Get the free Corporate Surety Bond - E-Forms

Show details

State of Alabama Unified Judicial System Form CR17 Case Number Rev.9/94 CORPORATE SURETY BOND STATE OF ALABAMA IN THE CIRCUIT COURT OF, COUNTY KNOW ALL MEN BY THESE PRESENT, that we, (bail company),

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate surety bond

Edit your corporate surety bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate surety bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

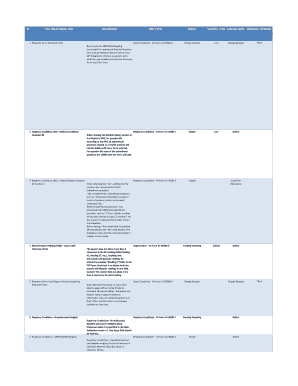

Editing corporate surety bond online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit corporate surety bond. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

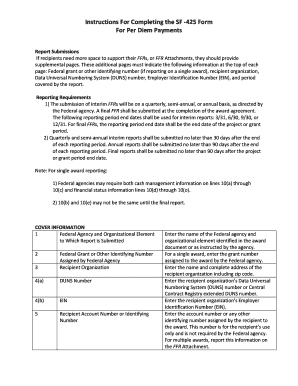

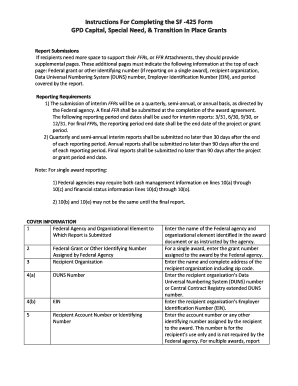

How to fill out corporate surety bond

How to fill out a corporate surety bond:

01

Begin by obtaining the necessary forms from the appropriate surety bond company or agency. These forms can usually be found online or through a local surety bond provider.

02

Carefully review the instructions accompanying the forms to understand the required information and documentation. This may include details about the project or contract for which the bond is being obtained.

03

Fill out the bond application form accurately, ensuring that all required fields are completed. This typically involves providing information about the business or corporation, such as its name, address, and contact details.

04

Include any necessary supporting documentation, as specified in the instructions. This could include financial statements, project contracts, or any other relevant paperwork that demonstrates the company's ability to fulfill the bond requirements.

05

Once the forms and documentation are complete, double-check all the information for accuracy and completeness. Any mistakes or missing details may delay the bonding process.

06

Submit the completed bond application along with any required fees or payments to the surety bond company. Be aware that the fees may vary depending on the bond amount and the specific requirements of the bond.

07

Once the bond application has been submitted, it will go through a review and underwriting process. This may involve a thorough assessment of the company's financial standing and creditworthiness.

08

If approved, the surety bond will be issued and sent to the company or its authorized representative. It is important to read and understand the terms and conditions of the bond carefully.

09

Keep a copy of the bond for your records and ensure it is properly filed and preserved. The bond may need to be presented to various parties, such as project owners or government agencies, as proof of financial responsibility.

Who needs a corporate surety bond:

01

Contractors or construction companies: Many construction projects require contractors to obtain a surety bond to guarantee the completion of the project.

02

Business owners: Certain industries, such as auto dealerships, mortgage brokers, and money transmitters, may be legally obligated to secure a surety bond.

03

Government agencies: Local, state, and federal government entities may require surety bonds from businesses to ensure compliance with regulations or to protect taxpayers' interests.

04

License and permit holders: Individuals or companies holding professional licenses or permits, such as real estate agents, notaries, or alcohol distributors, may need to obtain a surety bond before conducting business.

05

Executors or trustees: In some cases, individuals appointed as executors or trustees of estates may be required to post a surety bond to protect the beneficiaries and their assets.

Overall, the process of filling out a corporate surety bond involves completing the required forms, providing supporting documentation, and submitting the application to a surety bond company. Various individuals and entities may need a corporate surety bond depending on their industry, licensing requirements, or contractual obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is corporate surety bond?

A corporate surety bond is a type of bond that guarantees a company will adhere to certain regulations and obligations.

Who is required to file corporate surety bond?

Certain businesses and individuals may be required to file a corporate surety bond, depending on the specific regulations and requirements of their industry or jurisdiction.

How to fill out corporate surety bond?

To fill out a corporate surety bond, you will need to provide information about your company, the purpose of the bond, and any other relevant details. It is recommended to work with a surety bond agency or attorney to ensure accuracy.

What is the purpose of corporate surety bond?

The purpose of a corporate surety bond is to provide financial protection to the obligee in case the bonded party fails to fulfill their obligations.

What information must be reported on corporate surety bond?

The information required on a corporate surety bond may vary, but typically includes details about the bonded party, the bond amount, the term of the bond, and any other relevant terms and conditions.

How can I modify corporate surety bond without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including corporate surety bond, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit corporate surety bond online?

With pdfFiller, the editing process is straightforward. Open your corporate surety bond in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit corporate surety bond on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute corporate surety bond from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your corporate surety bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Surety Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.