Get the free Impuesto sobre sucesiones y donaciones

Show details

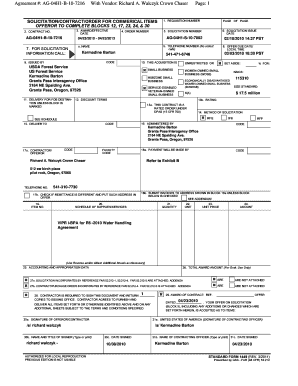

Impasto sober successions y donations Consolidation de Domingo Delegation / Official liquidator (1) 653 CPR: 9055050 ESPCI reserved para la Administration Racial Formulation Imprimis en Blanco Contribute

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign impuesto sobre sucesiones y

Edit your impuesto sobre sucesiones y form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your impuesto sobre sucesiones y form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing impuesto sobre sucesiones y online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit impuesto sobre sucesiones y. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out impuesto sobre sucesiones y

How to fill out impuesto sobre sucesiones y:

01

Gather necessary documents: Before filling out the impuesto sobre sucesiones y form, make sure you have all the required documents handy. This may include the death certificate, will or inheritance declaration, identification documents of both the deceased and the beneficiary, and any other relevant paperwork.

02

Determine the applicable tax rate: The impuesto sobre sucesiones y, also known as inheritance tax, varies depending on the region or country. Check the specific tax rates and exemptions applicable to your situation. It's essential to understand the tax regulations to accurately fill out the form.

03

Identify the taxable assets: Determine the assets that are subject to inheritance tax. This can include money, property, investments, vehicles, and other possessions. It's important to list all the assets and their corresponding values accurately.

04

Calculate the tax liability: Based on the applicable tax rate and the value of the taxable assets, calculate the tax liability. This will give you an estimation of the amount you need to pay. Some regions may offer deductions or exemptions, so make sure to consider those as well.

05

Complete the impuesto sobre sucesiones y form: Fill out the form with the required information, including personal details of the deceased and the beneficiary, asset values, and any other relevant information. Double-check the form for accuracy and completeness before submitting it.

06

Pay the taxes: Once the form is filled out correctly, calculate the final tax amount owed and make the payment within the specified deadline. Payment methods may vary depending on the region, so ensure to follow the guidelines provided.

Who needs impuesto sobre sucesiones y?

01

Individuals inheriting assets: Anyone who is named as a beneficiary in a will or inheritance declaration and is entitled to receive assets from the deceased may need to pay impuesto sobre sucesiones y. The tax liability depends on the value of the inherited assets and the applicable tax rates.

02

Executors or administrators of an estate: If you are responsible for managing the estate and distributing the assets to the beneficiaries, you may need to fill out the impuesto sobre sucesiones y form. It is important to comply with the tax regulations and properly account for the taxes owed before distributing the assets.

03

Legal and financial advisors: Individuals who work in the fields of law or finance, particularly those specializing in estate planning, inheritance, or taxation, may need to be familiar with impuesto sobre sucesiones y. They can provide guidance to beneficiaries or executors on how to navigate the tax process and ensure compliance with the applicable regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is impuesto sobre sucesiones y?

Impuesto sobre Sucesiones y is a tax on inheritances and gifts that is imposed by certain regions or countries.

Who is required to file impuesto sobre sucesiones y?

Beneficiaries who receive inheritances or gifts above a certain threshold are required to file impuesto sobre sucesiones y.

How to fill out impuesto sobre sucesiones y?

To fill out impuesto sobre Sucesiones y, beneficiaries must gather information on the inheritance or gift received and report it to the relevant tax authority.

What is the purpose of impuesto sobre sucesiones y?

The purpose of impuesto sobre Sucesiones y is to tax the transfer of wealth from one generation to another.

What information must be reported on impuesto sobre sucesiones y?

Beneficiaries must report details of the inheritance or gift received, including the value of the assets transferred.

How can I send impuesto sobre sucesiones y to be eSigned by others?

When you're ready to share your impuesto sobre sucesiones y, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I edit impuesto sobre sucesiones y on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign impuesto sobre sucesiones y right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How can I fill out impuesto sobre sucesiones y on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your impuesto sobre sucesiones y. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your impuesto sobre sucesiones y online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Impuesto Sobre Sucesiones Y is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.