Get the free AML Associate Compliance Checklist Associate ... - Cloudfront.net

Show details

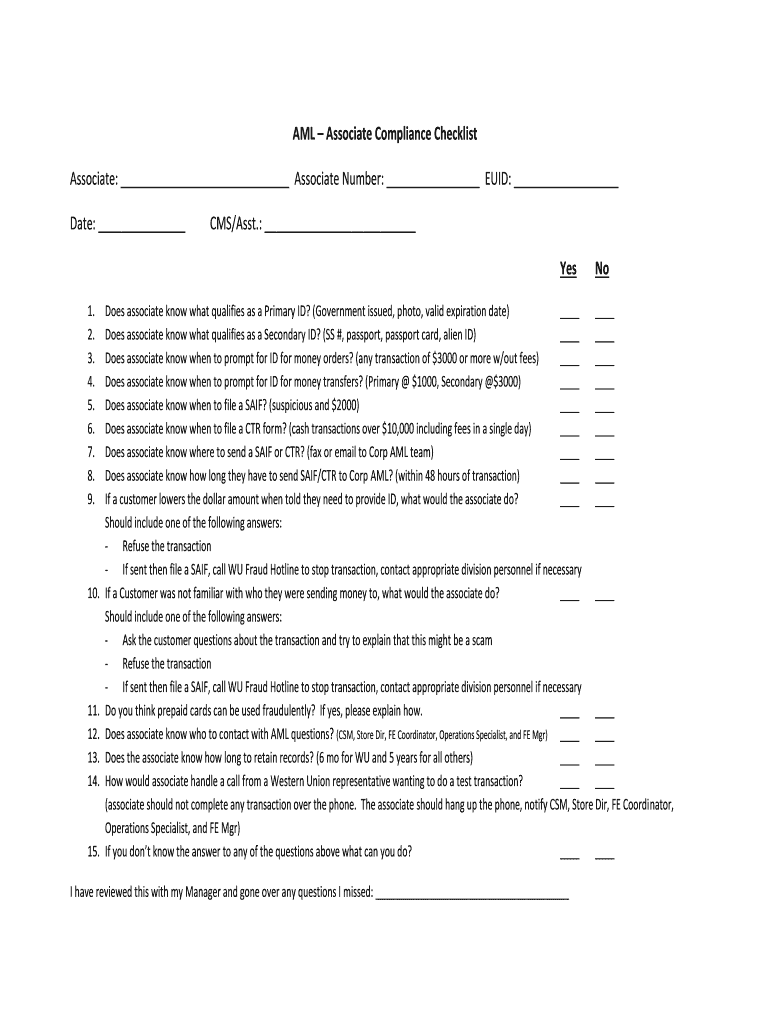

AML Associate Compliance Checklist Associate: Associate Number: QUID: Date: CMS/Asst.: Yes 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. No Does associate know what qualifies as a Primary ID?

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aml associate compliance checklist

Edit your aml associate compliance checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aml associate compliance checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing aml associate compliance checklist online

To use the professional PDF editor, follow these steps below:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit aml associate compliance checklist. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aml associate compliance checklist

How to fill out an AML associate compliance checklist:

01

Review the checklist thoroughly: Before starting to fill out the checklist, make sure you understand each item and requirement mentioned on it.

02

Gather necessary documents: Collect all the relevant documents that are required to complete the checklist, such as identification documents, financial statements, transaction records, etc.

03

Provide accurate information: Ensure that you provide accurate and up-to-date information in each section of the checklist. Double-check the details to avoid any errors.

04

Complete all sections: Go through each section of the checklist and provide the required information or documentation accordingly. Do not leave any section incomplete unless it is explicitly mentioned to skip.

05

Cross-reference information: Cross-reference the information provided in different sections of the checklist to maintain consistency and accuracy.

06

Seek clarification if needed: If you come across any unclear or ambiguous requirement in the checklist, don't hesitate to seek clarification from your supervisor or a compliance officer.

07

Include all necessary supporting documentation: Attach all the necessary supporting documentation in the checklist where required. This may include copies of identification, transaction records, or any other relevant paperwork.

08

Validate and sign: Once you have completed filling out the checklist, review it again to ensure all sections are properly filled. Sign and date the checklist as required.

09

Submit the checklist: Submit the completed checklist to the appropriate department or person responsible for compliance review or record-keeping.

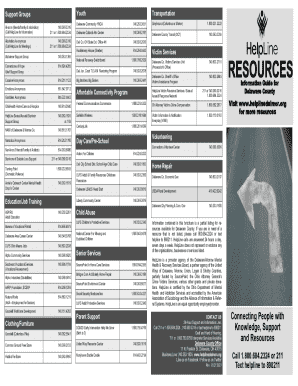

Who needs an AML associate compliance checklist?

01

Financial Institutions: Banks, credit unions, and other financial institutions need an AML associate compliance checklist to ensure that they are complying with Anti-Money Laundering (AML) regulations.

02

Money Services Businesses: Money transfer agencies, check cashing businesses, and currency exchanges need an AML associate compliance checklist to maintain their compliance with AML laws and regulations.

03

Securities Firms: Broker-dealers, investment advisers, and other securities firms need an AML associate compliance checklist to fulfill their regulatory obligations and prevent money laundering activities.

04

Cryptocurrency Exchanges: With the rise of cryptocurrencies, exchanges dealing with virtual currencies also require an AML associate compliance checklist to address the unique risks associated with digital assets.

05

Non-Financial Businesses: Certain non-financial businesses, such as dealers in high-value goods, real estate agencies, and casinos, may also need an AML associate compliance checklist if they are subject to AML regulations based on their jurisdiction or business activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in aml associate compliance checklist?

With pdfFiller, the editing process is straightforward. Open your aml associate compliance checklist in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit aml associate compliance checklist in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing aml associate compliance checklist and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out the aml associate compliance checklist form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign aml associate compliance checklist and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is aml associate compliance checklist?

AML associate compliance checklist is a document that helps financial institutions ensure that they are in compliance with anti-money laundering regulations.

Who is required to file aml associate compliance checklist?

Financial institutions, including banks and other financial service providers, are required to file AML associate compliance checklists.

How to fill out aml associate compliance checklist?

AML associate compliance checklists should be completed by designated compliance officers within the financial institution, following the guidelines and instructions provided.

What is the purpose of aml associate compliance checklist?

The purpose of the AML associate compliance checklist is to help financial institutions detect and prevent money laundering and terrorist financing activities.

What information must be reported on aml associate compliance checklist?

Information such as customer identification, transaction monitoring, risk assessment, and suspicious activity reporting must be reported on the AML associate compliance checklist.

Fill out your aml associate compliance checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aml Associate Compliance Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.