Get the free Risk Management Quality Improvement

Show details

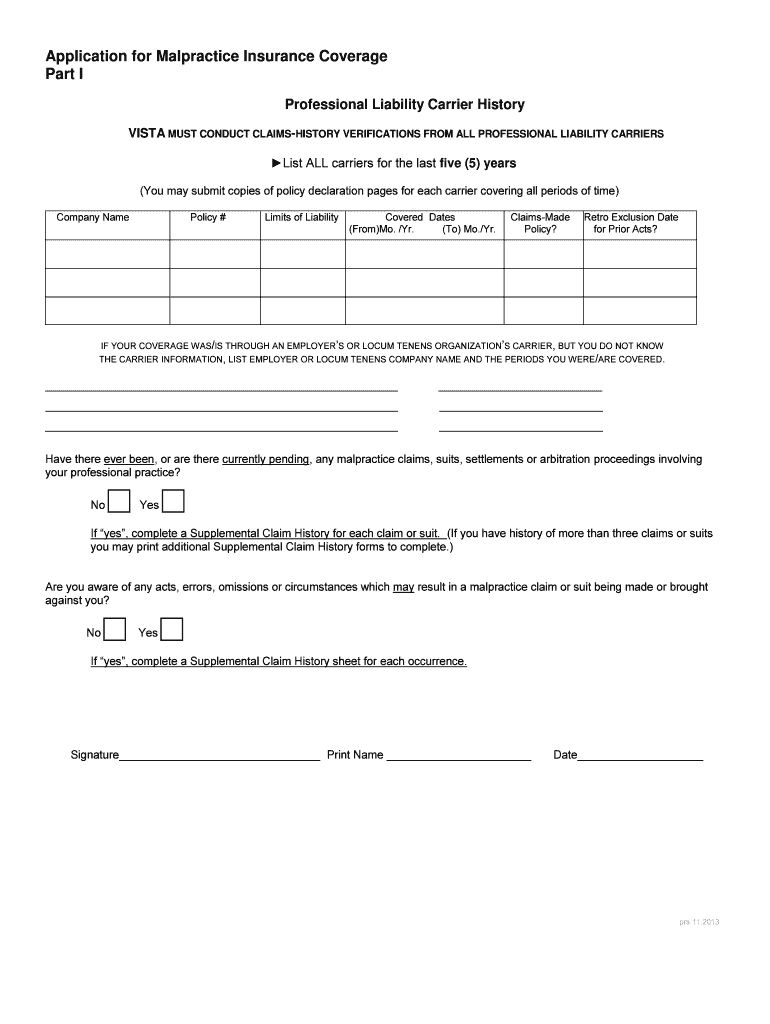

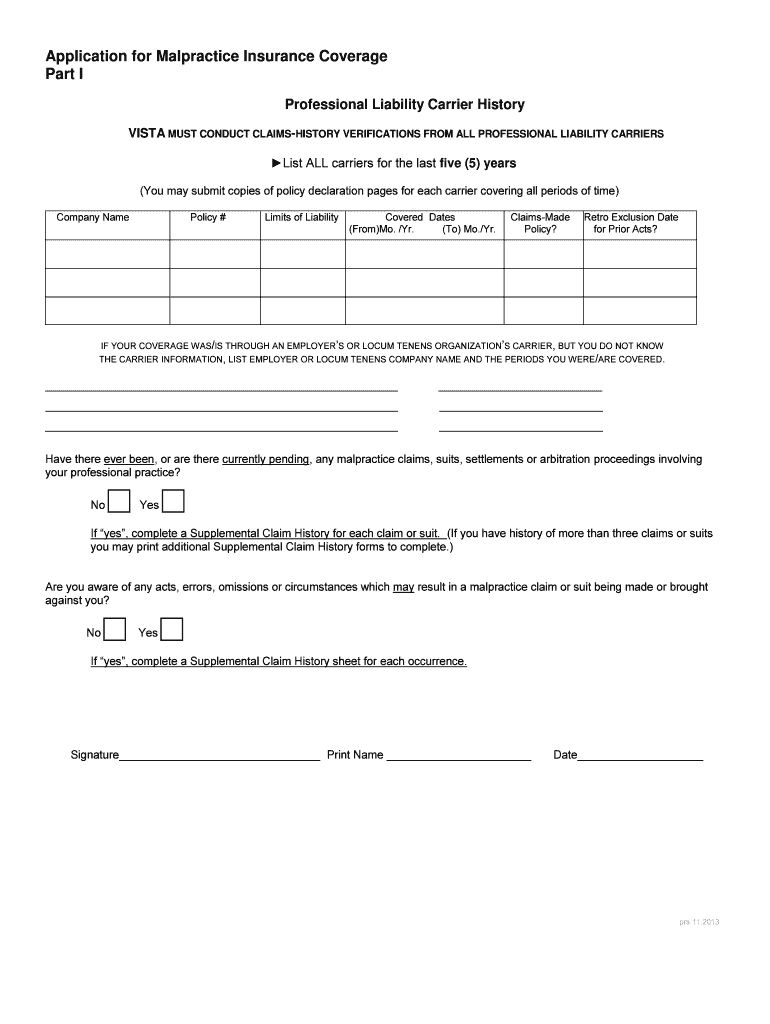

Application for Malpractice Insurance Coverage Part I Professional Liability Carrier History VISTA MUST CONDUCT CLAIMSHISTORY VERIFICATIONS FROM ALL PROFESSIONAL LIABILITY CARRIERS List ALL carriers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign risk management quality improvement

Edit your risk management quality improvement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your risk management quality improvement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit risk management quality improvement online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit risk management quality improvement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out risk management quality improvement

How to fill out risk management quality improvement:

01

Identify potential risks: Start by conducting a thorough assessment of your organization's operations and processes. Identify areas where risks are likely to occur, such as patient safety, data security, financial management, and regulatory compliance.

02

Develop risk management strategies: Once you have identified potential risks, create strategies to mitigate and manage those risks. This may include implementing safety protocols, training staff members, implementing IT security measures, and regular audits.

03

Establish quality improvement initiatives: Quality improvement goes hand in hand with risk management. Develop initiatives to continuously monitor and improve the quality of your organization's services, processes, and outcomes. This may involve collecting and analyzing data, implementing evidence-based practices, and engaging in ongoing staff education and training.

04

Create a risk management plan: Develop a comprehensive risk management plan that outlines your organization's strategies, processes, and responsibilities related to risk identification, assessment, mitigation, and monitoring. Clearly define roles and responsibilities for staff members involved in risk management and quality improvement.

05

Implement the plan: Once the risk management plan is developed, ensure that it is effectively communicated to all relevant staff members and stakeholders. Train staff on the plan's implementation and provide ongoing support and guidance. Regularly review the plan to ensure its effectiveness and make necessary adjustments.

Who needs risk management quality improvement:

01

Healthcare organizations: Hospitals, clinics, nursing homes, and other healthcare providers must have robust risk management and quality improvement programs in place to ensure patient safety, minimize medical errors, and comply with regulatory requirements.

02

Financial institutions: Banks and financial institutions face various risks, such as credit risk, operational risk, and cybersecurity threats. Implementing risk management strategies and quality improvement initiatives is crucial to protect client assets, maintain financial stability, and comply with regulatory guidelines.

03

Manufacturing companies: Manufacturers are exposed to risks related to product quality, supply chain disruptions, and workplace safety. Implementing risk management and quality improvement strategies can help in ensuring product safety, minimizing defects, and maintaining efficient operations.

04

Service-oriented industries: Any industry that provides services, such as hospitality, transportation, or consulting, can benefit from risk management and quality improvement. Identifying and managing risks associated with service delivery can help in enhancing customer satisfaction, maintaining reputation, and minimizing potential liabilities.

Overall, any organization that aims to operate efficiently, protect its stakeholders, and continually improve its processes can benefit from implementing risk management and quality improvement practices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is risk management quality improvement?

Risk management quality improvement is the process of identifying, assessing, and managing potential risks to improve the overall quality of a project or organization.

Who is required to file risk management quality improvement?

Anyone involved in a project or organization that wants to ensure the quality of their risk management practices is required to file risk management quality improvement.

How to fill out risk management quality improvement?

Risk management quality improvement can be filled out by analyzing current risk management practices, identifying areas for improvement, and implementing strategies to mitigate risks.

What is the purpose of risk management quality improvement?

The purpose of risk management quality improvement is to enhance the effectiveness of risk management practices, reduce potential losses, and increase the overall quality of project or organization.

What information must be reported on risk management quality improvement?

Information such as current risk management practices, areas for improvement, implemented strategies, and results of risk mitigation efforts must be reported on risk management quality improvement.

How can I manage my risk management quality improvement directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your risk management quality improvement as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I execute risk management quality improvement online?

Completing and signing risk management quality improvement online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I complete risk management quality improvement on an Android device?

On Android, use the pdfFiller mobile app to finish your risk management quality improvement. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your risk management quality improvement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Risk Management Quality Improvement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.