Get the free COMPANIES ACT L992

Show details

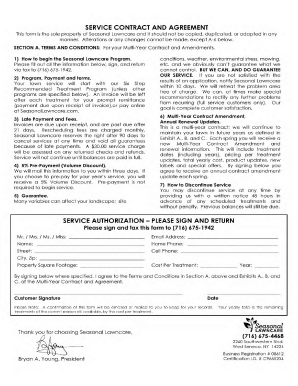

COMPANIES ACT L992COMPANIES ACT t93L to 2004 (TREASURY SHARE)

REGULATIONS 2AIO

II

2

34

5

67

89

10

11

T213Title

Commencement

Interpretation

Treasury shares

Notice of purchase (Form T1)

Maximum holdings

Exercise

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign companies act l992

Edit your companies act l992 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your companies act l992 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing companies act l992 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit companies act l992. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out companies act l992

How to fill out the Companies Act 1992:

01

Research and understand the Companies Act 1992: It is important to have a thorough understanding of the Act and its requirements before attempting to fill it out. Review the legislation, consult legal professionals, and research any relevant guidelines or resources.

02

Gather necessary information: Before filling out the Act, gather all the required information such as company details, shareholders' information, financial statements, and any other relevant documents. Having all the necessary information ready will make the process smoother.

03

Identify the specific sections to be filled out: The Companies Act 1992 consists of various sections that may need to be completed depending on the circumstances. Identify the specific sections applicable to your situation and ensure that you provide accurate and complete information.

04

Follow the prescribed format: The Companies Act 1992 may have specific formats or templates for certain sections. It is crucial to follow these formats and provide the information in the required manner. This will help in ensuring that the Act is filled out correctly and prevents any potential errors.

05

Enter the information accurately: Pay close attention to detail when filling out the Act. Enter all the required information accurately, ensuring there are no mistakes or omissions. Mistakes can lead to legal and regulatory issues, so it is important to double-check all the data entered.

06

Seek professional advice if needed: If you are unsure about any section or requirement of the Companies Act 1992, seek professional advice from lawyers, accountants, or experts in company law. They can provide guidance and ensure that you are correctly filling out the Act.

Who needs the Companies Act 1992:

01

Companies: The Companies Act 1992 is primarily designed for companies registered under the specific jurisdiction where the Act applies. It outlines the legal framework within which companies must operate, including requirements for corporate governance, financial reporting, and shareholder rights.

02

Directors and officers: Directors and officers of companies have a legal responsibility to comply with the Companies Act 1992. They must ensure that the Act is adhered to, and all necessary documentation and reporting are completed accurately and on time.

03

Shareholders: Shareholders are also affected by the Companies Act 1992 as it provides them with certain rights and protections. The Act outlines the rules for shareholder meetings, voting rights, and disclosure requirements that shareholders must follow.

04

Regulators and government authorities: Regulators and government authorities responsible for overseeing corporate activities and enforcing company law rely on the Companies Act 1992. It provides them with the legal framework and guidelines to monitor and regulate companies' activities within their jurisdiction.

05

Investors and creditors: Investors and creditors rely on the Companies Act 1992 to understand the legal framework and protections available when investing in or extending credit to companies. The Act provides transparency and accountability measures that can influence investment and credit decisions.

Overall, the Companies Act 1992 is relevant to companies, directors, officers, shareholders, regulators, government authorities, investors, and creditors in ensuring compliance, transparency, and accountability in corporate activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is companies act 1992?

Companies Act 1992 is a legislation that governs the formation, management, and dissolution of companies in a specific jurisdiction.

Who is required to file companies act 1992?

All registered companies within the jurisdiction are required to comply with the provisions of Companies Act 1992.

How to fill out companies act 1992?

Companies must fill out the necessary forms and declarations as required by Companies Act 1992 and submit them to the relevant government authorities.

What is the purpose of companies act 1992?

The purpose of Companies Act 1992 is to regulate the conduct of companies, ensure transparency, and protect the interests of stakeholders.

What information must be reported on companies act 1992?

Companies are required to report financial statements, shareholder information, director details, and any other relevant information as specified in Companies Act 1992.

Can I sign the companies act l992 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your companies act l992 in seconds.

Can I create an eSignature for the companies act l992 in Gmail?

Create your eSignature using pdfFiller and then eSign your companies act l992 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out companies act l992 on an Android device?

Complete your companies act l992 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your companies act l992 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Companies Act l992 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.