Get the free mortgage credit report

Show details

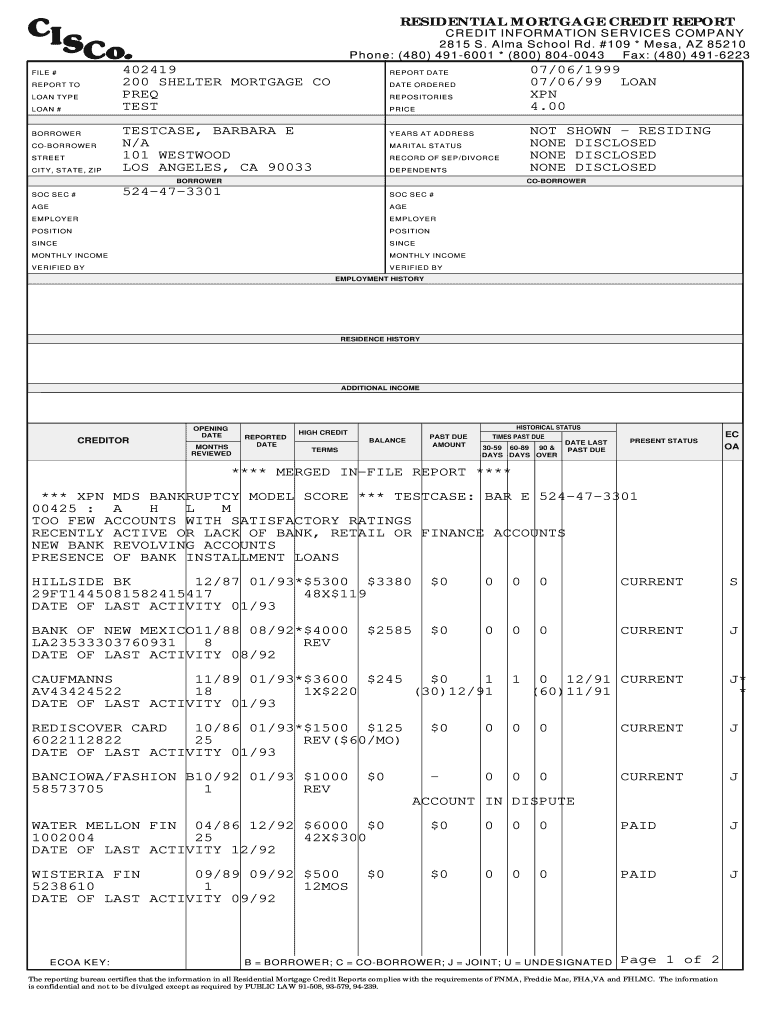

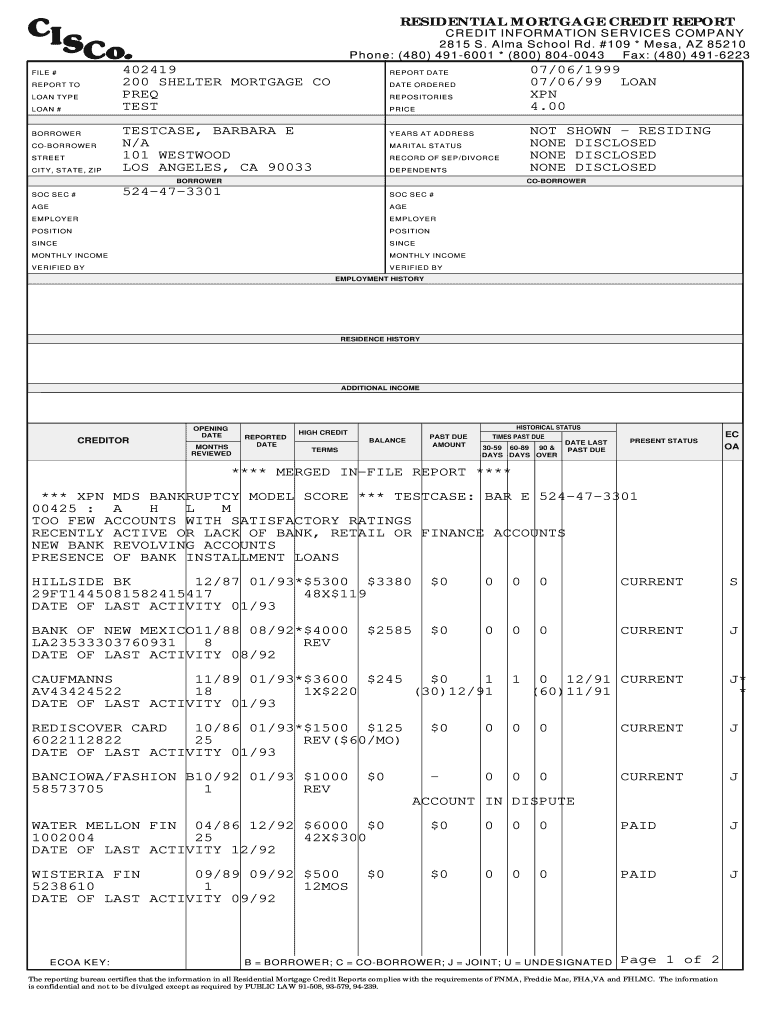

RESIDENTIAL MORTGAGE CREDIT REPORT CREDIT INFORMATION SERVICES COMPANY 2815 S. Alma School Rd. #109 * Mesa, AZ 85210 Phone: (480) 4916001 * (800) 8040043 Fax: (480) 4916223 FILE # REPORT TO LOAN TYPE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage credit report

Edit your mortgage credit report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage credit report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage credit report online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mortgage credit report. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage credit report

How to fill out a mortgage credit report:

01

Start by gathering all necessary information and documents such as your personal identification, employment history, and financial statements.

02

Carefully review the instructions provided by the lender or credit reporting agency to ensure you understand the requirements and the specific information they need.

03

Begin by providing your personal information, including your full name, date of birth, social security number, and current address.

04

Next, provide details about your employment history, including current and previous employers, job positions, and income sources. Be sure to include accurate and up-to-date information.

05

As for your financial information, provide details about your assets, including bank accounts, investments, and any other sources of income or financial resources.

06

Disclose your liabilities such as outstanding debts, loans, and credit card balances.

07

Include information about your previous credit history, including any missed or late payments, bankruptcies, or foreclosures.

08

If you have any co-borrowers, provide their personal and financial information as well to complete the joint mortgage credit report.

09

Review all the information you have entered to ensure accuracy and completeness.

10

Finally, submit the completed mortgage credit report to the lender or credit reporting agency as instructed.

Who needs a mortgage credit report:

01

Individuals who are applying for a mortgage loan are typically required to provide a mortgage credit report.

02

Mortgage lenders use this report to assess the borrower's creditworthiness and determine the terms and conditions of the loan.

03

Whether you are applying for a home loan to purchase a property or refinancing an existing mortgage, a mortgage credit report is an essential requirement for lenders.

Fill

form

: Try Risk Free

People Also Ask about

What is mortgage credit report?

Mortgage credit scores focus mainly on your payment history, credit utilization, and credit mix. This is how they determine you are a good risk and could afford the mortgage payment you're applying for.

What is the meaning of credit report in mortgage?

A credit report is a statement that has information about your credit activity and current credit situation such as loan paying history and the status of your credit accounts.

Would a mortgage loan be on a credit report?

Like all major lines of credit, a mortgage will appear on your credit report. This is probably a good thing: A mortgage can help build your credit in the long run, provided you pay as agreed.

What is a credit score disclosure letter?

A Credit Score Disclosure alerts a consumer of their FICO scores, defines what a FICO is, informs how FICO scores affect their access to consumer credit and provides contact information for the bureaus.

Can I request a copy of my credit report from a mortgage lender?

You can ask, but they are not required to give you a copy if they fund your loan. If you are rejected, then they are required to provide your credit report so you can know what information was used in making the decision. However, you don't need your lender to give you a copy.

What is the mortgage credit based on?

An MCC (Mortgage Interest Credit) -is a federal income TAX CREDIT available to First Time Homebuyers. The amount of the tax credit is calculated at a percentage of the annual mortgage interest paid each year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mortgage credit report for eSignature?

When you're ready to share your mortgage credit report, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I get mortgage credit report?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific mortgage credit report and other forms. Find the template you need and change it using powerful tools.

How do I edit mortgage credit report in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing mortgage credit report and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is mortgage credit report?

A mortgage credit report is a detailed report that shows a borrower's credit history and current credit standing.

Who is required to file mortgage credit report?

Lenders and financial institutions are required to file mortgage credit reports for all potential borrowers.

How to fill out mortgage credit report?

Mortgage credit reports can be filled out online through various credit reporting agencies or by submitting physical copies of financial documents.

What is the purpose of mortgage credit report?

The purpose of a mortgage credit report is to assess a borrower's creditworthiness and ability to repay a loan.

What information must be reported on mortgage credit report?

Information such as credit scores, payment history, outstanding debts, and credit inquiries must be reported on a mortgage credit report.

Fill out your mortgage credit report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Credit Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.