Get the free NIT 1- 15- 16- One time maint WAC

Show details

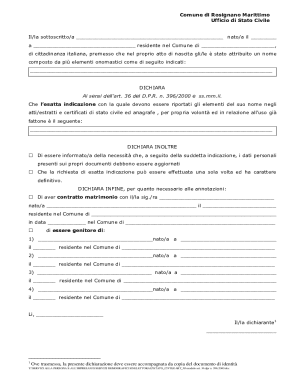

Name of the Contractor Date of Application & receipt Tender Issued on Cost of Tender Date of Opening Rs. 158 00 14/05/2015 BHARAT ANCHOR NI GAM LIMITED INDEX Sr. No. Item Page No. 1. Guidelines for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nit 1- 15- 16

Edit your nit 1- 15- 16 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nit 1- 15- 16 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nit 1- 15- 16 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nit 1- 15- 16. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nit 1- 15- 16

How to fill out nit 1-15-16:

01

Start by carefully reading the instructions provided on the nit form 1-15-16. Make sure you understand the purpose of this form and the information needed to be filled out.

02

Begin with the first section of the form, which usually requires personal information such as your name, address, contact details, and any other relevant identifying information. Fill in all the required fields accurately and completely.

03

Move on to the subsequent sections of the nit form. These sections might ask for details related to employment, education, or any specific requirements. Provide the requested information in a clear and concise manner.

04

Double-check all the information you have entered to ensure its accuracy. Mistakes or missing information can lead to delays or the rejection of the form.

05

If there are any additional documents or attachments required, make sure to gather them and attach them securely to the form.

06

Once you have completed filling out the form, review it once again to make sure everything is in order. Proofread for any spelling or grammatical errors.

07

Finally, sign and date the nit form 1-15-16 as required. This confirms that you have provided accurate information to the best of your knowledge.

Who needs nit 1-15-16:

01

Individuals who are required to submit this specific nit form based on their specific circumstances, such as when applying for a particular job, educational program, or financial assistance.

02

Employers or organizations requesting nit form 1-15-16 from their employees or applicants for administrative or legal purposes.

03

Government agencies or institutions that utilize this form as part of their documentation or verification processes.

It's important to note that the specific requirements for the nit form 1-15-16 and who needs it may vary depending on the jurisdiction, industry, or organization's guidelines. Therefore, it's essential to consult the relevant authorities or refer to the instructions provided with the form to ensure compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit nit 1- 15- 16 from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your nit 1- 15- 16 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit nit 1- 15- 16 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your nit 1- 15- 16, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I edit nit 1- 15- 16 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign nit 1- 15- 16 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is nit 1- 15- 16?

Nit 1- 15- 16 is a tax form used to report information about income, expenses, deductions, and credits for individuals.

Who is required to file nit 1- 15- 16?

Individuals who earn income in a tax year are required to file nit 1- 15- 16.

How to fill out nit 1- 15- 16?

To fill out nit 1- 15- 16, individuals need to provide information about their income, expenses, deductions, and credits on the form.

What is the purpose of nit 1- 15- 16?

The purpose of nit 1- 15- 16 is to calculate the tax liability of an individual based on their income and deductions.

What information must be reported on nit 1- 15- 16?

Information such as total income, deductions, credits, and tax owed must be reported on nit 1- 15- 16.

What is the penalty for late filing of nit 1- 15- 16?

The penalty for late filing of nit 1- 15- 16 is a percentage of the unpaid tax amount, increasing the longer the delay.

Fill out your nit 1- 15- 16 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nit 1- 15- 16 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.