IL PTAX-342-R 2015 free printable template

Show details

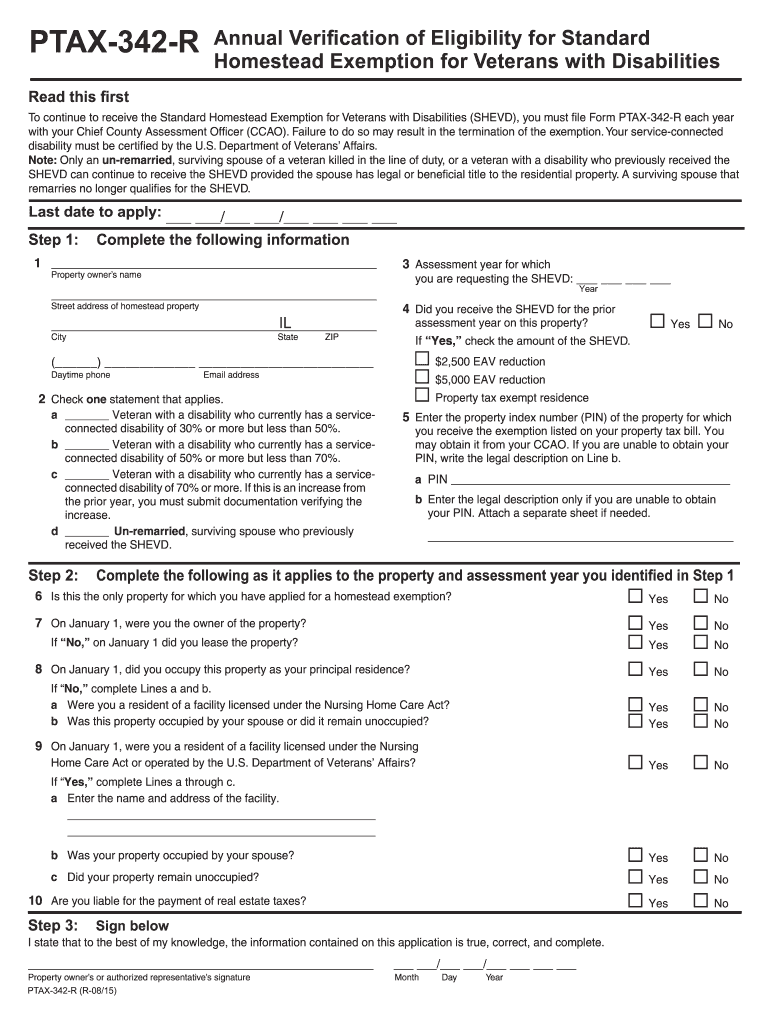

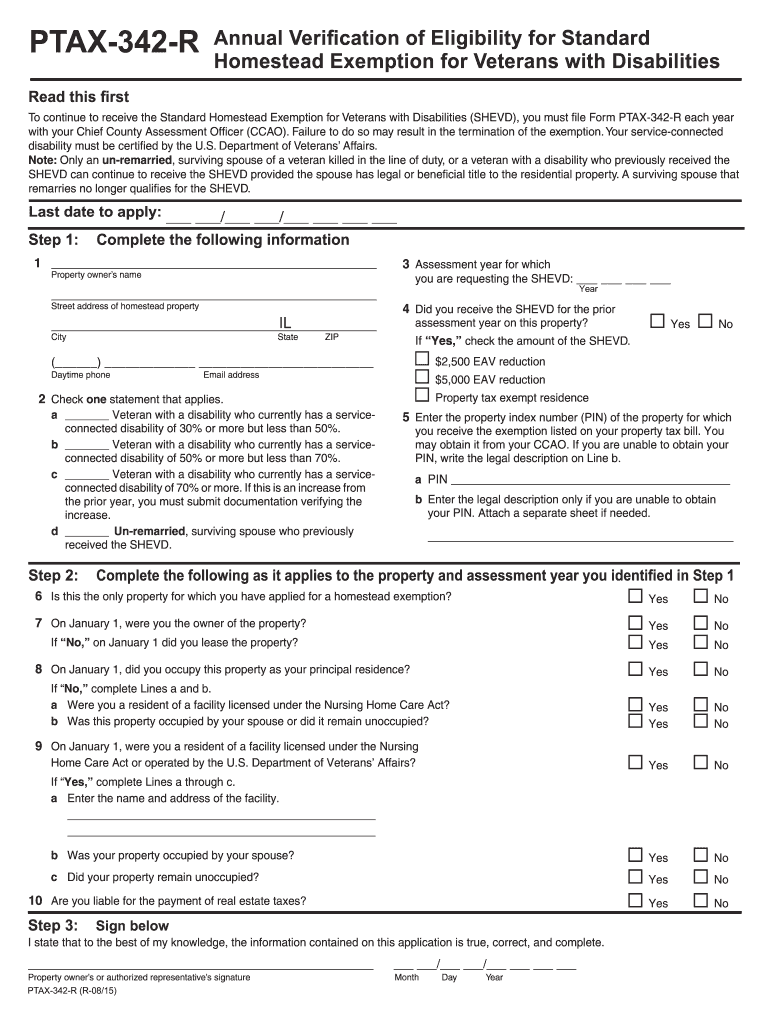

PTAX-342 Application for Standard Homestead Exemption for Veterans with Disabilities (SHED). Step 1: Complete ... Step 2: Complete the disabled veterans#39; eligibility information ... the equalized

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL PTAX-342-R

Edit your IL PTAX-342-R form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL PTAX-342-R form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL PTAX-342-R online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IL PTAX-342-R. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL PTAX-342-R Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL PTAX-342-R

How to fill out IL PTAX-342-R

01

Obtain Form IL PTAX-342-R from the Illinois Department of Revenue website.

02

Fill in your name and address in the designated fields.

03

Provide the property index number (PIN) and the name of the property.

04

Indicate the reason for your request in the specific section on the form.

05

Attach any required supporting documentation, such as proof of ownership or occupancy.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form to the appropriate local assessment office.

Who needs IL PTAX-342-R?

01

Property owners in Illinois who are seeking a property tax exemption.

02

Individuals who believe they qualify for a tax exemption due to certain qualifications.

03

Anyone looking to appeal their property tax assessment.

Fill

form

: Try Risk Free

People Also Ask about

How do I apply for disabled veterans property tax exemption in Illinois?

A veteran is eligible to receive the exemption for another tax year in which the veteran returns from active duty. Applicants must file a Form PTAX-341, Application for Returning Veterans' Homestead Exemption, with the Chief County Assessment Office.

Does Illinois waive property taxes for disabled veterans?

Veterans 70% or more disabled receive an EAV reduction of $250,000, and because of this can be totally exempt from property taxes on their home. The automatic renewal of this exemption due to the COVID-19 pandemic has ended. All applicants must reapply annually.

At what age do seniors stop paying property taxes in Illinois?

Senior Citizens Real Estate Tax Deferral Program allows persons 65 years of age and older, who have a total household income of less than $65,000 and meet certain other qualifications, to defer all or part of the real estate taxes and special assessments on their principal residences.

What is the Ptax 342 in St Clair County IL?

Form PTAX-342, Application for Standard Homestead Exemption for Veterans with Disabilities, must be submitted to • initially apply for the SHEVD, • transfer the SHEVD to the surviving spouse for the first year after the death of the veteran with a disability, or • transfer the SHEVD to a new primary residence.

What is the property tax exemption in St Clair County IL?

The amount of the exemption is $4,000 in assessed value for State taxes and $2,000 in assessed value for County taxes.

What is the property tax rate in St Clair County Illinois 2023?

St. Clair County collects, on average, 1.87% of a property's assessed fair market value as property tax. St.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the IL PTAX-342-R in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your IL PTAX-342-R in minutes.

How do I edit IL PTAX-342-R on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share IL PTAX-342-R from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How can I fill out IL PTAX-342-R on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your IL PTAX-342-R, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is IL PTAX-342-R?

IL PTAX-342-R is a form used in Illinois for reporting certain information regarding property tax exemptions and assessments.

Who is required to file IL PTAX-342-R?

Individuals or entities that have received a property tax exemption or are claiming an exemption in Illinois are required to file IL PTAX-342-R.

How to fill out IL PTAX-342-R?

To fill out IL PTAX-342-R, you need to provide accurate information regarding your property, exemptions claimed, and any supporting documentation as required.

What is the purpose of IL PTAX-342-R?

The purpose of IL PTAX-342-R is to ensure the correct assessment and exemption of property taxes and to provide transparency in property tax administration.

What information must be reported on IL PTAX-342-R?

The information that must be reported on IL PTAX-342-R includes property identification details, the type of exemption being claimed, and documentation supporting the claim.

Fill out your IL PTAX-342-R online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL PTAX-342-R is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.