Get the free 2do Trimestre de 2011 - Auditor a Superior del Estado - asezac gob

Show details

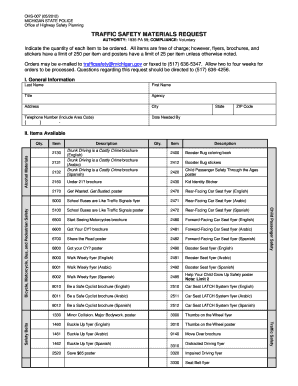

AUDITOR SUPERIOR DEL ESTATE Unidad General de Administracin Department de Recursos Materials Padre de procedures y prestores DE services 30/JUNIOR DE 2011 GIRO: ARTICLES DE CAFETERIA Y OFFICIAL No.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2do trimestre de 2011

Edit your 2do trimestre de 2011 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2do trimestre de 2011 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2do trimestre de 2011 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2do trimestre de 2011. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2do trimestre de 2011

How to fill out 2do trimestre de 2011?

01

Gather all the necessary information: Start by collecting all the relevant data and documents required to fill out the 2do trimestre de 2011. This may include financial statements, invoices, receipts, and any other paperwork related to the activities and transactions that took place during that period.

02

Review the guidelines: Familiarize yourself with the guidelines provided for filling out the 2do trimestre de 2011. These guidelines may vary depending on the country or jurisdiction, so it is important to understand the specific requirements and instructions.

03

Organize the information: Sort and organize the collected information in a systematic manner. This could involve creating spreadsheets or using accounting software to categorize and track the financial activities for the specified trimester.

04

Fill out the appropriate forms: Based on the guidelines and requirements, start filling out the relevant forms for the 2do trimestre de 2011. Provide accurate and detailed information in each section of the form, ensuring that all the necessary fields are properly filled.

05

Double-check for accuracy: After completing the forms, carefully review all the information provided. Check for any errors, omissions, or inconsistencies that could lead to complications or inaccuracies in the final report. Make any necessary corrections or adjustments.

06

Submit the completed forms: Once you are confident that all the information is accurate and complete, submit the filled-out forms as per the prescribed method. This may involve mailing the forms, submitting them online, or handing them over to the relevant authorities in person.

Who needs 2do trimestre de 2011?

01

Business owners and managers: Business owners and managers are among the primary individuals who need to fill out the 2do trimestre de 2011. This financial report provides crucial insights into the performance and financial position of the business during that specific period. It helps them make informed decisions, evaluate profitability, and meet regulatory requirements.

02

Accountants and financial professionals: Accountants and financial professionals are responsible for maintaining accurate financial records and preparing financial reports. They play a key role in filling out the 2do trimestre de 2011 by gathering, organizing, and analyzing the relevant data. This report assists them in assessing the financial health of the company and monitoring its compliance with accounting standards.

03

Tax authorities and regulatory bodies: Tax authorities and regulatory bodies require the 2do trimestre de 2011 to ensure that businesses comply with tax laws and financial reporting standards. This report helps them assess the tax liabilities, verify the accuracy of financial information, and detect any potential fraudulent activities.

04

Investors and stakeholders: Investors and stakeholders may also need the 2do trimestre de 2011 to evaluate the financial performance and stability of a company. This report provides them with insights into the company's revenue, expenses, and profitability during that period, helping them make informed investment decisions.

In conclusion, filling out the 2do trimestre de 2011 involves gathering and organizing the necessary information, following the guidelines, filling out the forms accurately, and submitting them to the appropriate authorities. It is essential for business owners, accountants, tax authorities, and investors to ensure compliance and gain insights into the financial performance of a company during that specific period.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2do trimestre de?

2do trimestre de refers to the second quarter of the year.

Who is required to file 2do trimestre de?

Businesses and individuals who are required to report their income and expenses for the second quarter of the year are required to file 2do trimestre de.

How to fill out 2do trimestre de?

To fill out 2do trimestre de, you will need to gather all relevant financial information for the second quarter of the year and report it accurately on the required forms or online platform.

What is the purpose of 2do trimestre de?

The purpose of 2do trimestre de is to report financial information for the second quarter of the year in order to comply with tax regulations and calculate any applicable taxes owed.

What information must be reported on 2do trimestre de?

Information such as income, expenses, deductions, credits, and any other financial transactions related to the second quarter of the year must be reported on 2do trimestre de.

How do I complete 2do trimestre de 2011 online?

Completing and signing 2do trimestre de 2011 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out the 2do trimestre de 2011 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign 2do trimestre de 2011 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I fill out 2do trimestre de 2011 on an Android device?

On Android, use the pdfFiller mobile app to finish your 2do trimestre de 2011. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your 2do trimestre de 2011 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2do Trimestre De 2011 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.