Get the free WINNING IN IRA ROLLOVERS - FRA LLC

Show details

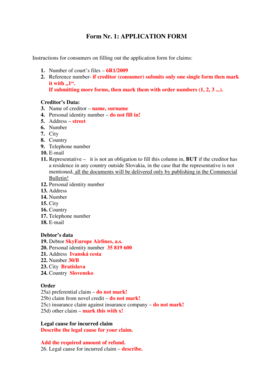

FINANCIAL RESEARCH ASSOCIATES PRESENTS WINNING IN IRA ROLLOVERS SEPTEMBER 1516, 2014 THE HARVARD CLUB SUCCESSFUL STRATEGIES FOR MARKETING, GAINING ASSETS, AND PROVIDING SERVICE TO A SEGMENTED MARKET

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign winning in ira rollovers

Edit your winning in ira rollovers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your winning in ira rollovers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit winning in ira rollovers online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit winning in ira rollovers. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out winning in ira rollovers

How to Fill Out Winning in IRA Rollovers?

Gather necessary documents:

01

Financial statements from the IRA provider(s) you wish to rollover from.

02

Personal identification, such as social security number and driver's license.

03

Forms provided by the new IRA provider for initiating the rollover process.

Determine the rollover type:

01

Traditional IRA to Traditional IRA: Moving funds from one traditional IRA to another.

02

Traditional IRA to Roth IRA: Converting pre-tax funds to after-tax funds.

03

Roth IRA to Traditional IRA: Transferring post-tax funds into a traditional IRA.

04

Roth IRA to Roth IRA: Transferring funds between two Roth IRAs.

Check rollover eligibility:

01

Ensure that you are eligible for the desired type of rollover based on IRS regulations.

02

Consider any limitations, such as waiting periods or contribution limits.

Contact the new IRA provider:

01

Reach out to the new IRA provider where you intend to open the account.

02

Inquire about their rollover process and request any necessary forms or guidance.

Complete the necessary paperwork:

01

Fill out the required forms provided by both the old and new IRA providers.

02

Pay attention to accuracy and provide all requested information.

Review and double-check:

01

Carefully review the filled-out forms for any errors or missing information.

02

Ensure that you have accurately initiated the desired rollover type.

Submit the paperwork:

01

Send the completed forms to the respective IRA providers.

02

Consider using certified mail or tracking methods for secure delivery.

Follow up:

01

Stay in contact with both the old and new IRA providers to ensure a smooth transfer.

02

Confirm that the funds have been successfully transferred and deposited into the new IRA.

Who Needs Winning in IRA Rollovers?

Individuals seeking to consolidate retirement accounts:

01

People who have multiple IRAs and want to simplify their investment strategy.

02

Those who have retired and want to combine different retirement accounts for easier management.

Individuals looking for better investment options:

01

Some IRAs may offer more diverse or desirable investment choices.

02

People who want to take advantage of better returns or lower fees provided by a new IRA provider.

Those planning to convert traditional IRAs to Roth IRAs:

01

Individuals who expect to benefit from long-term tax advantages provided by Roth IRAs.

02

People who anticipate higher tax rates in the future and wish to pay taxes on their retirement funds now.

Individuals changing jobs or retiring:

01

Those leaving a job where they had an employer-sponsored retirement plan, such as a 401(k).

02

Individuals who want to rollover funds from an employer-sponsored plan into an IRA for more investment control.

Remember to consult with a financial advisor or tax professional to ensure that any financial decisions align with your specific financial goals and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is winning in ira rollovers?

A winning in IRA rollovers refers to gains or profits made from moving funds from one retirement account to another.

Who is required to file winning in ira rollovers?

Individuals who have conducted IRA rollovers and received gains or profits are required to report them.

How to fill out winning in ira rollovers?

Winning in IRA rollovers can be reported using IRS Form 1099-R.

What is the purpose of winning in ira rollovers?

The purpose of reporting winning in IRA rollovers is to ensure accurate tax reporting of retirement account transactions.

What information must be reported on winning in ira rollovers?

The amount of gains or profits from the IRA rollover must be reported, along with any relevant tax information.

Where do I find winning in ira rollovers?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the winning in ira rollovers in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute winning in ira rollovers online?

Completing and signing winning in ira rollovers online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I fill out winning in ira rollovers on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your winning in ira rollovers, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your winning in ira rollovers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Winning In Ira Rollovers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.