Get the free Expatriate Insurance Proposal

Show details

Expatriate Insurance Proposal form Completing the Proposal form 1. This application must be completed in full including all required attachments. 2. If more space is needed to answer a question, please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign expatriate insurance proposal

Edit your expatriate insurance proposal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your expatriate insurance proposal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit expatriate insurance proposal online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit expatriate insurance proposal. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out expatriate insurance proposal

How to Fill Out an Expatriate Insurance Proposal:

01

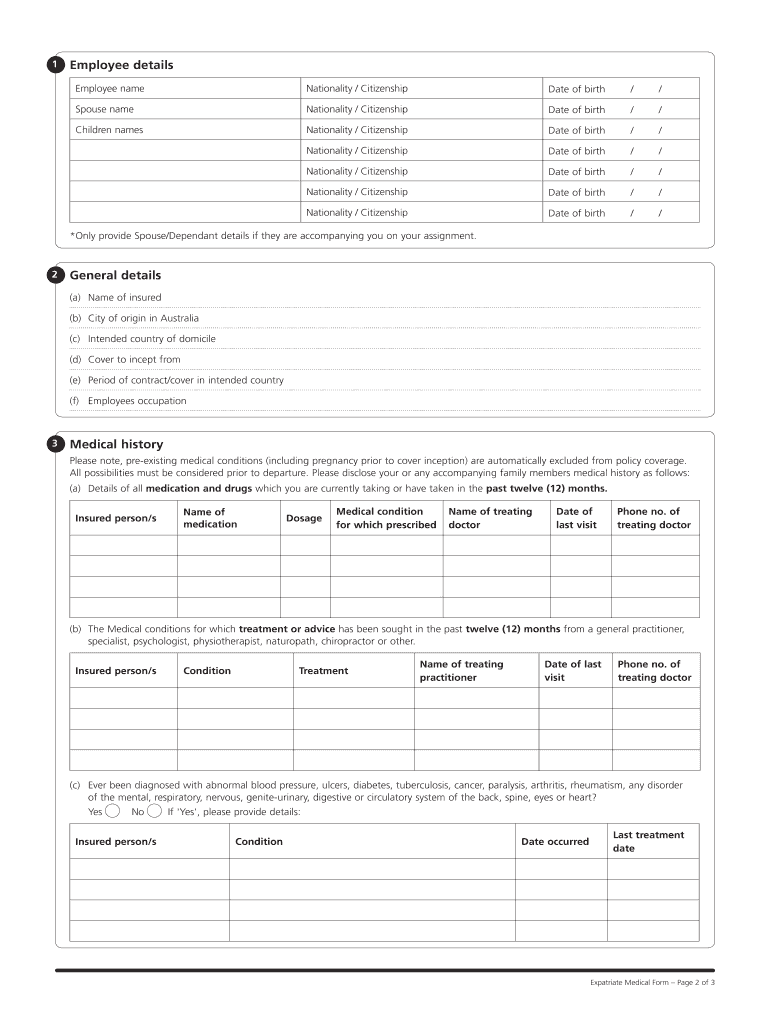

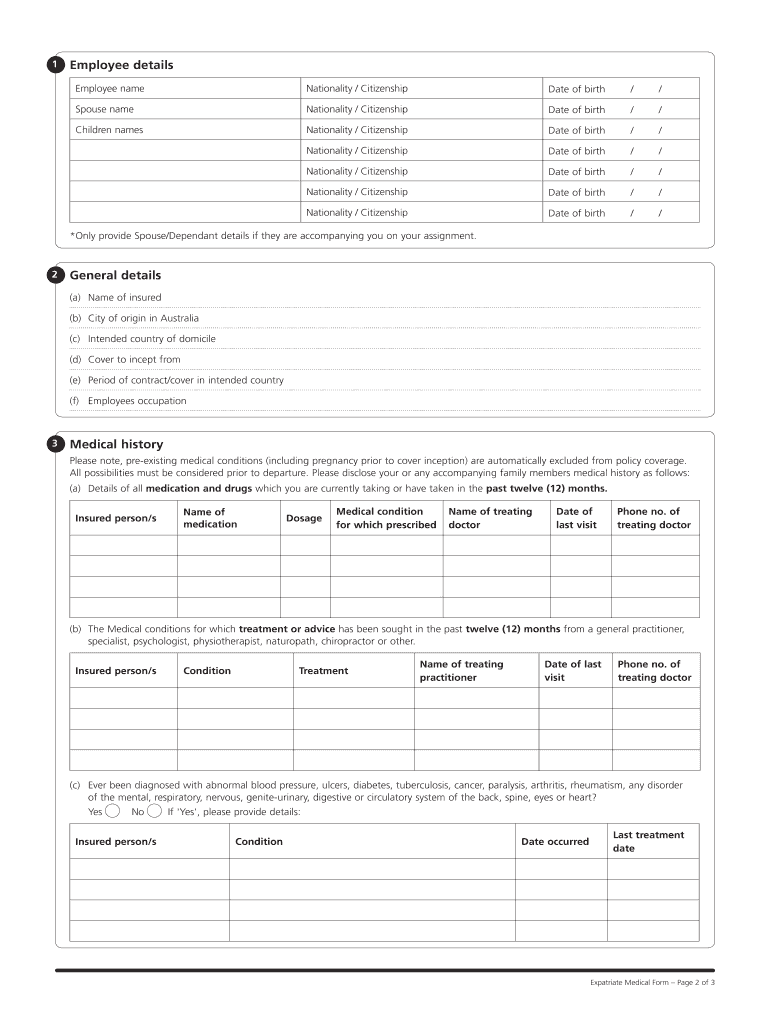

Start by gathering the necessary information. You will need personal details such as the expatriate's full name, date of birth, nationality, and contact information. Additionally, you will need information about their current occupation, employment status, and any pre-existing medical conditions.

02

Next, determine the coverage options required. Expatriate insurance proposals typically include various types of coverage, such as medical, evacuation, trip interruption, and personal belongings coverage. Carefully consider the specific needs of the expatriate and select the appropriate coverage options.

03

Provide accurate information about the expatriate's destination and duration of stay. Include details about the country or countries they will be residing in, as well as the proposed length of their stay. This information is crucial for assessing the level of risk and determining the cost of coverage.

04

Disclose any pre-existing medical conditions. It is essential to be transparent about any pre-existing medical conditions the expatriate may have. Failure to provide this information accurately can lead to claims being denied if the condition was not disclosed during the proposal stage.

05

Review and fill out the proposal form carefully. Most insurance providers will have a specific form for expatriate insurance proposals. Take your time to read through the form thoroughly and provide accurate information in each section. Avoid leaving any fields blank, and ensure that all information is legible.

06

Seek assistance if needed. If filling out the proposal form seems overwhelming or if you have any questions, do not hesitate to seek guidance from the insurance provider's customer service team. They can assist you in completing the form accurately and provide any additional information you may need.

Who Needs an Expatriate Insurance Proposal:

01

Expatriates: Individuals who are temporarily residing or working in a foreign country or countries can benefit from expatriate insurance. This proposal is essential for those who are not covered by their home country's health insurance and require comprehensive coverage during their time abroad.

02

Global Companies: Companies with a globally mobile workforce need to protect their employees while they work overseas. By providing expatriate insurance proposals, they can ensure that their employees have access to medical and emergency assistance services, as well as coverage for unexpected events during their assignments.

03

Study Abroad Programs: Students participating in study abroad programs often require expatriate insurance for comprehensive medical coverage and assistance services. This proposal is crucial for their safety and well-being during their time in a foreign country.

Remember, filling out an expatriate insurance proposal accurately and comprehensively is essential to ensure that the expatriate receives the necessary coverage and protection during their time abroad.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is expatriate insurance proposal?

Expatriate insurance proposal is a document outlining the insurance coverage and benefits for individuals living and working abroad.

Who is required to file expatriate insurance proposal?

Employers or organizations sponsoring expatriate employees are required to file expatriate insurance proposal.

How to fill out expatriate insurance proposal?

To fill out expatriate insurance proposal, you need to provide detailed information on the individuals to be covered, insurance benefits required, and any specific requirements by the insurance provider.

What is the purpose of expatriate insurance proposal?

The purpose of expatriate insurance proposal is to ensure that individuals working abroad have adequate insurance coverage for health, travel, and other benefits.

What information must be reported on expatriate insurance proposal?

The expatriate insurance proposal must include information on the individuals to be covered, their medical history, required insurance benefits, and any additional requirements by the insurance provider.

Can I create an electronic signature for the expatriate insurance proposal in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out the expatriate insurance proposal form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign expatriate insurance proposal and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete expatriate insurance proposal on an Android device?

Complete expatriate insurance proposal and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your expatriate insurance proposal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Expatriate Insurance Proposal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.