Get the free NEW SMSF - DBA Lawyers

Show details

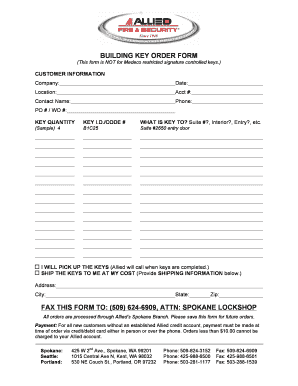

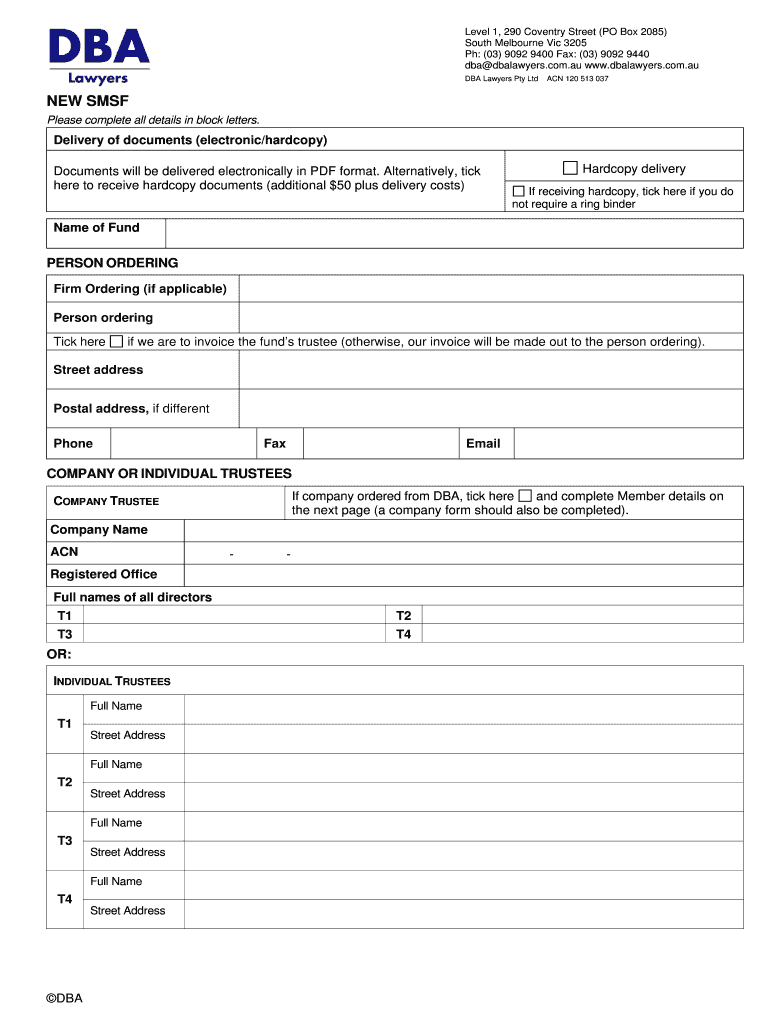

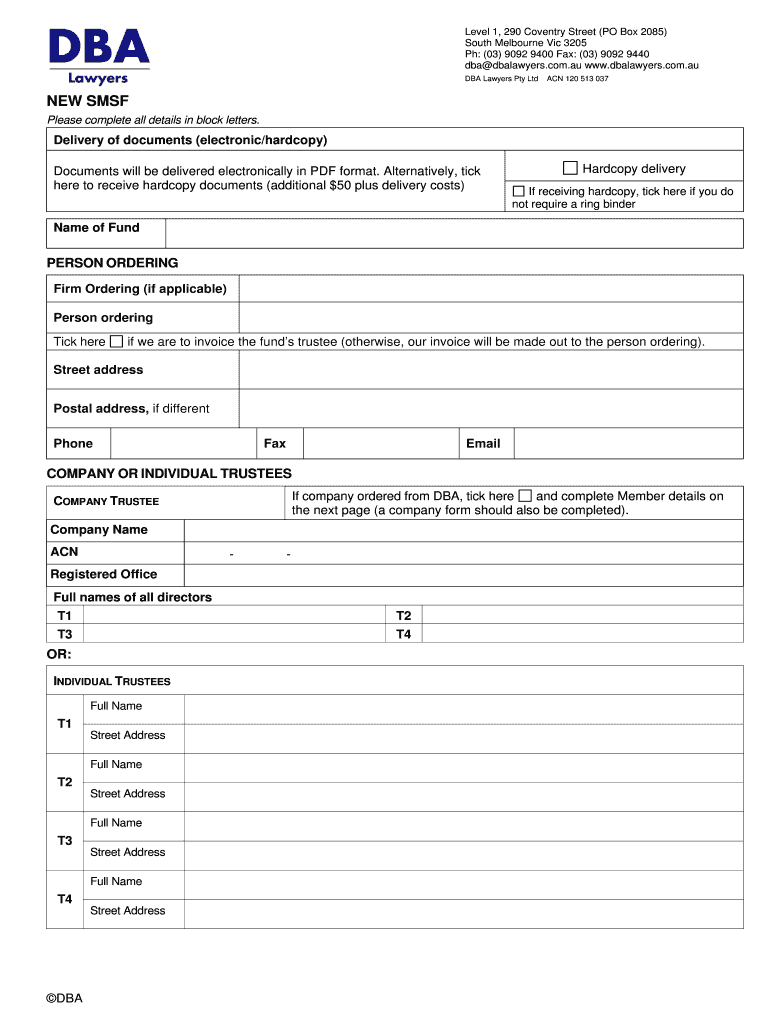

Level 1, 290 Coventry Street (PO Box 2085) South Melbourne Vic 3205 pH: (03) 9092 9400 Fax: (03) 9092 9440 DBA dbalawyers.com.AU www.dbalawyers.com.au DBA Lawyers Pty Ltd ACN 120 513 037 NEWS MSF

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new smsf - dba

Edit your new smsf - dba form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new smsf - dba form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new smsf - dba online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit new smsf - dba. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new smsf - dba

How to fill out new smsf - dba:

01

Start by gathering all the necessary information and documents such as personal identification, tax file numbers, business registration details, and financial statements.

02

Determine the structure of your self-managed superannuation fund (SMSF) and choose a name for it. Make sure the chosen name is not already registered by another entity.

03

Register the new SMSF with the Australian Business Register (ABR) and obtain an Australian Business Number (ABN) and a Tax File Number (TFN) for the fund.

04

Elect to be regulated by the Australian Prudential Regulation Authority (APRA) or opt for self-regulation. If you choose self-regulation, you will need to complete the necessary paperwork and obtain an SMSF trust deed.

05

Prepare the trust deed, which outlines the rules and obligations of the SMSF. This document should be drafted by a legal professional with expertise in superannuation law.

06

Appoint trustees for the SMSF. Typically, an SMSF can have between one to four trustees, and they can be individuals or corporate entities. Each trustee must sign a trustee declaration form.

07

Determine the investment strategy for your SMSF. This strategy should align with the fund's objectives, risk tolerance, and the diversification of investments.

08

Setup a separate bank account for the SMSF and ensure all fund expenses and income are transacted through this account.

09

Keep accurate and detailed records of all transactions, contributions, investments, and payments made by the SMSF. It is important to maintain proper record-keeping for audit and compliance purposes.

10

Prepare and lodge annual financial statements and returns for the SMSF. This includes the preparation of financial statements, an annual return, and any other required reports to be submitted to the Australian Taxation Office (ATO).

Who needs new smsf - dba:

01

Individuals who want greater control over their superannuation investments and wish to actively manage their retirement savings.

02

Business owners or self-employed individuals who want to use their SMSF for business-related purposes such as property investments or to purchase business premises.

03

Investors who have a high level of financial literacy and are willing to commit time and effort to manage their SMSF effectively.

04

Individuals who are looking for flexibility and alternative investment options not provided by traditional superannuation funds.

05

Those who have amassed a significant amount of superannuation savings and would like to have more control over the investment decisions and strategies within their retirement fund.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new smsf - dba for eSignature?

Once you are ready to share your new smsf - dba, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I sign the new smsf - dba electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your new smsf - dba.

How can I edit new smsf - dba on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing new smsf - dba, you can start right away.

What is new smsf - dba?

New SMSF - DBA stands for New Self-Managed Super Fund - Digital Business Account. It is a new account for self-managed super funds to manage their digital business activities.

Who is required to file new smsf - dba?

All self-managed super funds that engage in digital business activities are required to file the new SMSF - DBA.

How to fill out new smsf - dba?

To fill out the new SMSF - DBA, super funds need to provide information about their digital business activities, financial transactions, and any other relevant details required by the Australian Taxation Office.

What is the purpose of new smsf - dba?

The purpose of the new SMSF - DBA is to help self-managed super funds manage their digital business activities more efficiently and comply with tax regulations.

What information must be reported on new smsf - dba?

Information about the fund's digital business activities, financial transactions, and any other relevant details required by the Australian Taxation Office must be reported on the new SMSF - DBA.

Fill out your new smsf - dba online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Smsf - Dba is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.