Get the free Seminar on gst treatment & impact on construction industry - CIDB

Show details

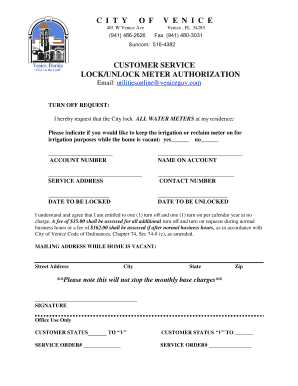

Organized by: DATE TIME VENUE GST TREATMENT & IMPACT ON CONSTRUCTION INDUSTRY : 17 November 2015 (Tuesday) : 8.30 a.m. 1.00 p.m. Santana Ballroom The Santana Hotel Kuala Lumpur Japan Pagan Turban

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign seminar on gst treatment

Edit your seminar on gst treatment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your seminar on gst treatment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing seminar on gst treatment online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit seminar on gst treatment. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out seminar on gst treatment

Point by point instructions on how to fill out seminar on gst treatment:

01

Begin by providing the title of the seminar, which should clearly indicate that it is focused on gst treatment.

02

Include the date, time, and location of the seminar, ensuring that it is easily accessible and convenient for participants.

03

Specify the objectives and goals of the seminar, highlighting the importance of understanding gst treatment and its impact.

04

Outline the agenda or schedule for the seminar, including the topics that will be covered and the duration of each session.

05

Mention the qualifications and expertise of the speakers or presenters, emphasizing their knowledge and experience in gst treatment.

06

Provide details on how to register for the seminar, including any registration fees or requirements.

07

Mention any prerequisites or recommended background knowledge for participants, ensuring that they have a basic understanding of gst treatment.

08

Explain the format of the seminar, whether it will be a lecture, workshop, or interactive discussion.

09

Highlight any additional resources or materials that will be provided to participants, such as handouts, presentations, or case studies.

10

Finally, encourage individuals or businesses who deal with gst treatment or have a vested interest in understanding its implications to attend the seminar.

Who needs seminar on gst treatment?

01

Businesses or individuals involved in the sale or provision of goods and services, as they need to understand how gst treatment affects their operations and financials.

02

Accounting and finance professionals who need to stay updated on the latest regulations and guidelines regarding gst treatment.

03

Consultants or advisors who provide guidance on gst treatment to their clients and want to enhance their knowledge and expertise.

04

Tax practitioners who want to expand their knowledge and skillset in gst treatment to better assist their clients.

05

Students or individuals considering a career in finance, accounting, or taxation who want to gain a comprehensive understanding of gst treatment.

06

Directors, managers, or decision-makers in organizations who want to make informed decisions regarding gst treatment and its impact on their business strategies.

In conclusion, filling out a seminar on gst treatment involves providing detailed information about the event and its content, while the target audience includes businesses, professionals, consultants, tax practitioners, students, and decision-makers who have an interest in understanding and applying gst treatment efficiently.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit seminar on gst treatment from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including seminar on gst treatment. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I fill out seminar on gst treatment on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your seminar on gst treatment from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I complete seminar on gst treatment on an Android device?

Use the pdfFiller Android app to finish your seminar on gst treatment and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is seminar on gst treatment?

Seminar on GST treatment is an informative session or event that educates individuals or businesses on the proper handling and treatment of Goods and Services Tax (GST) in a given jurisdiction.

Who is required to file seminar on gst treatment?

Any individual or business that is registered for GST and is looking to enhance their knowledge on proper GST treatment may attend or file a seminar on GST treatment.

How to fill out seminar on gst treatment?

To fill out a seminar on GST treatment, one must provide accurate information about GST regulations, compliance requirements, input tax credits, and any recent updates or changes in GST laws.

What is the purpose of seminar on gst treatment?

The purpose of a seminar on GST treatment is to educate individuals or businesses on the correct procedures for handling GST, ensure compliance with tax laws, and maximize benefits like input tax credits.

What information must be reported on seminar on gst treatment?

Information reported on a seminar on GST treatment may include details on GST rates, taxable supplies, input tax credits, compliance requirements, and recent changes in GST laws.

Fill out your seminar on gst treatment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Seminar On Gst Treatment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.