, it is not possible. Because donor-advised funds can only make grants to public charities and private foundations are considered private charities, they are not qualified recipients of any funds or assets from a donor-advised fund.

What is an alternative to a donor-advised fund?

Take the pooled income fund (PIF). PIFs are essentially charitable trusts that “pool” together irrevocable gifts from one or more individuals, or a family. Like the more common charitable remainder trust (CRT), a PIF is a type of split interest trust. There's a gift to a charitable trust.

Can you convert private foundation to donor-advised fund?

How easily can a private foundation convert to a donor-advised fund? The process is relatively simple. All the net assets will need to be granted out from the private foundation to a donor-advised fund account. Then, final tax returns will need to be filed for the private foundation.

How much does it cost to start a donor-advised fund?

How much does it cost to set up a donor-advised fund account? To start a donor-advised fund account with NPT, you will need to make a contribution of $10,000 or more. Once your account is established, you can make subsequent contributions in any amount at any time.

What are the downsides of donor-advised fund?

Disadvantages of Donor-Advised Funds (DAFs) 9 DAFs often carry many hidden fees of which donors are unaware, similar to 401(k) plans. Critics, therefore, contend that the financial industry and its wealthy clients, rather than charities, are the real beneficiaries of DAFs.

What tax form do I need for donor-advised fund?

The IRS requires that donors compete and file with their federal income tax return Section A of IRS Form 8283 for non-cash charitable contributions exceeding $500.

What is the average size of a donor-advised fund?

This is especially true within the “national charity” category where NPT includes the workplace giving accounts. NPT claims that the average size of a DAF account for these sponsors in 2021 was around $134,000. But if you take out those 766,186 AOGF accounts from the calculation the size soars to over $416,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the way advised guidelines tucson print in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your fund bb unitedwaytucson pdffiller in minutes.

How do I fill out guidelines unitedwaytucson template using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign guidelines way unitedwaytucson sample and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit guidelines tucson unitedwaytucson create on an Android device?

With the pdfFiller Android app, you can edit, sign, and share get guidelines unitedwaytucson download on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is AZ United Way Donor Advised Fund Guidelines?

AZ United Way Donor Advised Fund Guidelines outline the rules and procedures for donors who wish to establish a fund that allows them to recommend grants to charitable organizations while receiving tax benefits.

Who is required to file AZ United Way Donor Advised Fund Guidelines?

Individuals or entities that have established a donor advised fund with AZ United Way are required to adhere to and file according to the AZ United Way Donor Advised Fund Guidelines.

How to fill out AZ United Way Donor Advised Fund Guidelines?

To fill out the AZ United Way Donor Advised Fund Guidelines, donors should complete the specified forms provided by AZ United Way, making sure to include all required information about their contributions and intended grant distributions.

What is the purpose of AZ United Way Donor Advised Fund Guidelines?

The purpose of AZ United Way Donor Advised Fund Guidelines is to ensure that donor advised funds are managed in compliance with legal requirements and to provide a structured process for granting money to charitable organizations.

What information must be reported on AZ United Way Donor Advised Fund Guidelines?

Information that must be reported includes donor information, fund contributions, recommended grants, and any changes in the fund's purpose or management.

Fill out your AZ United Way Donor Advised Fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Get Advised Unitedwaytucson Template is not the form you're looking for?Search for another form here.

Keywords relevant to united advised fund tucson search

Related to donor advised guidelines tucson create

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.