Get the free Debt Recovery Basics - Schembri & Co Lawyers

Show details

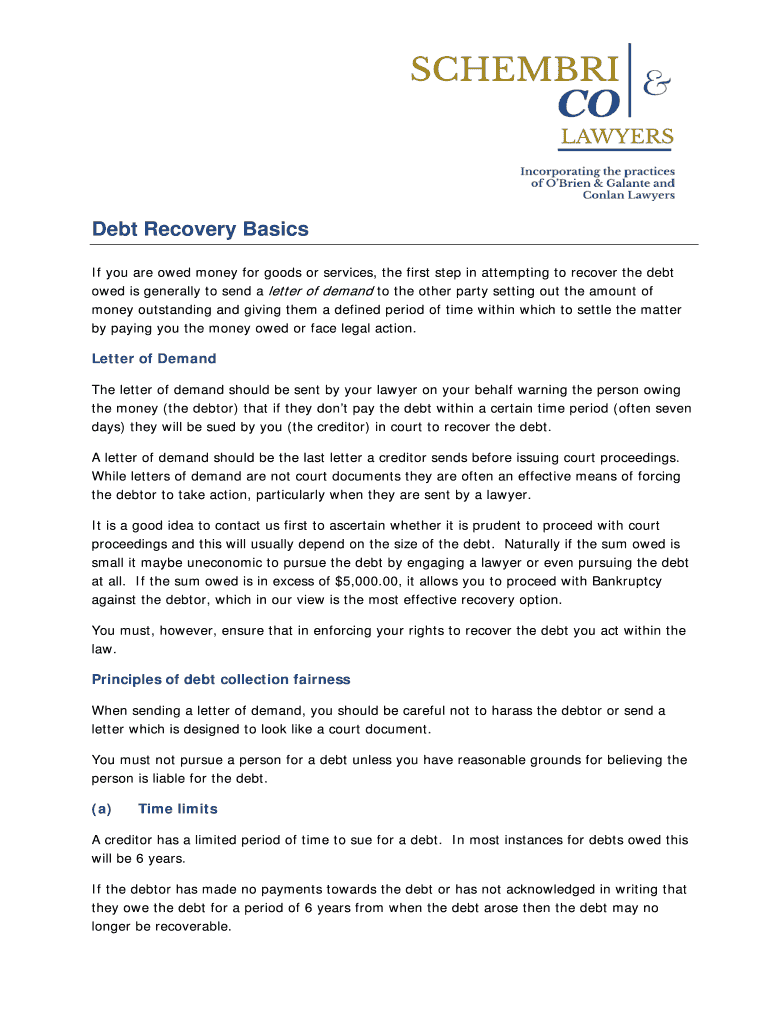

Debt Recovery Basics

If you are owed money for goods or services, the first step in attempting to recover the debt

owed is generally to send a letter of demand to the other party setting out the amount

We are not affiliated with any brand or entity on this form

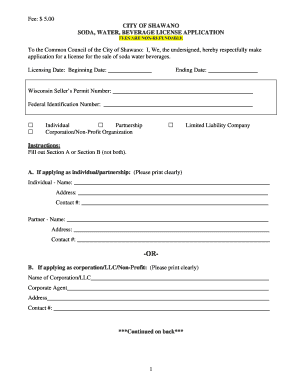

Get, Create, Make and Sign debt recovery basics

Edit your debt recovery basics form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your debt recovery basics form via URL. You can also download, print, or export forms to your preferred cloud storage service.

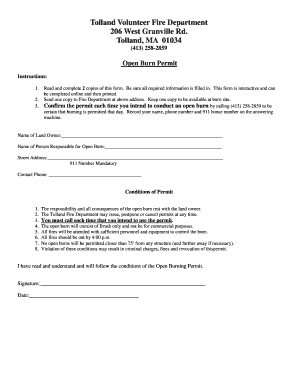

How to edit debt recovery basics online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit debt recovery basics. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

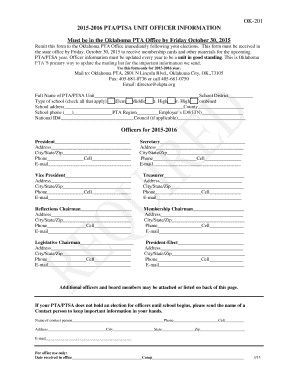

How to fill out debt recovery basics

How to fill out debt recovery basics:

01

Understand the types of debts: Familiarize yourself with the different types of debts, such as credit card debts, medical bills, or loans.

02

Gather necessary documentation: Collect all relevant documents related to the debt, including invoices, receipts, contracts, and correspondence.

03

Identify the debtor: Determine the individual or entity responsible for the debt, ensuring accurate contact information and details.

04

Assess the amount owed: Calculate the total amount owed by considering the principal debt, interest charges, late fees, and any other relevant costs.

05

Review applicable laws and regulations: Familiarize yourself with the legal framework governing debt recovery in your jurisdiction, including consumer protection laws and debt collection practices.

06

Communicate with the debtor: Initiate contact with the debtor through written communication, email, or phone, clearly stating the outstanding debt and requesting payment.

07

Consider negotiation or settlement options: Explore the possibility of negotiating a payment plan, reduced settlement amount, or other arrangements that may help in recovering the debt.

08

Keep detailed records: Maintain comprehensive records of all communications, payments, and any agreement reached with the debtor.

09

Pursue legal action if necessary: If all attempts to recover the debt fail, consult with a lawyer or debt collection agency to explore the possibility of legal action, such as filing a lawsuit or obtaining a judgment.

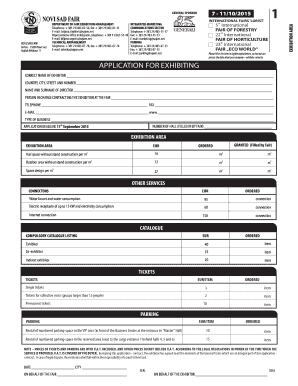

Who needs debt recovery basics:

01

Individuals with outstanding debts: Anyone who has lent money or provided goods or services and is owed a debt by an individual or business entity.

02

Creditors and lenders: Banks, financial institutions, and other lending organizations that need to recover unpaid loans or credit card debts.

03

Small business owners: Entrepreneurs and independent businesses that face difficulties in collecting payments from customers or clients.

04

Collections agencies: Professionals in the field of debt collection who require a strong understanding of the basics to effectively recover debts on behalf of their clients.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my debt recovery basics in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your debt recovery basics and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send debt recovery basics to be eSigned by others?

Once your debt recovery basics is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit debt recovery basics on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute debt recovery basics from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is debt recovery basics?

Debt recovery basics refer to the fundamental principles and procedures involved in collecting unpaid debts from individuals or businesses.

Who is required to file debt recovery basics?

Debt recovery basics are typically filed by creditors or collection agencies who are seeking to recover outstanding debts.

How to fill out debt recovery basics?

To fill out debt recovery basics, you need to provide relevant information about the debtor, the outstanding debt amount, the history of debt collection efforts, and any legal actions taken.

What is the purpose of debt recovery basics?

The purpose of debt recovery basics is to establish a formal record of the debt, outline the steps taken to collect it, and potentially initiate legal actions if necessary.

What information must be reported on debt recovery basics?

Debt recovery basics typically require reporting the debtor's personal or business information, details of the debt and its history, attempts made to collect the debt, and any legal proceedings initiated.

Fill out your debt recovery basics online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Debt Recovery Basics is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.