Get the free Asset Investment Managers Insurance Venture Capital Private Equity Proposal

Show details

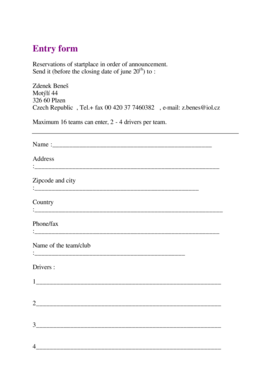

Asset Investment Managers Insurance Venture Capital Private Equity Proposal form Directors and Officers Liability Entity Securities Professional Liability Crime Outside Directorship Liability Instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign asset investment managers insurance

Edit your asset investment managers insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your asset investment managers insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit asset investment managers insurance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit asset investment managers insurance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out asset investment managers insurance

How to fill out asset investment managers insurance:

01

Gather all necessary information: Before filling out the insurance application, collect all relevant information such as the company name, address, contact details, and any additional pertinent information required by the insurance provider.

02

Assess your insurance needs: Determine the coverage you require for your asset investment management business. This may include liability coverage, professional indemnity insurance, property insurance, or other specific types of coverage based on the nature of your operations.

03

Research insurance providers: Look for reputable insurance companies that specialize in providing coverage for asset investment managers. Compare their offerings, financial strength, and customer reviews to ensure you select a reliable and trustworthy provider.

04

Complete the application form: Fill out the insurance application form accurately and thoroughly. Provide all the requested information, including details about your business operations, any past insurance claims, and any other relevant information to the best of your knowledge.

05

Consult with an insurance broker: If you find the application process complex or have specific insurance needs, consider consulting with an insurance broker who specializes in asset investment manager insurance. They can provide guidance, help you navigate through the process, and ensure that you obtain the appropriate coverage for your business.

06

Review and submit the application: Carefully review the completed application form for any errors or omissions. Once satisfied, submit the application to the insurance provider along with any supporting documents they require.

07

Follow up and review policy details: After submitting the application, follow up with the insurance provider to ensure they have received it and to inquire about any additional steps or documentation required. Once your policy is issued, review it in detail to understand the coverage, exclusions, and any endorsements or amendments.

08

Keep a copy of your policy: Once you have obtained asset investment managers insurance, make sure to keep a copy of your policy in a safe and easily accessible place. Familiarize yourself with the claims process and any contact information for your insurance provider.

Who needs asset investment managers insurance:

01

Asset management firms: Insurance coverage is crucial for asset management firms as they deal with financial responsibilities, client investments, and potential legal risks. Asset investment managers insurance safeguards these firms from claims arising from errors, negligent advice, or breach of fiduciary duty.

02

Hedge fund managers: Hedge fund managers make investment decisions on behalf of their clients, often dealing with significant amounts of capital. Asset investment managers insurance provides protection against potential lawsuits resulting from investment losses, regulatory investigations, or allegations of negligence.

03

Private equity firms: Private equity firms manage capital investments and participate in the acquisition and restructuring of companies. They face potential risks such as financial losses, breach of fiduciary duty, or lawsuits from investors or portfolio companies. Asset investment managers insurance offers coverage for these risks.

04

Venture capital firms: Venture capital firms invest in startups and early-stage companies, assuming risks associated with these investments. Asset investment managers insurance helps protect against potential lawsuits related to investment decisions, shareholder disputes, or allegations of fraudulent practices.

05

Mutual fund managers: Mutual fund managers oversee the investment portfolios of mutual funds and have a fiduciary duty to act in the best interest of their clients. Asset investment managers insurance provides coverage for claims arising from mismanagement, breach of fiduciary duty, or investment losses.

06

Portfolio managers: Portfolio managers handle the investment strategies and decisions for individual clients or institutional investors. Asset investment managers insurance offers protection against claims of negligence, errors in investment advice, or breach of contract.

07

Registered investment advisors: Registered investment advisors provide financial advice and investment management services to clients. Asset investment managers insurance safeguards them from potential claims resulting from incorrect advice, failure to disclose risks, or allegations of mismanagement.

08

Financial professionals: Professionals working in the finance industry, including financial advisors, wealth managers, and investment consultants, may also require asset investment managers insurance to protect themselves against various risks associated with advising clients on investments and managing assets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is asset investment managers insurance?

Asset investment managers insurance is a type of insurance that covers risks and liabilities associated with managing assets on behalf of clients or investors.

Who is required to file asset investment managers insurance?

Asset investment managers are required to file asset investment managers insurance.

How to fill out asset investment managers insurance?

Asset investment managers insurance should be filled out by providing accurate and detailed information about the assets being managed, potential risks, and coverage needed.

What is the purpose of asset investment managers insurance?

The purpose of asset investment managers insurance is to protect the assets being managed and provide insurance coverage for potential risks and liabilities.

What information must be reported on asset investment managers insurance?

Information such as details of the assets being managed, risk assessment, coverage limits, and contact information must be reported on asset investment managers insurance.

How do I edit asset investment managers insurance online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your asset investment managers insurance to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for signing my asset investment managers insurance in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your asset investment managers insurance and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit asset investment managers insurance on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign asset investment managers insurance right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your asset investment managers insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Asset Investment Managers Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.