Get the free Restricted Locked-in Savings Plan RLSP - Mawer

Show details

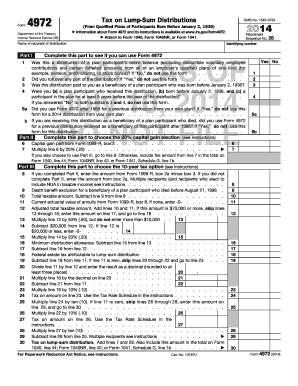

Addendum to the Retirement Savings Plan Declaration of Trust Establishing a Restricted Locked In Savings Plan Federal (LSP) 1. What the Words Mean: Please remember that in this Addendum, I, me and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign restricted locked-in savings plan

Edit your restricted locked-in savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your restricted locked-in savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit restricted locked-in savings plan online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit restricted locked-in savings plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out restricted locked-in savings plan

How to fill out a restricted locked-in savings plan?

01

Gather necessary documents: Before starting, make sure you have all the required documents handy. This may include identification proof, employment details, and any other relevant information.

02

Research the plan options: Familiarize yourself with the different types of restricted locked-in savings plans available. Each plan may have different rules and restrictions, so it's important to understand which one suits your needs best.

03

Contact the plan provider: Reach out to the plan provider to obtain the necessary application forms. They will guide you through the process, explain any specific requirements, and answer any questions you may have.

04

Fill out the application form: Carefully fill out the application form, providing accurate and up-to-date information. Double-check all the sections to ensure there are no errors or omissions.

05

Include supporting documents: Attach any required supporting documents as mentioned in the application form. This may include proof of identification, employment verification, or any other relevant paperwork.

06

Review and submit: Take the time to review the application form thoroughly. Ensure all the details are correct, and all necessary information and supporting documents have been included. Once you're confident, submit the completed application to the plan provider by following their specified instructions.

Who needs a restricted locked-in savings plan?

01

Individuals with pension funds: A restricted locked-in savings plan is particularly beneficial for individuals who have pension funds from previous employers. It allows them to manage and grow their retirement savings in a tax-advantaged manner.

02

Employees with employer-sponsored retirement plans: Those who have employer-sponsored retirement plans with restrictions on how funds can be withdrawn may also find a restricted locked-in savings plan useful. It provides an opportunity to diversify investment options and potentially increase retirement savings.

03

Individuals seeking long-term financial security: If you are someone who prioritizes financial stability and wishes to ensure a secure retirement, a restricted locked-in savings plan can be an effective tool. It helps protect your savings, prevents impulsive spending, and ensures a steady income stream post-retirement.

04

People looking for tax advantages: Depending on your jurisdiction, a restricted locked-in savings plan may offer tax advantages. Contributions made to these plans may attract tax deductions or enjoy tax-deferred growth, making it an attractive option for individuals looking to minimize their tax liabilities.

Note: It's important to consult with a financial advisor or professional who specializes in retirement planning to determine if a restricted locked-in savings plan is the right option for your specific financial circumstances and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is restricted locked-in savings plan?

A restricted locked-in savings plan is a type of retirement savings plan where contributions made by both the individual and their employer are locked in and cannot be withdrawn until a certain age or under specific circumstances.

Who is required to file restricted locked-in savings plan?

Individuals who are enrolled in a restricted locked-in savings plan are required to file the plan and report any contributions made throughout the year.

How to fill out restricted locked-in savings plan?

To fill out a restricted locked-in savings plan, individuals need to provide information about their contributions, including the amount deposited by both the individual and the employer.

What is the purpose of restricted locked-in savings plan?

The purpose of a restricted locked-in savings plan is to provide individuals with a source of retirement income that is separate from their regular savings or investments.

What information must be reported on restricted locked-in savings plan?

The restricted locked-in savings plan must report the total contributions made by both the individual and their employer, as well as any investment gains or losses.

How do I make edits in restricted locked-in savings plan without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit restricted locked-in savings plan and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for the restricted locked-in savings plan in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your restricted locked-in savings plan.

Can I create an electronic signature for signing my restricted locked-in savings plan in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your restricted locked-in savings plan directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Fill out your restricted locked-in savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Restricted Locked-In Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.