Get the free Super and bankruptcy

Show details

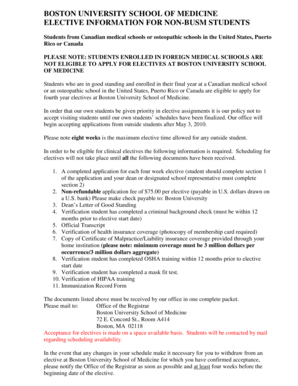

NEWS

Super and bankruptcy:

protecting your nest egg

Superannuation represents the largest asset for

many Australians. However, with tough economic

times, bankruptcy and other insolvency activity is

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign super and bankruptcy

Edit your super and bankruptcy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your super and bankruptcy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit super and bankruptcy online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit super and bankruptcy. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out super and bankruptcy

How to fill out super and bankruptcy:

01

Start by gathering all the necessary documents related to your superannuation and financial situation. This may include your superannuation statements, tax returns, bank statements, and any other relevant financial documents.

02

Understand the requirements and eligibility criteria for filing for bankruptcy. Familiarize yourself with the bankruptcy laws in your country or jurisdiction to ensure you meet the necessary qualifications.

03

Consult with a financial advisor or bankruptcy attorney to understand the implications of filling out super and bankruptcy. They can provide guidance and advice tailored to your specific situation.

04

Complete the necessary forms and paperwork for both superannuation and bankruptcy. These forms may vary depending on your jurisdiction, so ensure you have the correct documents for your region.

05

Provide accurate and complete information when filling out the forms. Double-check all the details before submission to avoid mistakes or inaccurate information.

06

Submit the completed forms and paperwork to the relevant authorities. This may involve sending them electronically or through physical mail. Make sure to follow any specific instructions provided.

Who needs super and bankruptcy:

01

Individuals who are facing financial difficulties and are unable to repay their debts may consider filing for bankruptcy. Bankruptcy provides individuals with a fresh start by eliminating or restructuring their debts under the supervision of the court.

02

Individuals who have accumulated superannuation funds and are approaching retirement age may need to navigate the process of managing their super. This includes understanding the various investment options, accessing the funds, and making decisions regarding pension or lump sum payments.

03

People who have experienced a significant financial setback, such as a business failure or sudden loss of income, may need to explore both superannuation and bankruptcy options to regain stability and protect their financial future.

It's important to note that seeking professional advice from financial experts or legal professionals is highly recommended when dealing with both superannuation and bankruptcy. Each individual's situation may vary, and seeking personalized guidance ensures the best course of action is taken.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit super and bankruptcy online?

With pdfFiller, it's easy to make changes. Open your super and bankruptcy in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit super and bankruptcy in Chrome?

Install the pdfFiller Google Chrome Extension to edit super and bankruptcy and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out the super and bankruptcy form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign super and bankruptcy. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is super and bankruptcy?

Super refers to superannuation, which is a retirement savings account in Australia. Bankruptcy is a legal process where a person is declared unable to pay their debts. Super and bankruptcy are two separate financial concepts.

Who is required to file super and bankruptcy?

Individuals who are facing financial difficulties or unable to pay their debts may be required to file for bankruptcy. All working individuals in Australia are required to have a superannuation account.

How to fill out super and bankruptcy?

Filling out super and bankruptcy forms requires providing detailed financial information and may differ based on individual circumstances. It is recommended to seek legal or financial advice when filling out these forms.

What is the purpose of super and bankruptcy?

The purpose of super is to save for retirement, while bankruptcy aims to provide a fresh start for individuals struggling with overwhelming debt.

What information must be reported on super and bankruptcy?

Information such as income, assets, debts, and financial transactions must be reported on super and bankruptcy forms.

Fill out your super and bankruptcy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Super And Bankruptcy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.