Get the free Chapter 6 Reports - The Document Foundation Wiki - libreoffice-na

Show details

Base Handbook Chapter 6 Reports Copyright This document is Copyright 2013 by its contributors as listed below. You may distribute it and/or modify it under the terms of either the GNU General Public

We are not affiliated with any brand or entity on this form

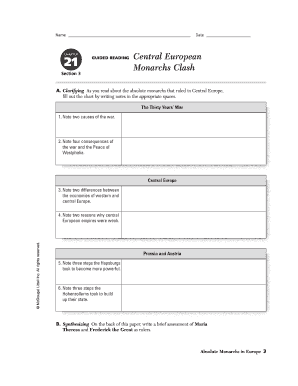

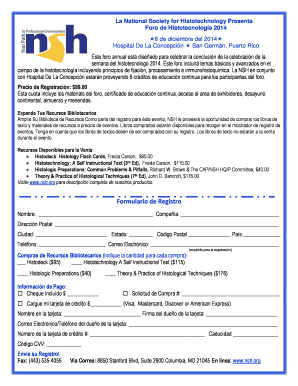

Get, Create, Make and Sign chapter 6 reports

Edit your chapter 6 reports form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 6 reports form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chapter 6 reports online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit chapter 6 reports. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 6 reports

How to fill out chapter 6 reports:

01

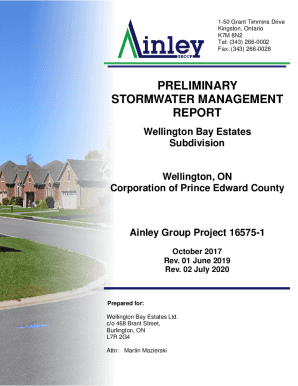

Understand the purpose: Chapter 6 reports are typically used to document financial information for a specific project or activity. Before starting to fill out the report, it is essential to understand the purpose and specific requirements of the chapter 6 report.

02

Gather necessary documentation: Collect all the relevant financial documents and records related to the project or activity that the chapter 6 report is being prepared for. This may include invoices, receipts, expense reports, budget details, and any other supporting documents.

03

Review the guidelines: Familiarize yourself with the guidelines or instructions provided for filling out the chapter 6 report. These guidelines may vary depending on the organization or industry you are working in. Ensure that you understand the specific format, sections, and information that should be included in the report.

04

Identify the sections: Chapter 6 reports typically consist of different sections that need to be filled out accurately. These sections may include a summary of financial information, project budget details, expenditure breakdown, and any other relevant sections specified in the guidelines.

05

Organize the information: Arrange the gathered financial information in a systematic manner to ensure it aligns with the sections of the chapter 6 report. This may involve categorizing expenses, documenting income sources, and providing a clear overview of all financial transactions related to the project.

06

Provide detailed explanations: In each section of the chapter 6 report, provide detailed explanations for the financial information presented. Use clear and concise language to describe the purpose and nature of each expense or income item. Any deviations or discrepancies should be addressed and explained appropriately.

07

Double-check for accuracy: Before finalizing the chapter 6 report, thoroughly review all the information provided. Double-check calculations, cross-reference with supporting documents, and ensure coherence throughout the report. Any errors or inconsistencies should be corrected promptly.

08

Seek clarification if needed: If you encounter any difficulties or uncertainties while filling out the chapter 6 report, don't hesitate to seek clarification from the appropriate individuals or departments. It's better to ask for guidance than to submit an inaccurate or incomplete report.

Who needs chapter 6 reports:

01

Project managers: Chapter 6 reports provide project managers with detailed financial information about a specific project or activity. They need these reports to monitor expenses, evaluate the financial performance, and make informed decisions regarding the project's budget and resource allocation.

02

Accountants: Accountants play a crucial role in reviewing and reconciling financial information presented in chapter 6 reports. They rely on these reports to ensure compliance with accounting standards, identify any discrepancies, and prepare financial statements or reports for internal or external stakeholders.

03

Auditors: Auditors may require chapter 6 reports to assess the financial accuracy and reliability of a project or activity. These reports serve as crucial documentation for auditing purposes, helping auditors evaluate the proper utilization of funds and adherence to financial regulations.

04

Funding agencies or stakeholders: Chapter 6 reports are often requested by funding agencies or stakeholders who have provided financial support for a project or activity. These reports demonstrate transparency and accountability, ensuring that the funds allocated are appropriately utilized and the project is progressing as planned.

05

Regulatory bodies: In some industries or sectors, regulatory bodies may require chapter 6 reports to monitor and ensure compliance with financial regulations, standards, or reporting requirements. These reports provide an overview of the financial aspects of a project, ensuring transparency and accountability within the regulatory framework.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit chapter 6 reports from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your chapter 6 reports into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I fill out chapter 6 reports on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your chapter 6 reports, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I edit chapter 6 reports on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as chapter 6 reports. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

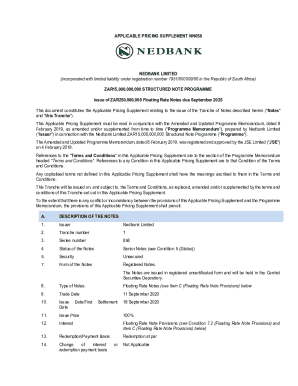

What is chapter 6 reports?

Chapter 6 reports refer to reports that must be filed by certain taxpayers under Chapter 6 of the Internal Revenue Code, which relates to foreign account reporting requirements.

Who is required to file chapter 6 reports?

U.S. taxpayers who have certain foreign financial accounts or foreign assets may be required to file chapter 6 reports.

How to fill out chapter 6 reports?

Chapter 6 reports are typically filled out using the appropriate forms provided by the IRS, such as Form 8938 or FinCEN Form 114.

What is the purpose of chapter 6 reports?

The purpose of chapter 6 reports is to help the IRS track and prevent tax evasion related to foreign financial accounts or assets.

What information must be reported on chapter 6 reports?

Chapter 6 reports typically require information about the taxpayer's foreign financial accounts, including the highest balance during the reporting period.

Fill out your chapter 6 reports online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 6 Reports is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.